Weekly Market Recap

What Happened Last Week All-Time Highs: Investor optimism on trade and the budget bill in

How we help advisors guide clients through their life journeys

Intuitive technology that supports advisors

Horizon’s innovative investment framework

Outsourced CIO (OCIO) consulting solutions

Customizable actively managed single-stock portfolio

Intuitive, user-friendly planning software

Goals-based investing with Horizon Funds

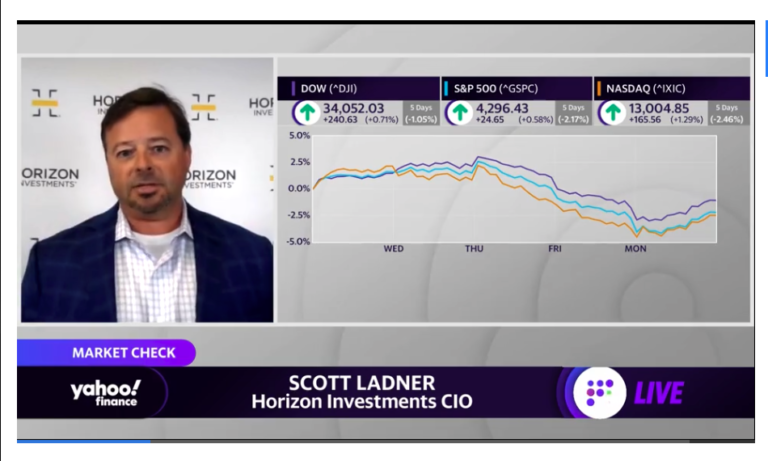

Our latest thoughts, in and on the media

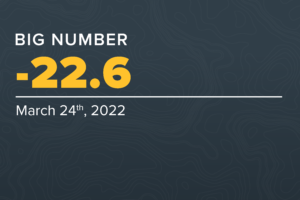

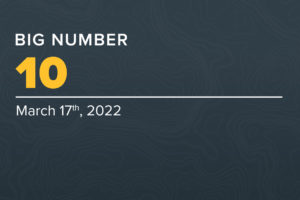

Our regular look at the market’s most revealing number

Our in-depth thinking on goals-based investing

What we do—and why we do it

What we do—and why we do it

Our culture and open positions

Topics

What Happened Last Week All-Time Highs: Investor optimism on trade and the budget bill in

Launches represent start of next wave of ETF introductions following firm’s introduction of Horizon-branded ETFs

A rising supply of homes has the potential to bring relief to would-be buyers For

What Happened Last Week Middle East Escalation: Investors largely shrugged off rising tensions last week,

Read More Askar – stock.adobe.com

Read More Renan – stock.adobe.com

Listen Here

Sentiment finally rises After months of feeling downbeat, consumers’ attitudes are perking up. The University

What Happened Last Week Israel Strikes Iran: Israel struck Iran’s nuclear infrastructure and senior military

Register Here

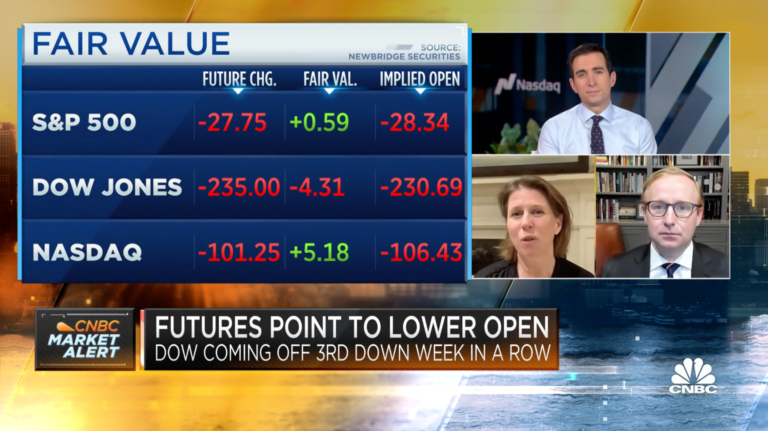

Powell and co. are likely to sit on their hands for a while Fed watchers

Read More

See why we’re committed to Fueling Advisor Growth. As advisors navigate unprecedented changes, Horizon provides

What Happened Last Week Labor Data: Friday’s non-farm payrolls report showed a slowing, but still

Consider a goals-based investment perspective going into summer The old adage “April showers bring May

What Happened Last Week Tariffs in the Courts: A trade court ruled that most of

Read More

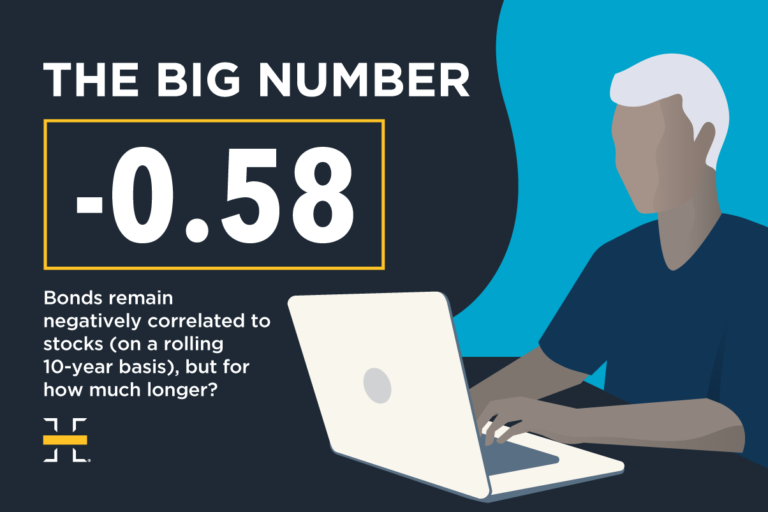

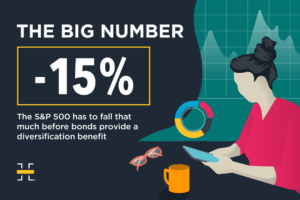

The timely importance of taking a differentiated approach to diversification Bonds these days are doing

What Happened Last Week Sell America: U.S. long-term Treasuries, equities, and the dollar all declined

Read More

Read More

Read More

Watch Now

Some assets may have rallied too far, too fast Investors have breathed multiple sighs of

Despite lower levies for now, uncertainty remains On Monday, the U.S. and China announced that

Watch Now

Watch Now

What Happened Last Week Markets Listless: Equity markets consolidated with notably lower volatility last week

A lengthy run for the S&P 500 These days, the stock market is showing up

What Happened Last Week Stocks Rally: The S&P 500 rallied for nine straight days to

Equity investors should look beyond the usual suspects these days This week marks the 100th

Watch Now

What Happened Last Week Easing Fears: Equities rallied, led by the Mag 7, as tariffs,

Read More

Market participants have fled dollar-based assets, leading to dollar weakness The U.S. dollar has experienced

CHARLOTTE, NC (April 22, 2025) – Horizon Investments, LLC, a leader in providing the financial

Read More

What Happened Last Week Yields Stabilized: Despite Trump’s consideration of firing Powell, 10-year yields declined,

Watch Now

Read More

Although uncertainty remains, perpetual market swings may be less frequent While still higher than what

Gain Strategies The first quarter was one of volatility and investor whiplash that felt much

What Happened Last Week Equities: The S&P 500 surged 5.7%, yet frequent trade policy reversals,

Watch Now

Short-Term Market Volatility Market volatility over the past week has been nothing short of historic.

Watch Now

Read More

Download Presentation

What Happened Last Week Tariff Shock: Trump’s huge tariffs—a 10% baseline already in effect and

Watch Now

The power of diversification has been on display throughout 2025 Headline after headline this week

Read More

Tariffs are taxes and taxes slow economic growth. The Trump administration’s newly announced tariff policy

Read More

What Happened Last Week Tariff Impact: Equity markets declined following Trump’s announcement of 25% auto

Watch Now

History suggests a rebound could be in order The market’s smaller stocks are down—and it

What Happened Last Week Equity Consolidation: Intra-equity market volatility was calmer last week after a

Read More

Watch Now

What Happened Last Week Market Correction Signals: S&P 500 falls for a fourth week—one of

Watch Now

Recent stock market losses are not as bad as they may seem Last week saw

What Happened Last Week U.S. Sell-Off: Weak investor sentiment drove the S&P 500 to its

Listen Now

Join Scott Ladner, Chief Investment Officer, and Austin Fitch, CFA®, Head of Consulting Solutions on

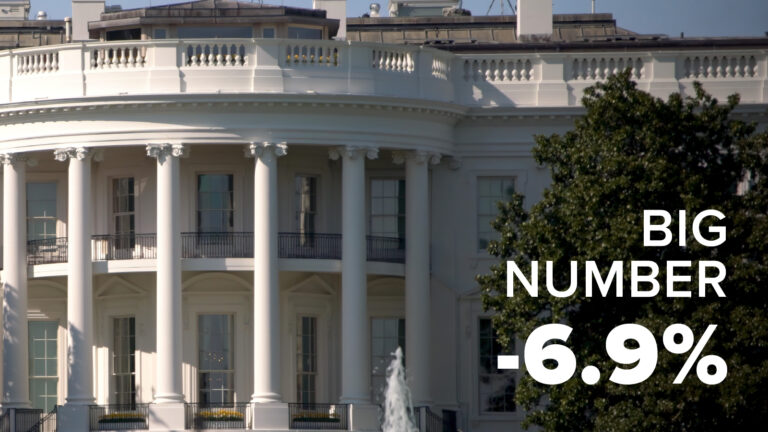

Consumers may be tapping the brakes on their spending The outlook for the U.S. economy

The President Trump Seesaw: A Post-Inauguration Review of the Markets Over the last several weeks,

What Are Risk Management Strategies? Risk management strategies are systematic investment approaches to identifying, assessing,

Understanding Wealth Preservation Wealth preservation refers to protecting and maintaining your financial assets to ensure

What Happened Last Week Sentiment Souring: Policy uncertainty is likely contributing to the deterioration in

Watch Now

The U.S. has been lagging Europe and China in recent months. It seems “America First”

What Happened Last Week Equity Sentiment Falls: S&P 500 hits new all-time highs but small-caps

Watch Now

Watch Now

Uncertainty is spiking, but optimism remains strong. The White House’s sweeping, and sometimes see-sawing, economic

What Happened Last Week Tariffs: Markets welcomed Trump’s tariff delay, but skepticism raises the risk

Earnings have been much better than expected thus far among the market’s small companies. Large-company

Watch Now

What Happened Last Week Policy Uncertainty: Investors welcomed a delay in tariffs on Canada and

What Are Goals-Based Retirement Portfolios? Goals-based retirement portfolios represent a differentiated approach to asset management

What is a Goals-Based Investment Manager? A goals-based investment manager typically creates and implements personalized

Watch Now

Understanding Goals-Driven Investing Goals-driven investing is a unique approach to asset management that places your

What is Goal-Based Investment Planning? Goal-based investment planning is a comprehensive approach to investment management

What is Goals-Based Asset Management? Goals-based asset management is a unique financial approach that aligns

New import taxes on China, while Mexico and Canada get a reprieve for now. The

Listen Now

What Happened Last Week DeepSeek Dip: Tech stocks plunged due to fears of overinvestment in

What is a Goals-Based Investment Manager? A goals-based investment manager typically creates and implements personalized

Watch Now

Watch Now

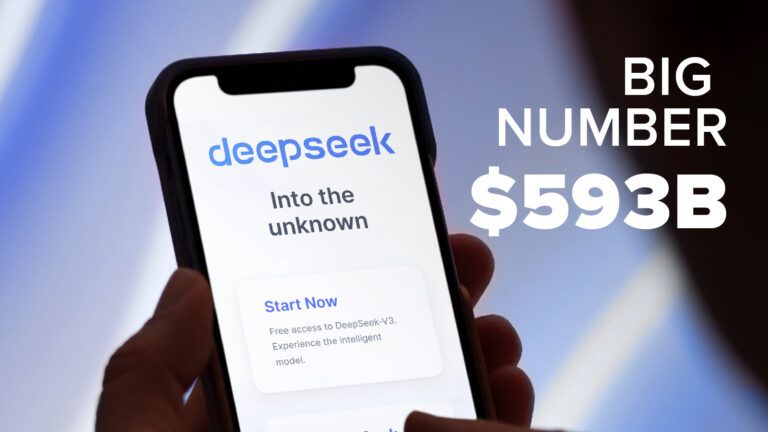

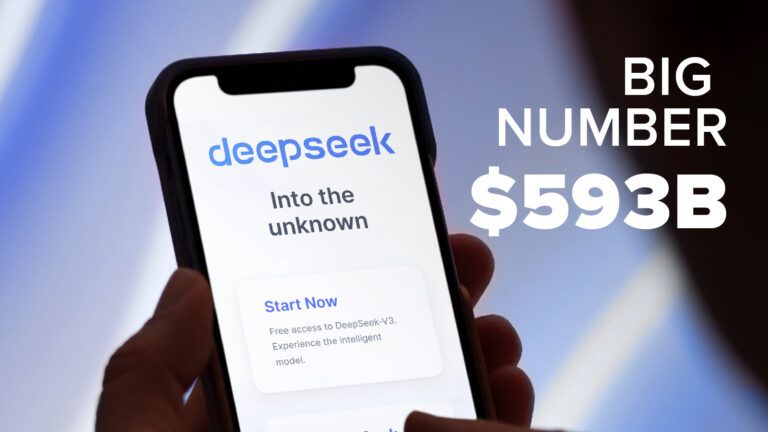

What does Nvidia’s historic rout mean for investors? The bad news: AI darling Nvidia lost

What Happened Last Week Dollar Decline: The dollar had its worst week in a year

Will Trump’s tariffs push the greenback even higher? The U.S. dollar has risen sharply in

Watch Now

CHARLOTTE, NC (January 23, 2025) – Horizon Investments, LLC, a provider to the financial

Watch Now

What Happened Last Week Lower Rates: Downside inflation surprises in the U.S. and U.K. and

Watch Now Mike Dickson sees early-year volatility as ‘normal’, with positive signs from CPI, retail

OVERVIEW Stocks posted mixed results during the fourth quarter of 2024. Investors were initially encouraged

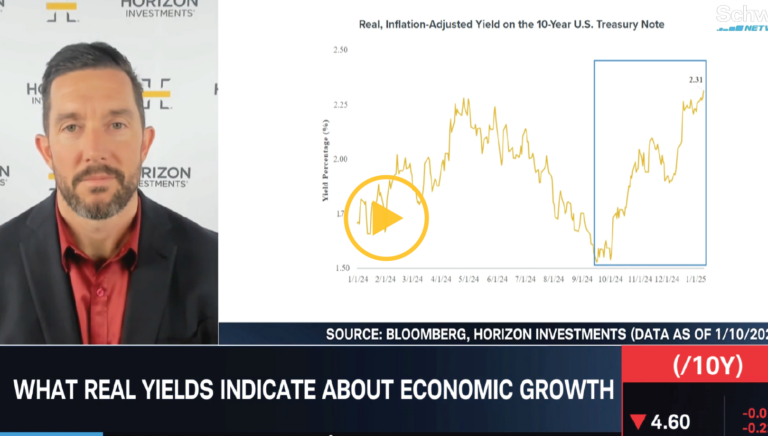

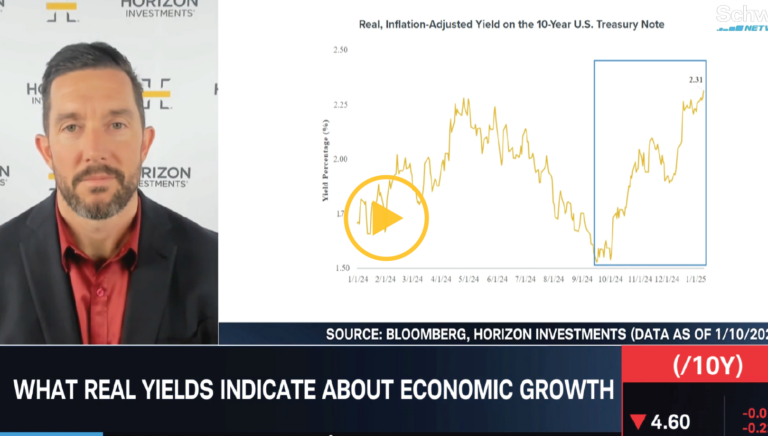

Will the U.S. economy’s growth machine keep on humming? Surging bond yields are rattling investors,

Watch Now

Watch Video As stocks dip and Treasury yields climb, CIO Scott Ladner remains cautiously optimistic.

Gain Strategies The choppy, volatile market environment continued in the final quarter of 2024.

What Happened Last Week Global Selloff: Stocks fell as rising yields and rate uncertainty pressured

Watch Video Despite no significant changes in the economy, a shift in perspective has created

Do top-heavy markets eventually spread out? Many investors have experienced extraordinary stock market gains over

Download Presentation

What Happened Last Week Santa Rally Fizzles: The S&P 500 closed the week ~2% below

Watch Now

Watch Now

What Happened Last Week Hawkish Cut: The Fed cut 25 bp and pointed to a

Watch Now During a recent interview with BNN Bloomberg, Zach Hill highlighted key themes for

Small-cap stocks may offer tactical opportunities. Investors who expect a late-year, post-election rally in small-company

Watch Now

What Happened Last Week Equity Reprieve: U.S. large-cap gains paused last week despite a rally

Watch Now Broadcom hits a record high after proving nay-sayers wrong. How will the custom

The digital currency seems to have the wind at its back these days. An ongoing

What Happened Last Week Fresh All-Time High: S&P notches another ATH, supported by mega-caps. Price

Watch Now

Watch Now

Watch Now

Opportunities outside of the top performers. It’s no secret that a small number of stocks

What Happened Last Week All-Time Highs: Both domestic large- and small-caps hit fresh all-time highs

Watch Now

What Happened Last Week Stocks Rose: S&P 500 closed within a hair of all-time highs

The latest homebuilder data could provide some promising signals for the housing market. Chief Investment

Positive earnings surprises are back on track. With more than 90% of the companies in

CHARLOTTE, NC (November 19, 2024) – Horizon Investments, LLC, a leader in providing the financial

Chief Investment Officer Scott Ladner dove into the key forces shaping today’s markets during a

Listen Now

What Happened Last Week Price Action: Headline equities sold off as investors digested marginally hawkish

While inflation remains sticky in areas like services and housing, Mike sees an opportunity to

Recent election results bring a 2016 vibe back to the market, with U.S. stocks currently

What Happened Last Week Republican Election Sweep: Republicans granted a strong mandate to pursue an

Investors saw sharp market movement the day following the election Donald Trump and the Republicans

Stocks have had a habit of gaining ground no matter who becomes President. Regardless of

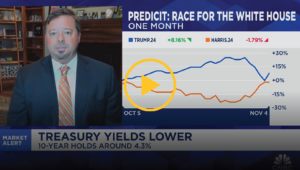

What Happened Last Week Yields Rose: Concerns over higher spending in the U.S. post-election caused

Inflation concerns, rather than growth expectations, could be behind the rise in 10-year yields, especially

Buyers need lower rates to get back in the game. In anticipation of the Fed’s

“We’re gaining on it.” The mega-cap growth to small-cap stock transition that is. A solid

Chief Investment Scott Ladner joined BNN Bloomberg to discuss potential impacts of the U.S. election

What Happened Last Week Yields Pushed Higher: Talk of fiscal worries added to the existing

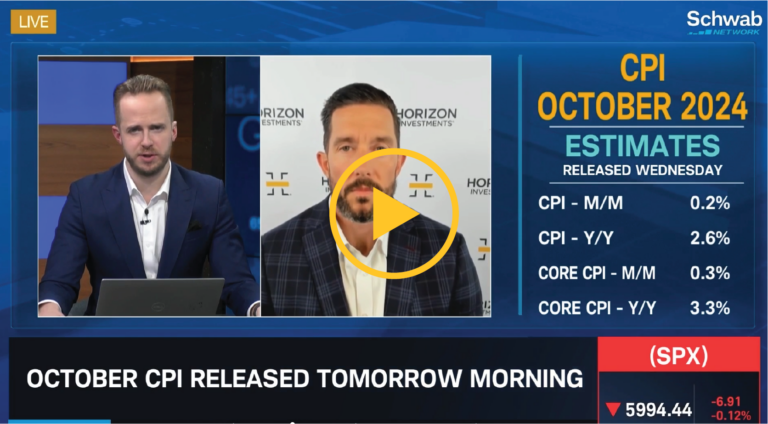

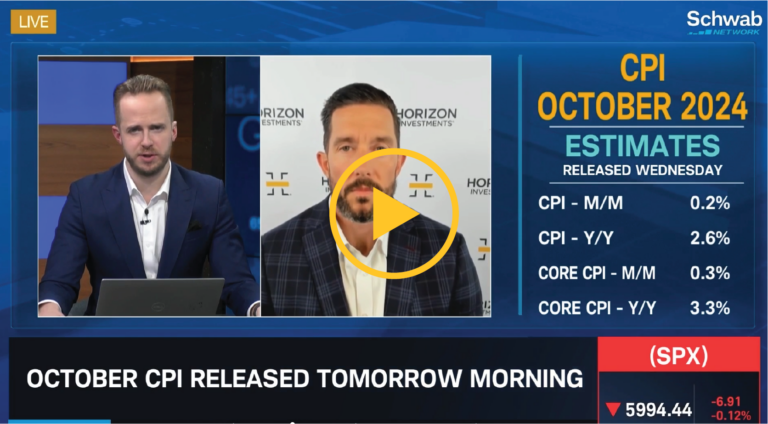

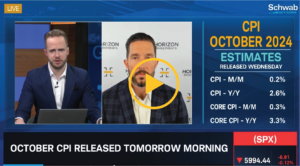

Head of Research and Quantitative Strategies Mike Dickson joined Schwab Network to highlight the U.S.’s

Consumer spending, corporate earnings, and the overall economy remain robust. Investors will examine one of

What Happened Last Week New All-Time High: S&P 500 notches new all-time highs and posted

We think a “barbell approach” combining both sectors and ETFs may be beneficial to balance

OVERVIEW Stocks posted another quarter of positive returns — despite some significant volatility along the

“We’re looking under the hood of the micro,” says Horizon Investments’ Zach Hill. He looks

The stock market is two years (and counting) into a bull market. Last Saturday marked

What Happened Last Week Price Action: Fresh all-time highs in U.S. large caps on bank

Gain Strategies Despite returns of over 5% for both global stocks (MSCI All Country

Lowest spreads in nearly three years Want more evidence that the U.S. economy is in

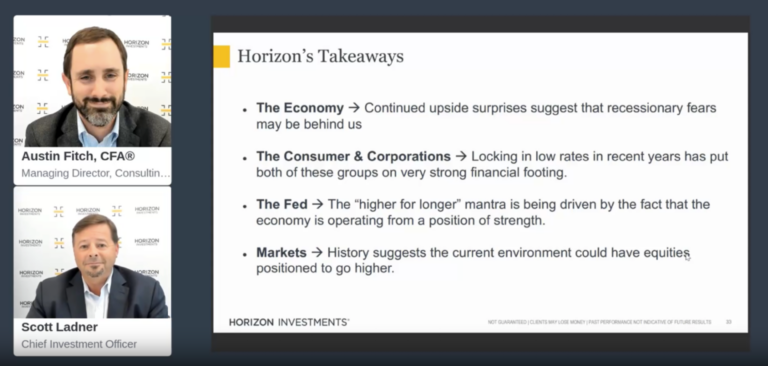

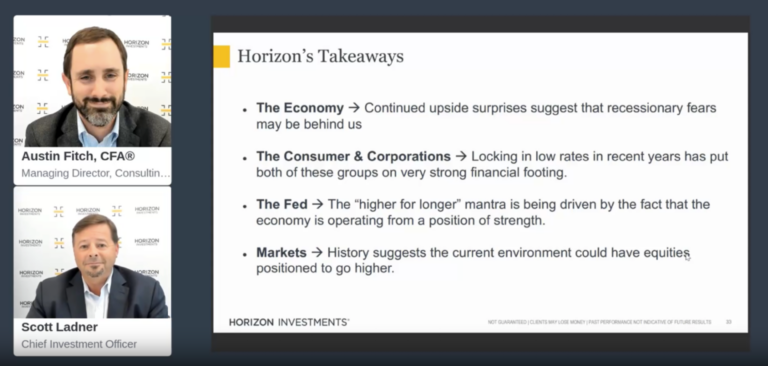

Chief Investment Officer Scott Ladner and Head of Consulting Solutions Austin Fitch, CFA®, review the

Chief Investment Officer Scott Ladner joined BNN Bloomberg for a wide-ranging conversation on the post-COVID

What Happened Last Week Geopolitical Volatility: Oil soared over 9% as investors weighed Israeli retaliation

It’s been 17 years since we’ve seen a weekly return this strong Long-suffering Chinese stocks

How do you harness the resilience of the U.S. consumer? With steady wage gains and

During a recent conversation with Schwab Network, Chief Investment Officer Scott Ladner highlighted three key

With recent Chinese stimulus measures stirring excitement in the markets, it’s easy to get caught

Defensive stocks have come into focus as global tensions have risen in recent weeks –

What Happened Last Week China: Property market support was announced over the weekend in major

Which sector has been leading the rally so far in 2024? One market sector has

What Happened Last Week Fed: Equities rallied as the Fed cut 50 bps to kick

https://www.youtube.com/watch?v=-f7S0cz_D-4&t=95s We remain bullish on equities, anticipating that continued support from the Fed will drive

What Happened? The Federal Reserve (Fed) started their much-awaited easing cycle on Wednesday after holding

Are you ready? All eyes are on Jerome Powell on Wednesday as investors await the

What happened last week Stocks Rebound: U.S. large caps posted their best week of the

Successful investing doesn’t have to be a thrill ride. Anyone who has driven California’s Pacific

Election Season: A Time for Ballots, Not Drastic Portfolio Changes When major elections are near,

September holds its notorious history of challenging stocks. How could interest rate cuts affect the

Regardless of stabilized delinquency rates and healthy debt-to-income ratios, consumers do not believe this is

What happened last week Price Action: Poor September seasonality may be to blame for a

Join us at 4:00 PM ET on Tuesday, October 8, 2024, for Horizon’s Quarterly Webcast,

Here’s how stocks may perform for the rest of 2024 As the fall harvest season

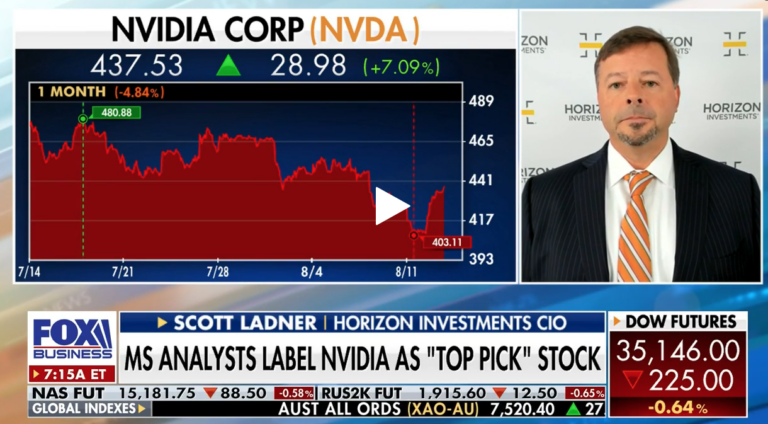

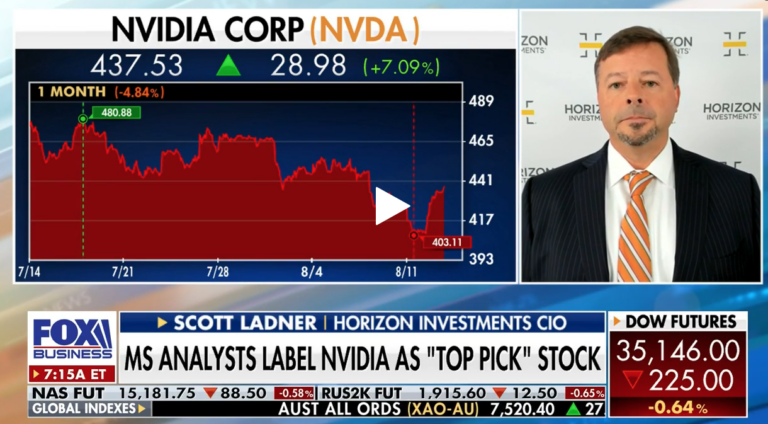

Despite Nvida’s recent slump, the market kept moving. Chief Investment Officer Scott Ladner joins Schwab

What happened last week NVDA: Nvidia’s (NVDA) beat and raise was not enough to impress

Watch out above. Here comes revenue per employee. Chief Investment Officer Scott Ladner joins CNBC

Fed Chair Powell tees up the long-awaited rate cut Fed Chair Powell said just about

What happened last week Powell Pivot: Chair Powell validated the market’s view that a rate

Conventional economic thinking may not have a place in today’s market cycle. Head of Portfolio

Best week of 2024 for the S&P 500 After a brief summer slump and a

What happened last week Market Recovery: S&P rallies to within 2% of its all-time high.

Homebuilders and housing stocks may be a smart first play for the anticipated September cut

U.S. company profits continue to impress. Earnings season is in the home stretch, with more

What happened last week Price Action: U.S. and global stocks ended the week practically unchanged

Slower numbers do not necessarily mean weak numbers. Chief Investment Officer Scott Ladner joins BNN

The markets have shown remarkable resilience, rebounding from last Monday’s sell-off. But is it time

The S&P 500 fell 3% on Monday—its biggest one-day decline in nearly two years—amid growing

Market volatility spikes—but how much should you worry about it? The first full week of

What happened last week Price action: Summer liquidity, poor economic data, a less dovish than

The recent market volatility should prompt investors to take a deep breath and evaluate their

A growing number of stocks are having their moment in the sun Everybody loves a

What happened last week Price Action: Small-caps continued to outperform year-to-date leaders, like the tech-heavy

Don’t read too much into harbingers of stock market doom and gloom Sometimes, it pays—literally—to

What happened last week Equity Market Reversion: Small-caps outperformed mega-cap technology by a little less

Overview Overall, stocks delivered another quarter of strong gains during the three-month period ending June

Will softness in housing inflation, jobs, and other metrics prompt the Fed to act soon?

What happened last week Softening Economic Data: Cooler than expected inflation data weighed on interest

Gain Strategies Global stocks continued their upward march in the second quarter, powered higher

Chief Investment Officer Scott Ladner and Head of Consulting Solutions Austin Fitch, CFA®, review the

What happened last week Price Action: MAG-7 leads U.S. equity indices to fresh all-time highs

Will we see broader market growth beyond the tech giants? Head of Portfolio Management Zach

Will the next round of AI earnings be impressive – or lackluster? Chief Investment Officer

Six more months! Six more months! Investors cheered as stocks ended the second quarter last

What happened last week Reversion Price Action: Year-to-date equity trends continued their reversal last week;

Is the seventh month of the year a stock investor’s best friend? While scorching temperatures

What happened last week AI vs. the Rest: Year-to-date equity trends reversed last week as

Head of Portfolio Management Zach Hill, CFA®, joins BNN Bloomberg to share our thoughts on

Would a September rate cut be a political move? Chief Investment Officer Scott Ladner joined

Are there potential opportunities beyond the handful of big stock market winners? The equity market

What happened last week All-Time Equity Highs: Another week of new highs for U.S. large-caps

Are we in for a slow summer with the Fed? Head of Portfolio Management Zach

Falling bond market volatility could support equity prices. Investors looking for signs of what stocks

What happened last week AI Theme: NVIDIA (NVDA) rally to $3T in market capitalization vaults

Potential homebuyers are hitting the brakes. What could that mean for the future? Would-be homebuyers

What happened last week Revenge of the Meme Traders: Small-caps outperformed large-caps on resurgent trading

Thanks to AI, it seems a bunch of people want Nvidia’s semiconductors. Is it Nvidia’s

With GDP and inflation slowing, keep in mind our strong starting place. Chief Investment Officer

What happened last week Semis: NVDA’s “beat and raise” earnings report reignited the AI trade

Where do you go from yesterday’s Fed-induced sell-off? CIO Scott Ladner joins CNBC Worldwide Exchange

Should investors consider opportunities in global stocks? We believe international stocks could deserve a place

Utilities are the top performing sector this quarter. Is this the next AI play? Chief

What happened last week Price action: China led on a green week for global stocks,

Are U.S. consumers ready to go more rounds? “When will the consumer finally crack?” is

Finding a balance between growth potential and low-risk investments can be essential for long-term retirement

What happened last week Price action: The S&P 500 rose higher and through key technical

Generating goals-based income with an equity-centric, globally diversified portfolio. Memo to retirees seeking sustainable spending

https://www.youtube.com/watch?v=K_2CoH-Ju1o&t=8234s%20 Chief Investment Officer Scott Ladner joins Bloomberg to discuss large vs small business confidence.

Is the Fed out of play as a market catalyst at this point? Chief Investment

What happened last week Earnings: Strong earnings from AI-exposed mega-cap technology supported a modest rally

It’s a big week for news from corporate America. Earnings season is in full bloom,

OVERVIEW Stocks during the first quarter of 2024 extended the rally that began late last

What happened last week Stocks rose for the first time in four weeks on the

Middle East conflicts shouldn’t derail the strong domestic growth story. Rising Middle East tensions caused

What happened last week Equities fell for the third consecutive week as rates continued to

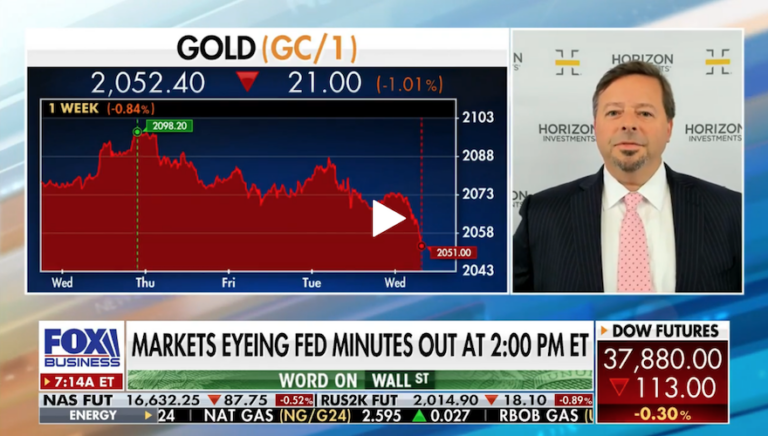

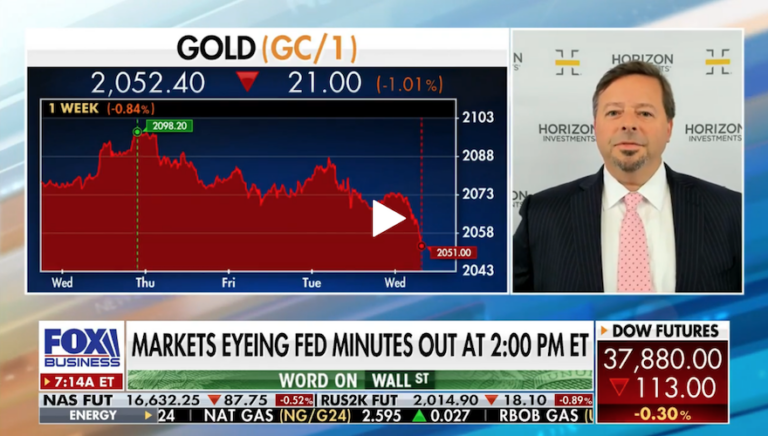

Chief Investment Officer Scott Ladner joins Mornings With Maria on Fox Business to analyze this

Chief Investment Officer Scott Ladner breaks down the chips and the materials and energy sectors

Can economic growth tailwinds outweigh higher interest rates? Month-over-month retail sales for March topped economist

What happened last week Equities sank as the 10-year Treasury yield surged above 4.5%. Third

Chief Investment Officer Scott Ladner and Head of Consulting Solutions Austin Fitch, CFA®, review the

Head of Research & Quantitative Strategies Mike Dickson, Ph.D, joins BNN Bloomberg to discuss pivoting

Gain Strategies Global stocks put in another strong quarter to start 2024 as continued

Can company profits exceed rising expectations? First quarter 2024 earnings season kicks off this week,

What happened last week The second quarter opened with a whimper as stocks declined and

First-quarter returns suggest the market may have more to give. Stocks went out like a

What happened last week Holiday-shortened week ends 1Q 2024 – U.S. equities (S&P 500) rose

Accelerating inflation and long-term growth have tilted the balance in favor of the hawks. Head

Derivatives can be effective when you know what you’re buying or selling. Covered call option

What happened last week Dovish central bank policy meetings resulted in fresh S&P 500 all-time

Keeping a close eye on Treasury market volatility Volatility in the Treasury bond market is

What happened last week Last week’s price action was choppy and lacked a cogent narrative.

Taking a tactical approach to “junk” bonds Yield-hungry investors eyeing an eventual Fed rate cut

What happened last week Mega-cap tech underperformed the broad market and equal-weight indices as market

Head of Research & Product Development Mike Dickson, Ph.D., joins Schwab Network to discuss his

Prices of many services are heating up again. Last week, we learned that the Fed’s

The market has done well in the face of repricing to half of their initial

We expect market broadening within the S&P rather than small or mid-caps. Chief Investment Officer

What happened last week Stocks rose as mega-cap tech and theAI theme continued to propel

Eventually, many clients will rely on the nest egg they have accumulated and preserved to

Do shares of non-U.S. companies deserve a place in your portfolio? With soaring U.S. stocks—and

What happened last week Nvidia, now a $2 trillion market-cap company, crushed lofty earnings expectations

What happened last week Hot inflation print pushed back the start of rate cuts; more

Is stocks’ extended winning streak “an offer you can’t refuse”? The S&P 500 has now

Zach reviews the 4Q23 earnings season, what Horizon anticipates from the Fed and interest rates

What happened last week A mega-cap-led rally lifted the S&P 500 above 5,000, a new

Earnings momentum, disinflation, and a global easing cycle… is the US an attractive place to

Robust consumer spending continues to support a strong economy. Last week’s impressive jobs data—employers added

Chief Investment Officer Scott Ladner joins Gregg Greenberg with InvestmentNews to share how Horizon’s goals-based

What happened last week Stocks ended the week higher on a mix of very strong

The economy and inflation are lining up as investors hoped they would. All eyes were

What happened last week Economic growth remains hot with inflation cooling – the probability of

It could be a great time to buy stocks. Here’s why. Investors celebrated last Friday

Until bazooka-style fiscal government spending is announced, we don’t see China as an attractive investment.

Navigating heightened market volatility and an evolving regulatory landscape has become the new normal for

A broader tech. trade could be the largest driver in 2024 as the market moves

China would need massive fiscal spending to get out of its balance sheet recession

We appear to be in a war-recovery-like period, going through an abrupt normalization process, which

What happened last week Action-packed and holiday-shortened trading week underscored by new all-time highs across

“Sticky” shelter costs could keep overall prices uncomfortably high. While inflation’s steady march downward of

While some headlines focus on credit card debt alone, Head of Research & Product Development

What happened last week Magnificent-7 (“MAG-7”) mega-caps led the “broadening-out” trades’ outperformers (e.g. small caps).

OVERVIEW Following a third-quarter slump, stocks roared back to life during the final three months

Gain Strategies In a topsy-turvy year for investors and economists alike, 2023 ended on a

Value and growth index fund investors may be surprised by their returns last year. Investors

Chief Investment Officer Scott Ladner and Head of Consulting Solutions Austin Fitch review the fourth

What happened last week The S&P 500 snaps its 9-week winning streak to end Friday

“This Covid cycle that we’ve just been through was not a traditional business cycle. It

What happened last week 2023 set a high bar for 2024 market-wise, although new all-time

REGISTER NOW Join Horizon’s Focus Webcast, hosted by Chief Investment Officer Scott Ladner and Head

How are the “Magnificent 7” stocks really doing? Outperformance isn’t always exactly what it seems

What happened last week Last week was a full macro week with a string of

Some crucial context on Americans’ “out of control” debt levels. “Credit Card Debt Crisis” “Credit

What happened last week The S&P 500 has rallied for its sixth straight week, retracing

Most stocks have been laggards this year, but that could be starting to change. It’s

What happened last week A strong seasonal rally is in full swing as the S&P

Chief Investment Officer Scott Ladner discusses his outlook for markets and investment strategy. Watch Video

Will December bring glad tidings to small-company stocks? Small-cap stocks have had quite the slog

Baby boomers have been approaching retirement for a decade, bringing billions of dollars out of

What happened last week A short trading week saw the S&P 500 inch toward an

Chief Investment Officer Scott Ladner joins CNBC to discuss the divergence in stock performance between

One active approach to risk management is currently beating the market. Risk management can be

Chief Investment Officer Scott Ladner joins Fox Business ‘The Claman Countdown’ to provide investing advice.

Scott Ladner joins BNN Bloomberg to discuss the U.S. markets, and Powell’s recent comments on

What happened last week Risk sentiment increased last week, lifting the S&P 500 through key

The end of Fed rate hikes suggests good things for equities. The stock market’s surge

What happened last week Risk sentiment increased last week, lifting the S&P 500 through key

Three years of less-than-stellar financial market performance. It’s been a tough slog for investors over

MASTERCLASS: Portfolio Construction The portfolio construction process can be broken down into a series of

What happened last week Investors reduced market exposure due to geopolitical tensions weighing on equities

GDP growth over the past three months may have been huuuuuge. Third-quarter GDP growth could

House hunters are facing a shocking number these days. Pity today’s homebuyers who are looking

OVERVIEW During the third quarter of 2023, investors hit “pause” on the rally that had

What happened last week Stocks and bonds sold off as geopolitical tensions outweighed strong economic

Bond market must get ‘under control’ before stocks rise again. Chief Investment Officer Scott Ladner

Gain Strategies After a surprising and surprisingly positive first half of the year for financial

What happened last week Stocks close the week higher despite mounting geopolitical concerns and rising

https://www.horizoninvestments.com/wp-content/uploads/2023/10/Q3-Webcast-Super-TB-Small_1.mp4 Chief Investment Officer Scott Ladner and Managing Director of Consulting Solutions Austin Fitch review

What happened last week Stronger economic data and domestic political turmoil contributed to a resumption

It’s been bleak days—and lots of them—for bond investors. As the fourth quarter begins, bonds

Look Outside of the Stocks that Gained from the Inflation Trade The staples companies were

Over the summer months, Horizon conducted the firm’s first annual Advisor Sentiment Survey to gauge

What happened last week Last week, the quarter ended with both stocks and bonds mainly

The greenback’s recent rally could have legs. The U.S. dollar is lighting up the charts,

What happened last week A more hawkish than expected Fed meeting saw higher interest rate

Next-generation investing in AI will take hold in 2024 CIO Scott Ladner joined BNN Bloomberg

Falling interest rate volatility in Treasuries could herald a stock market rally. There are few

https://youtu.be/mWhUrUv0Ffo?feature=shared Hear Zach cover what Horizon is taking from recent economic data, our expectations for

What happened last week Treasury yields continued to move last week higher on strong economic

Sharply higher oil prices have the potential to re-ignite inflation. Last week saw oil prices

What happened last week Strong data drove Treasury yields higher and stocks lower in a

Historically, the 9th month of the year hasn’t been kind to investors. “April is the

What happened last week It was a recovery week for equities as yield moves continued

What happened last week A choppy week in markets saw small recoveries for stocks and

CIO Scott Ladner joined Schwab Network to discuss recent employment and inflation data, factors behind

There are few signs of the economic struggles predicted at Jackson Hole last year. Attention

What happened last week The push higher in Treasury yields drove the third consecutive week

Stock investors may want to brace for some bumps in the road. After months of

Chief Investment Officer Scott Ladner joined Fox News to provide critical tips to investors on ‘Mornings

What happened last week Pressure building on the disinflation narrative as global bond yields surge

What happened last week Negative bond market developments likely drove the sell-off in equities Jobs

https://youtu.be/e26Kr8v2gvg Head of Portfolio Management Zach Hill, CFA® covered why the Fed matters less today,

CIO Scott Ladner joined Yahoo! Finance to discuss portfolio positioning and how to prepare for

Other market sectors are showing signs of life. The S&P 500 continued its winning streak

What happened last week Stocks climbed as the Fed and European Central Bank (ECB) raised

Is the Fed’s battle to contain inflation finally done? The market seems to think so.

CIO Scott Ladner joined TD Ameritrade to discuss this week’s FOMC meeting and A.I.’s potential

What happened last week Global stocks edge higher, led by the US, in a week

Chief Investment Officer Scott Ladner joined CNBC to discuss what’s ahead for the busiest week

The S&P 500’s lowest correlation level in years suggests outperformers and underperformers should emerge. Think

When was the last time a client asked, “What was my portfolio’s alpha?” You may

OVERVIEW During the second quarter of 2023, several key equity market indices built on their

https://youtu.be/etvuMLvXBAM Chief Investment Officer Scott Ladner and Managing Director of Consulting Solutions Austin Fitch review

Gain Strategies After a furious and volatile start to the year for stock and bond

Will six months of returns cause you to forsake global diversification? While it’s true that

What happened last week Equities sold off in volatile trading to start the third quarter

Horizon Investments chief investment officer Scott Ladner analyzes the market as it enters the second

What happened last week Strong end to a strong quarter with the S&P 500 closing

Stock market volatility has fallen to multi-year lows? “Merrily, we roll along, roll along.” Those

What happened last week Stocks sold off with small caps, value, and internationals leading losses

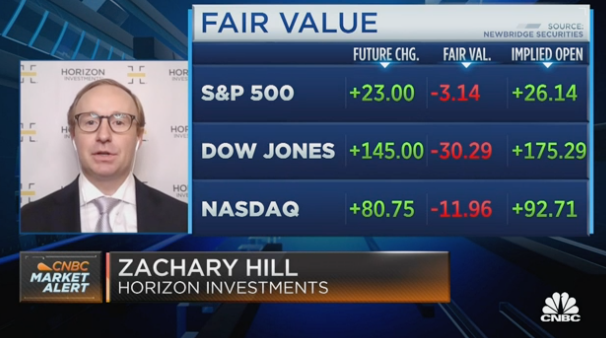

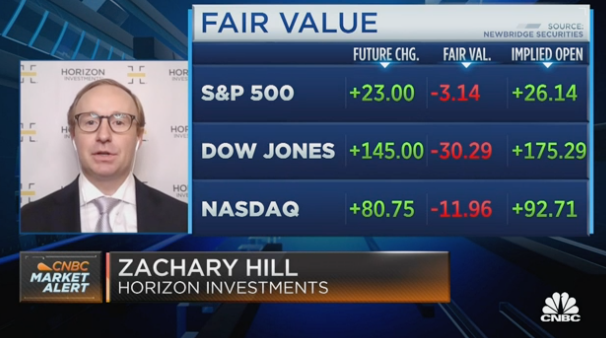

Zachary Hill, CFA, joins ‘Squawk Box’ to discuss the latest market trends, whether stocks are

With the oldest baby boomers over eleven years into retirement and the oldest Generation X

The housing market is the latest economic indicator to light up the charts? One of

What happened last week Increasingly positive investor sentiment boosted the S&P 500 closer to all-time

Does This Market Have Staying Power? Stocks escaped the bear’s grip. What comes next Investors

What happened last week It was a quiet week, with recent trends reversing in favor

The positive surprises in the labor market just keep on coming. Job creation in the

What happened last week Friday’s strong labor market data defined the trading week. A bipartisan

A.I. could be the most important productivity-enhancing development for the global economy since the uptake

Is the fast-moving market moving too fast? Technology stocks generally hate higher interest rates. Tech

What happened last week A debt ceiling agreement was reached, and will likely become law

CIO Scott Ladner, and Managing Director Austin Fitch, CFA® discuss the debt ceiling debate, disinflation,

Active management aims to navigate trends as they emerge—and fade We believe an active, dynamic

What happened last week The market saw year-to-date highs in stocks despite a lack of

Apple is once again worth more than the entire Russell 2000 In Marvel movies, it’s

Fear-inducing headlines are likely painting too grim of a picture. Silicon Valley Bank. Signature. First

Hear Zach Hill, CFA®, cover earnings season, Fed policy, and what Horizon is watching in

Investors seem to be a relatively calm, cool, and collected bunch these days—which may be

Overview The idea that the financial markets “climb a wall of worry” by showing resilience

Identifying investment opportunities may take a sharper focus going forward Fears about banks’ financial health

Gain Strategies Investors shifted among dominant themes numerous times in what was a volatile but

What tools can investors use to fight longevity risk in retirement? Many retirees today probably

There’s tech, and there’s the rest Investors in tech stocks these days are a wildly

Key Takeaways Investors require different outcomes from their investments, a one-size-fits-all passive approach is unlikely

Here’s something we have only seen once in 20 years In a true study of

Scott Ladner and Austin Fitch discuss the Fed announcement and the current market and what

Stocks stand to benefit if the Fed eases up on the brakes Continued concerns about

Bank woes raise questions about the Fed’s next move. Investors’ sudden hunger for U.S. government

Chip stocks have come out swinging to start 2023 In what could be a harbinger

The U.S. real estate market has been flexing its muscles in recent weeks. Unexpected strength

“The U.S. economy looks pretty strong, and we think that will feed into corporate profits.”

U.S. stocks have clearly perked up so far this year. But now, two key market

https://www.horizoninvestments.com/wp-content/uploads/2023/02/Fast-Take-Final-Video.mp4 Hear Zach Hill, CFA®, Head of Portfolio Management, cover Horizon’s thoughts on the state

In the consumer market, high-quality products are identified as reliable, longer lasting, and are generally

In the wake of a bruising 2022, investors seem to have decided that “risk on”

Expected interest rate volatility has fallen 28 points so far this year The financial markets

Gain Strategies The final quarter of what has been a difficult year for asset owners

Overview Financial markets suffered sizable—in some cases, historic—losses in 2022. Soaring inflation combined with an

Investors eye foreign markets and like what they see. For more than a decade, international

Put “protection” has come up short lately—but there’s a better way. Put options are often

WATCH VIDEO

Up is down, and down is up Two key components of the equity market—growth stocks

Hear Scott talk about areas of the market to watch in 2023, and his expectations

Scott provides insight on the state of the market.

WATCH VIDEO

“For tech and communication services, there was this belief that those revenue streams were impervious

Ladner: We think there will be a lot of tailwinds for the markets in the

https://www.horizoninvestments.com/wp-content/uploads/2022/12/Zach-Hill-V5.mp4 Hear Zach Hill, CFA®, Head of Portfolio Management, cover Horizon’s thoughts on what’s ahead

This year we have seen a first for stocks and bonds. Welcome to uncharted territory.

Zach Hill, CFA® discusses concerns around markets and the economy in 2023 on Mornings with

Everybody can appreciate a smooth ride—and for investors, a journey without too many bumps along

Throughout 2022, investors have seen various positive economic developments as signs that the Federal Reserve

Scott Ladner recently appeared on ‘Mornings with Maria’ with Fox Business to review inflation, the

Zach Hill, CFA® joined Nicole Petallides on TD Ameritrade Network to discuss the takeaways from

Could bond investors find the next few months to be “the most wonderful time of

Horizon’s Head of Portfolio Management, Zach Hill, CFA®, joined Squawk Box Friday to discuss the

https://www.horizoninvestments.com/wp-content/uploads/2022/11/Zach-Hill-Fast-Take-FInal-Video.mp4 Hear Horizon’s thoughts on quarterly earnings, Fed policy, and market outlook. Disclosure: The commentary

Investors won’t have to dip into their savings to pay for their Thanksgiving feasts this year,

Investors are shifting gears in the wake of good inflation news. Will it last? The

“The market is – as it has been a few times this year – very

The losers of the past are riding high—while yesterday’s winners appear to be out of

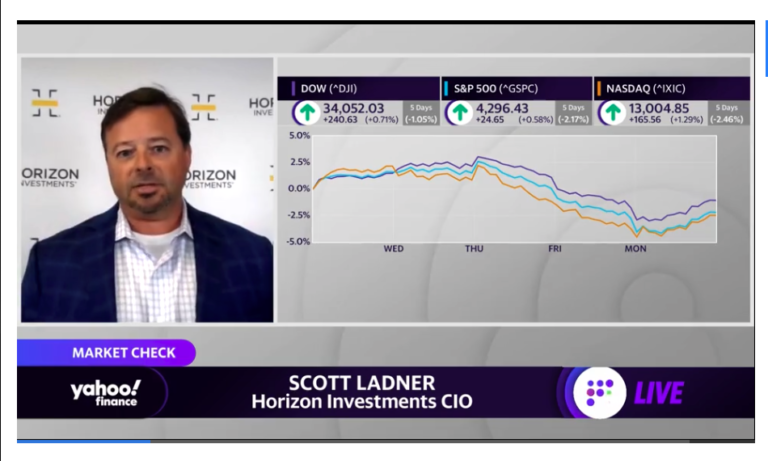

CIO Scott Ladner joined Yahoo Finance Live to discuss Fed policy and inflation, economic data,

We’re more than halfway through the third-quarter earnings season, and thus far, the S&P 500

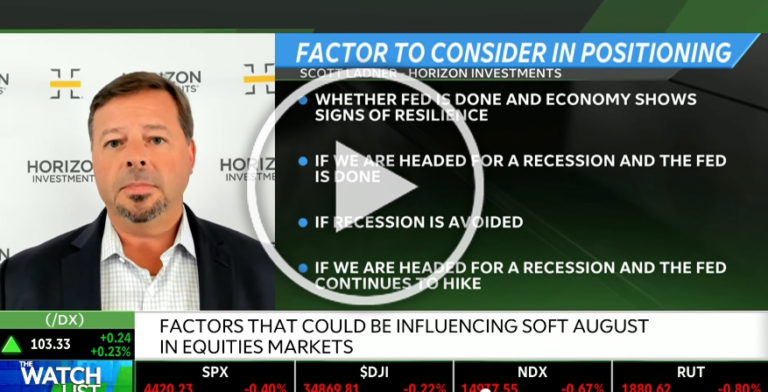

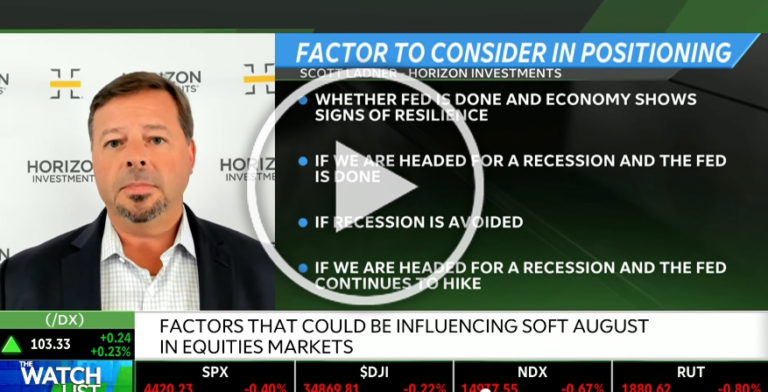

Scott Ladner joined Nicole Petallides on TD Ameritrade’s ‘The Watch List’ to discuss the market,

Ron Saba weighs in on shifting focus from tech stocks to so-called value stocks in

The squeeze on homebuyers appears to be getting tighter by the month—which could spell trouble

Horizon’s Head of Portfolio Management, Zach Hill, CFA®, discussed his expectations for earnings estimates, the

CIO Scott Ladner joined Maria Bartiromo on Fox Business to discuss the impact of inflation

Zach Hill, CFA® shares his expectations around negative demand, the next Fed meeting, and his

Horizon Investments CIO Scott Ladner explains the lull in chip demand and why now is

“It’s interest rates that are driving equity volatility, that is the way we have been

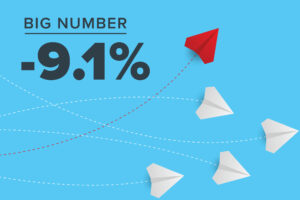

We all know that last week’s inflation report showed headline inflation continues to surge, with

Central bankers have become laser-focused on crushing inflation. What could that mean for the economy

Gain Strategies This year’s punishing price action across markets continued last quarter as global stocks

Head of Portfolio Management Zach Hill, CFA® joins Yahoo! Finance to weigh in on recent

CIO Scott Ladner joins BNN Bloomberg to discuss the BOE announcement, global growth, and sectors.

CIO Scott Ladner joins CNBC to discuss Treasuries, the Fed’s next moves, and the impact

It’s a game of “catch me if you can” between investors and the Fed these

CIO Scott Ladner argues housing leads the economy and will cause a market ‘softening’ as

Tomorrow, the Federal Reserve Board is set to announce its latest decision regarding interest rates.

“The recent CPI report threw cold water on hopes that the Fed could ease up

All eyes were once again on interest rates last week, as the European Central Bank

Head of Portfolio Management Zachary Hill, joined CNBC Worldwide Exchange to discuss the markets ahead

https://www.horizoninvestments.com/wp-content/uploads/2022/09/Fast-Take-With-Zach-Hill.mp4 Hear Horizon’s view of the markets as we head into the fall, along with

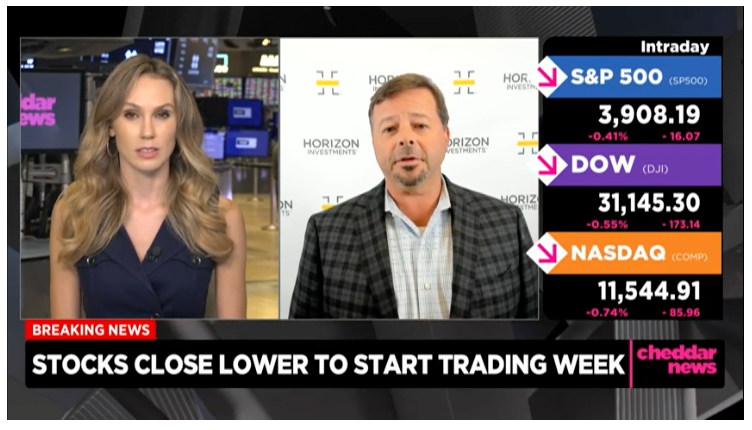

Chief Investment Officer Scott Ladner, joined Cheddar News’ Closing Bell to discuss U.S. stocks after

Chief Investment Officer Scott Ladner joined ‘Morning with Maria’ to weigh in on the August

“Nominal GDP slowdown has been baked in the cake. The stock market today has started

Demand for new homes is way down. What does that mean for investors? New home

Historical Recessions Given the increase in signs of a cooling economy, this study aims to

It’s a safe assumption that when Bob Dylan sang “the first one now will later

What a difference a couple of months can make. Since hitting its low point (closing

Is More Volatility Coming Down the Pike? Investors looking for greater clarity about the road

As investors digested both the Fed’s decision to raise interest rates by another 75 basis

The U.S dollar continues its steady march higher, up 14.7% during the past 12 months.

Scott Ladner, CIO of Horizon Investments, joins Worldwide Exchange to discuss his views on inflation

Overview Investors faced a wall of worry during the second quarter that proved to

Gain Strategies The second quarter of 2022 was another difficult one for asset markets

Over the next few weeks, a steady stream of second-quarter earnings reports will reveal how

The S&P 500 hasn’t seen two consecutive quarters of negative returns since the global financial

Economists surveyed by the Wall St. Journal now say there’s a 44% chance of a

Zach Hill, CFA and ERShares COO Eva Ados joined Yahoo Finance Live after the closing

Red-hot inflation, and the Fed’s now-aggressive efforts to fight it, are pushing up mortgage rates

Zach Hill, CFA®, head of portfolio management at Horizon Investments, says this bear market is

CIO Scott Ladner joined Brigg MacAdam LTD founding partner Greg Swenson and Rosecliff Capital CEO

American workers are reliving the past – and that’s a potentially big problem. The reason:

Equity markets sent investors smiling into the Memorial Day weekend, thanks to the biggest weekly

CIO Scott Ladner joined Bloomberg to share his expectations for the market and why boring

With the Nasdaq plummeting 27.2% and the S&P 500 Growth Index close behind at -26.2%,

https://www.horizoninvestments.com/wp-content/uploads/2022/05/Horizon-Investmenst-Mid-Quarter-Update-Small.mp4

Last week ended with the S&P dipping briefly into bear market territory before closing higher

CIO Scott Ladner joined Liz Claman to discuss this week’s market sell-off and share his

Investors in balanced portfolios these days may feel like they’ve fallen off a tightrope. The

Scott Ladner talks macroeconomics and a global view on markets with Ausbiz.

“…unless supply chains heal rapidly or workers flood back into the labor force, any equity

Stocks fell hard Thursday, May 5, 2022 following the FOMC meeting announcement in which the

Investors have been dumping high growth stocks for weeks, due to worries about inflation, rising

Scott Ladner on air for Mornings with Maria Bartiromo. Scott sheds light on the micro

Scott Ladner joins Kristina Hooper after the closing bell yesterday on Yahoo Finance to discuss

There’s something strange happening with energy ETFs. Zachary Hill, CFA comments on the sector’s flagships

The broader tech sell-off comes after the Federal Reserve announced plans to hike interest rates

Investors liked what they heard from the Fed this week. The Federal Reserve Board raised

Bonds are usually thought of as a safe haven for investors due to their lower

No doubt about it: Fixed-income investors are spooked. Volatility in U.S. Treasuries has soared this

The truth is, individual investors today don’t care as much about exposures as they do

We know that in Preservation, clients either ask or at least ponder: What product gives

Kahneman’s Behavioral Approach Noise: an unwanted variability in decision-making. Ask yourself, when am I at

Investment professionals rarely agree on the risks and direction of markets, yet many would agree

We see active financial advice as the new reality. Not robo. Not passive. But active!

U.S. companies start to report the effect of decades-high inflation on their profit margins.

“Volatility in the bond market is simply too high right now…” Zachary Hill, CFA is

As Americans become more comfortable with Covid-19’s transition from pandemic to endemic, two of our

Now that the Federal Reserve Board has started raising rates, the upcoming first quarter earnings

Zachary Hill, CFA‘s insights on the economic health from a consumer and corporate perspective.

Stocks fluctuate to end whirlwind week. But have we hit the bottom?

Fed Finally Moves Against Inflation With Rate Hike.

Wall Street adds to gains following surge in Chinese markets

Watch this short video as Scott Ladner discusses the current market environment, the Fed, interest

Horizon Investments CIO, Scott Ladner was on Mornings with Maria Bartiromo on Fox Business Network

Horizon Investments CIO, Scott Ladner joins Yahoo Finance Live to discuss the outlook for the

Zachary Hill, CFA, Head of Portfolio Management at Horizon Investments, reviews market volatility with TD

With such a choppy week so far in the markets, we pose the question, ‘Will

In case you missed it, check out Horizon Investments’ CIO Scott Ladner discussing his market

Listen to what Scott Ladner, Horizon CIO, and Kevin O’Leary, O’Shares, say about hedging against

Tracking alternative investments to Treasurys Kevin O’Leary of O’Shares and Scott Ladner of Horizon Investments

One sector’s secret weapon against rising inflation, according to ETF manager Alexi Panagiotakopoulos of Fundamental

Stocks closed the first trading week of 2022 in the red as investors digested a

Kevin O’Leary of O’Shares joins Scott Ladner of Horizon Investments to discuss how to invest

Flush with new cash, Horizon Investments is even better positioned to provide first-rate advice to

Check out what Zachary Hill, CFA, Horizon Investments’ Head of Portfolio Management, had to say

Tech stocks spur Wall Street slide as investors continue to monitor inflation impact

The waiting game is almost over. Zachary Hill, CFA weighs in onthe Fed’s decision coming

Investors sure are a gloomy bunch these days. How downbeat are they? According to the

As expected, the Federal Reserve Board on Wednesday raised the target range of the federal

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Many investors and financial advisors are still in the dark on what ESG factor investing

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Inflation sticker shock is spreading; 55% of the items in the Consumer Price Index have

Eye-popping jumps in energy prices worldwide has some people proclaiming we’re in a replay

From the youngest to the oldest American workers – GenZ to Baby Boomers – their

A large swath of the GenX population, many of whom are 20 years or less

The march higher in the cost of home health, assisted living or nursing home services

American workers just got another jolt of bad news about the financial health of Social

Federal Reserve Chairman Jay Powell repeated his view at last week’s Jackson Hole meeting that

There’s a record-breaking chasm opening up between American and Chinese stocks this year. The SPDR

The Baby Boomer retirement wave, egged on by Covid, rolls on. Another 248,000 Americans over

The Baby Boomer retirement wave, egged on by Covid, rolls on. Another 248,000 Americans over

You’ve likely heard that second quarter profits are surging, driven by easy year-over-year comparisons and

Target date funds operate under the assumption that someone’s asset allocation should follow a glide

Yet another setback for retirees who view traditional fixed-income investments as a secure way to

The July 4th holiday’s fireworks extended into the work week on Wall Street. The 10-year

The Federal Reserve’s meeting last week sparked a selloff in stocks and bonds as the

Capturing the pandemic’s weird real-world effects is reflected in how high above trend retail sales

Bidding wars for homes has soured people on reaching for the American dream: for the

What was a rumbling of change in the last few years is now barreling into

What was a rumbling of change in the last few years is now barreling into

They’re very different Presidents, but what Joe Biden and Donald Trump have in common is

They’re very different Presidents, but what Joe Biden and Donald Trump have in common is

They’re very different Presidents, but what Joe Biden and Donald Trump have in common is

Millions of workers are retiring early. But not necessarily because they want to. The pandemic

When financial markets went haywire in March 2020, people pursuing a traditional financial plan may

Of all the financial challenges facing retirees, being a widow can be one of the

Nearly every day the financial news headlines trumpet the selloff in bonds and the rising

A common investor assumption is that bonds tend to go up in value when the

Like the famous Energizer Bunny, small-capitalization stocks keep on going versus their larger peers. Year

They’re very different Presidents, but what Joe Biden and Donald Trump have in common is

On Wednesday, March 10, 2021, Scott Ladner, Horizon’s Chief Investment Officer, spoke with CNBC Pro’s

Does 2021 strike you as a replay of 1999? The investment theme now, as it

Many investors and financial advisors are still in the dark on what ESG factor investing

A common investor assumption is that bonds tend to go up in value when the

Federal Reserve chairman Jay Powell’s speaking engagement on March 4 is, in Horizon’s view, critical

Up, up and away for the price of a new single-family home, which reached a

Investors who are globally diversified may be seeing that pay off at the start of

Inflation isn’t a problem now, but financial markets are saying it could be soon. Traders

Here’s another knock against putting all of your retirement-income eggs in the bond market basket.

A common investor assumption is that bonds tend to go up in value when the

A common investor assumption is that bonds tend to go up in value when the

A common investor assumption is that bonds tend to go up in value when the

A record high for stocks…again. Earnings get much of the credit for the latest move.

When stocks fall, bonds rally. That’s standard market action today. And it makes bonds look

Categories

Topics

What Happened Last Week All-Time Highs: Investor optimism on trade and the budget bill in DC sent the S&P 500 to fresh all-time highs. Oil

Launches represent start of next wave of ETF introductions following firm’s introduction of Horizon-branded ETFs in Q1 2025 CHARLOTTE, NC (June 26, 2025) – Horizon,

A rising supply of homes has the potential to bring relief to would-be buyers For years, Americans have lamented that rising housing prices and elevated

What Happened Last Week Middle East Escalation: Investors largely shrugged off rising tensions last week, assuming a weakened Iran will quickly back down. Weekend Bombing:

Read More Askar – stock.adobe.com

Read More Renan – stock.adobe.com

Listen Here

Sentiment finally rises After months of feeling downbeat, consumers’ attitudes are perking up. The University of Michigan Consumer Sentiment index (one of the oldest gauges

What Happened Last Week Israel Strikes Iran: Israel struck Iran’s nuclear infrastructure and senior military leadership, leading to open conflict between the two nations. Cooling

Powell and co. are likely to sit on their hands for a while Fed watchers may want to consider taking the summer off this year.

Read More

See why we’re committed to Fueling Advisor Growth. As advisors navigate unprecedented changes, Horizon provides the solutions and support to help transform their practices and

What Happened Last Week Labor Data: Friday’s non-farm payrolls report showed a slowing, but still a healthy labor market. Broadcom Earnings: Broadcom (AVGO) disappointed investors

Consider a goals-based investment perspective going into summer The old adage “April showers bring May flowers” proved true on Wall Street this year. After falling

What Happened Last Week Tariffs in the Courts: A trade court ruled that most of President Trump’s tariffs are illegal, yet he increased levies against

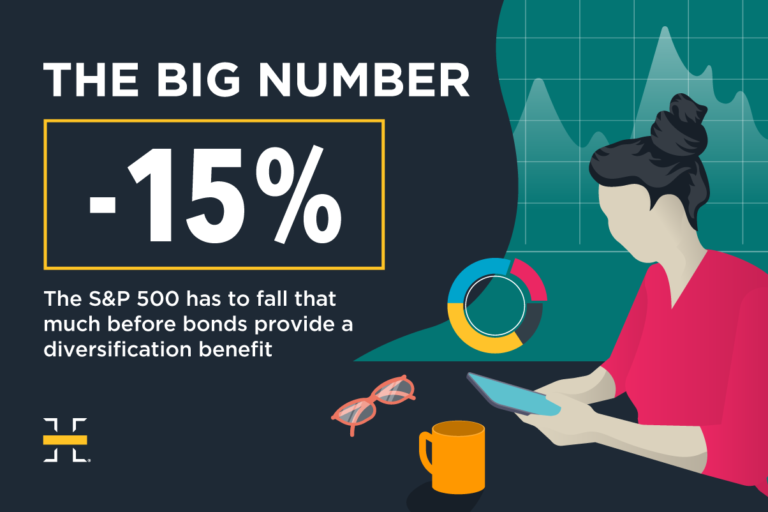

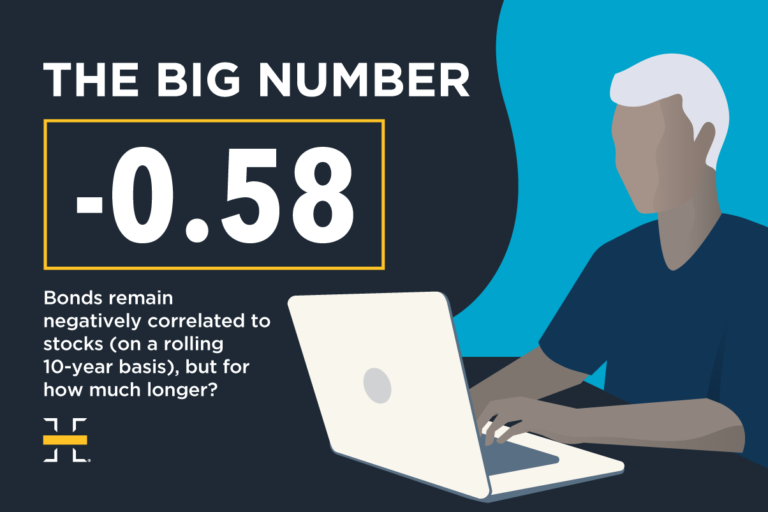

The timely importance of taking a differentiated approach to diversification Bonds these days are doing little to shore up investors’ bottom lines. In our opinion,

What Happened Last Week Sell America: U.S. long-term Treasuries, equities, and the dollar all declined as investors sought shelter in defensive assets and international stocks.

Read More

Read More

Some assets may have rallied too far, too fast Investors have breathed multiple sighs of relief in recent weeks as the Trump administration has dialed

Despite lower levies for now, uncertainty remains On Monday, the U.S. and China announced that they will temporarily suspend the high import tariffs they imposed

Watch Now

What Happened Last Week Markets Listless: Equity markets consolidated with notably lower volatility last week as investors digested the U.S.-UK trade framework and expectations for

A lengthy run for the S&P 500 These days, the stock market is showing up on both the “best of” and “worst of” lists. For

What Happened Last Week Stocks Rally: The S&P 500 rallied for nine straight days to close above pre-Liberation Day levels. Better Than Feared Data: Payrolls

Equity investors should look beyond the usual suspects these days This week marks the 100th day of President Trump’s current term in the White House.

What Happened Last Week Easing Fears: Equities rallied, led by the Mag 7, as tariffs, Powell firing fears, and DOGE-related cuts all eased. Positioning Snapback

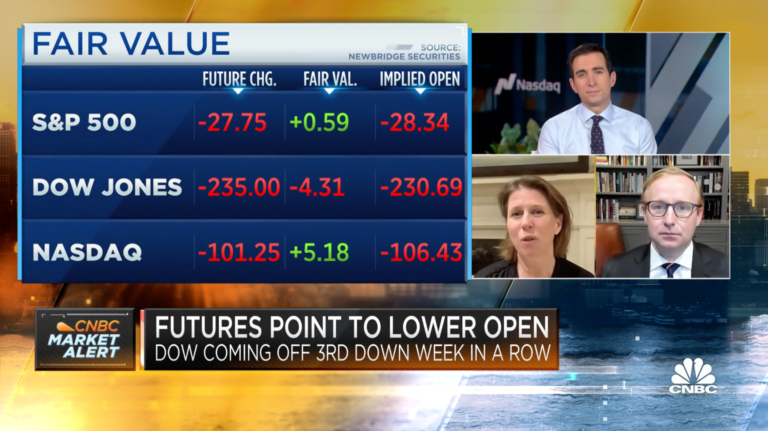

Market participants have fled dollar-based assets, leading to dollar weakness The U.S. dollar has experienced a sharp decline this year through April 17, falling 9.8%

CHARLOTTE, NC (April 22, 2025) – Horizon Investments, LLC, a leader in providing the financial advisor community with highly customized investment and technology solutions, is

Read More

What Happened Last Week Yields Stabilized: Despite Trump’s consideration of firing Powell, 10-year yields declined, supported by several solid Treasury auctions. Equity Volatility Eased: Selling

Watch Now

Read More

Although uncertainty remains, perpetual market swings may be less frequent While still higher than what Wall Street would prefer, market volatility has trended lower this

Gain Strategies The first quarter was one of volatility and investor whiplash that felt much worse than it was, although the early April price action

What Happened Last Week Equities: The S&P 500 surged 5.7%, yet frequent trade policy reversals, weak confidence, and a lack of a major valuation discount

Short-Term Market Volatility Market volatility over the past week has been nothing short of historic. The two-day loss in the S&P 500 in the wake

Read More

What Happened Last Week Tariff Shock: Trump’s huge tariffs—a 10% baseline already in effect and the “reciprocal” tranche to be implemented on April 9—threaten a

The power of diversification has been on display throughout 2025 Headline after headline this week highlighted that stocks posted their worst quarterly return since 2022—with

Read More

Tariffs are taxes and taxes slow economic growth. The Trump administration’s newly announced tariff policy represents a ~$600 billion tax hike, roughly twice the size

What Happened Last Week Tariff Impact: Equity markets declined following Trump’s announcement of 25% auto sector tariffs, pushing U.S. tariffs to their highest level since

History suggests a rebound could be in order The market’s smaller stocks are down—and it may be time to pick some up. While the S&P

What Happened Last Week Equity Consolidation: Intra-equity market volatility was calmer last week after a few weeks of sharp investor rotations out of the U.S.

What Happened Last Week Market Correction Signals: S&P 500 falls for a fourth week—one of the quickest corrections in 75 years—as indices finish below key

Recent stock market losses are not as bad as they may seem Last week saw the S&P 500 have its worst week since September. The

What Happened Last Week U.S. Sell-Off: Weak investor sentiment drove the S&P 500 to its third weekly decline, while the NASDAQ 100 entered correction territory.

Join Scott Ladner, Chief Investment Officer, and Austin Fitch, CFA®, Head of Consulting Solutions on Monday, March 10 at 10:00 a.m. ET for an informative

Consumers may be tapping the brakes on their spending The outlook for the U.S. economy took a hit recently—and investors will be watching carefully to

The President Trump Seesaw: A Post-Inauguration Review of the Markets Over the last several weeks, President Trump’s White House and the Department of Government Efficiency

What Are Risk Management Strategies? Risk management strategies are systematic investment approaches to identifying, assessing, and mitigating potential risks while optimizing returns. These comprehensive strategies

Understanding Wealth Preservation Wealth preservation refers to protecting and maintaining your financial assets to ensure long-term stability and growth. This practice is important for minimizing

What Happened Last Week Sentiment Souring: Policy uncertainty is likely contributing to the deterioration in animal spirits. Slowdown Fears: Investor growth concerns were fueled in

Watch Now

The U.S. has been lagging Europe and China in recent months. It seems “America First” doesn’t apply to the financial markets these days, as several

What Happened Last Week Equity Sentiment Falls: S&P 500 hits new all-time highs but small-caps and retail darlings suffer big losses. International Outperformance: The string

Watch Now

Uncertainty is spiking, but optimism remains strong. The White House’s sweeping, and sometimes see-sawing, economic policy announcements on tariffs and other issues have a growing

What Happened Last Week Tariffs: Markets welcomed Trump’s tariff delay, but skepticism raises the risk of more aggressive action down the line. Markets: Optimism over

Earnings have been much better than expected thus far among the market’s small companies. Large-company stocks have outpaced their small-cap peers since the start of

Watch Now

What Happened Last Week Policy Uncertainty: Investors welcomed a delay in tariffs on Canada and Mexico. Sentiment Support: A weaker dollar, primarily driven by lower

What Are Goals-Based Retirement Portfolios? Goals-based retirement portfolios represent a differentiated approach to asset management that aligns investment strategies with an individual’s unique financial objectives

What is a Goals-Based Investment Manager? A goals-based investment manager typically creates and implements personalized investment solutions to address individual financial goals. Unlike a traditional

Watch Now

Understanding Goals-Driven Investing Goals-driven investing is a unique approach to asset management that places your personal financial objectives at the core of your investment strategy.

What is Goal-Based Investment Planning? Goal-based investment planning is a comprehensive approach to investment management that focuses on aligning investment strategies directly with specific, personalized

What is Goals-Based Asset Management? Goals-based asset management is a unique financial approach that aligns investment solutions with an individual’s financial objectives. Unlike traditional asset

New import taxes on China, while Mexico and Canada get a reprieve for now. The trade war has started—albeit with a smaller opening shot than

Listen Now

What Happened Last Week DeepSeek Dip: Tech stocks plunged due to fears of overinvestment in AI infrastructure following DeepSeek’s model release. Trump Tariffs: Tariff threats

What is a Goals-Based Investment Manager? A goals-based investment manager typically creates and implements personalized investment solutions to address individual financial goals. Unlike a traditional

Watch Now

Watch Now

What does Nvidia’s historic rout mean for investors? The bad news: AI darling Nvidia lost $593 billion in market capitalization on Monday—the single-greatest one-day plunge

What Happened Last Week Dollar Decline: The dollar had its worst week in a year as no “day one” tariffs from the Trump administration lifted

Will Trump’s tariffs push the greenback even higher? The U.S. dollar has risen sharply in value versus other world currencies in the past few months,

Watch Now

CHARLOTTE, NC (January 23, 2025) – Horizon Investments, LLC, a provider to the financial advisor community of customizable investment and technology solutions, announced that

Watch Now

What Happened Last Week Lower Rates: Downside inflation surprises in the U.S. and U.K. and dovish Fed comments fueled a move lower in Treasury yields.

Watch Now Mike Dickson sees early-year volatility as ‘normal’, with positive signs from CPI, retail sales, and broadening sector strength beyond tech. Head of Research

OVERVIEW Stocks posted mixed results during the fourth quarter of 2024. Investors were initially encouraged by positive economic news and an uncontested U.S. Presidential election,

Will the U.S. economy’s growth machine keep on humming? Surging bond yields are rattling investors, fueling concerns that stocks may face turbulence ahead, driven by

Watch Video As stocks dip and Treasury yields climb, CIO Scott Ladner remains cautiously optimistic. Unlike 2022, when inflation and interest rate hikes were the

Gain Strategies The choppy, volatile market environment continued in the final quarter of 2024. Still, in contrast to the prior quarter, global equities (MSCI

What Happened Last Week Global Selloff: Stocks fell as rising yields and rate uncertainty pressured equities. Economic Strength: Strong jobs data showed resilience, but “good

Watch Video Despite no significant changes in the economy, a shift in perspective has created market volatility and raised questions about the Fed’s outlook. Chief

Do top-heavy markets eventually spread out? Many investors have experienced extraordinary stock market gains over the past two years, with the S&P 500 up 26.3%

What Happened Last Week Santa Rally Fizzles: The S&P 500 closed the week ~2% below its levels before the Fed’s rate cut in mid-December. Holiday

Watch Now

What Happened Last Week Hawkish Cut: The Fed cut 25 bp and pointed to a pause in their cutting cycle in January; economic projections and

Watch Now During a recent interview with BNN Bloomberg, Zach Hill highlighted key themes for 2025, including corporate resilience, deregulation, and earnings growth. However, recent

Small-cap stocks may offer tactical opportunities. Investors who expect a late-year, post-election rally in small-company stocks may need to be patient. Historically, December has been

Watch Now

What Happened Last Week Equity Reprieve: U.S. large-cap gains paused last week despite a rally across the mega-cap growth complex led by AVGO. U.S. Inflation:

Watch Now Broadcom hits a record high after proving nay-sayers wrong. How will the custom chip creator finish out the year? Head of Research Mike

The digital currency seems to have the wind at its back these days. An ongoing post-election surge drove Bitcoin’s price above $100,000 for the first

What Happened Last Week Fresh All-Time High: S&P notches another ATH, supported by mega-caps. Price Action: A weaker dollar drove international stocks outperformance. Payrolls: Good,

Watch Now

Opportunities outside of the top performers. It’s no secret that a small number of stocks in the S&P 500 have been largely responsible for the

What Happened Last Week All-Time Highs: Both domestic large- and small-caps hit fresh all-time highs over the holiday-shortened trading week. Rates Lower: Treasury yields fell

What Happened Last Week Stocks Rose: S&P 500 closed within a hair of all-time highs on the back of easing growth concerns, Trump’s cabinet picks,

The latest homebuilder data could provide some promising signals for the housing market. Chief Investment Officer Scott Ladner visited BNN Bloomberg to discuss how potential

Positive earnings surprises are back on track. With more than 90% of the companies in the S&P 500 index reporting their earnings results, we now

CHARLOTTE, NC (November 19, 2024) – Horizon Investments, LLC, a leader in providing the financial advisor community with highly customized investment and technology solutions, today

Chief Investment Officer Scott Ladner dove into the key forces shaping today’s markets during a recent appearance on Schwab network. From the ongoing bond volatility

What Happened Last Week Price Action: Headline equities sold off as investors digested marginally hawkish Fed commentary and Trump’s cabinet picks. Controversial Cabinet Picks: RFK

While inflation remains sticky in areas like services and housing, Mike sees an opportunity to navigate this complexity. He spotlighted healthcare as a potential hidden

Recent election results bring a 2016 vibe back to the market, with U.S. stocks currently leading over internationals, but inflation concerns are real. Head of

What Happened Last Week Republican Election Sweep: Republicans granted a strong mandate to pursue an ambitious policy with Trump’s decisive victory, anticipated majorities in Congress,

Investors saw sharp market movement the day following the election Donald Trump and the Republicans outperformed expectations on Election Day, securing the White House and

Stocks have had a habit of gaining ground no matter who becomes President. Regardless of which candidate emerges victorious, historically, investors have generally come out

What Happened Last Week Yields Rose: Concerns over higher spending in the U.S. post-election caused yields to spike, dampening equity sentiment. Mega-cap Earnings: The NASDAQ

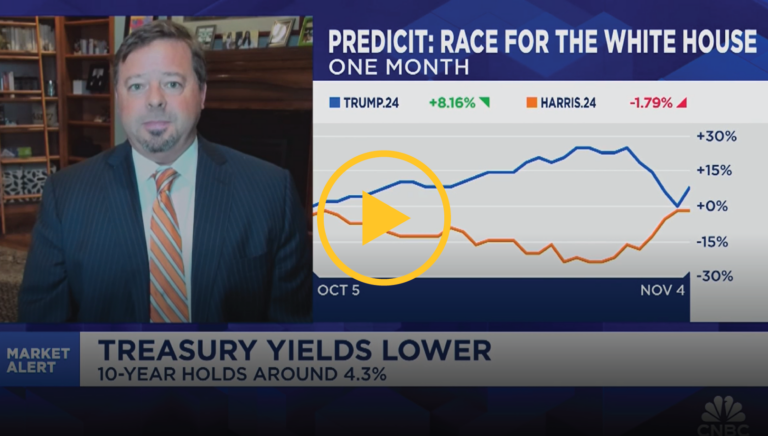

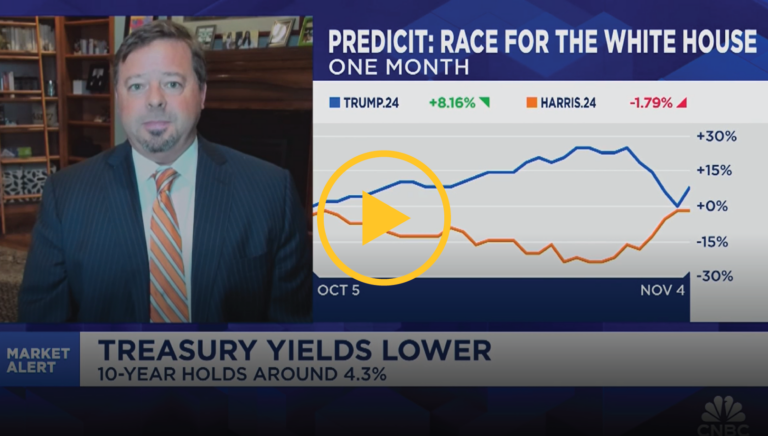

Inflation concerns, rather than growth expectations, could be behind the rise in 10-year yields, especially as prediction markets fluctuate with the election. Chief Investment Officer

Buyers need lower rates to get back in the game. In anticipation of the Fed’s rate cut last month, more would-be homebuyers applied for mortgages.

“We’re gaining on it.” The mega-cap growth to small-cap stock transition that is. A solid earnings outlook could solve recent small-caps underperformance relative to large-caps.

Chief Investment Scott Ladner joined BNN Bloomberg to discuss potential impacts of the U.S. election on markets.

What Happened Last Week Yields Pushed Higher: Talk of fiscal worries added to the existing upside momentum for U.S. yields. Stocks Sold Off: Global equities

Head of Research and Quantitative Strategies Mike Dickson joined Schwab Network to highlight the U.S.’s strong economic growth, with the Atlanta Fed’s GDP forecast at

Consumer spending, corporate earnings, and the overall economy remain robust. Investors will examine one of the last snapshots of the economy’s health before election day—and

What Happened Last Week New All-Time High: S&P 500 notches new all-time highs and posted gains for the sixth consecutive week. Price Action: Financials, value,

We think a “barbell approach” combining both sectors and ETFs may be beneficial to balance risk and capture opportunities as AI advances drug development and

OVERVIEW Stocks posted another quarter of positive returns — despite some significant volatility along the way—with several equity market indices recording a string of record

“We’re looking under the hood of the micro,” says Horizon Investments’ Zach Hill. He looks at how earnings season is proving to show continued resilience

The stock market is two years (and counting) into a bull market. Last Saturday marked the second anniversary of the current bull market for stocks.

What Happened Last Week Price Action: Fresh all-time highs in U.S. large caps on bank earnings and re-kindling of the AI narrative. Uncertainty: Market rallied

Gain Strategies Despite returns of over 5% for both global stocks (MSCI All Country World Index) and core bonds (Bloomberg US Aggregate Index), the

Lowest spreads in nearly three years Want more evidence that the U.S. economy is in good shape? Just take a look at the junk bond

Chief Investment Officer Scott Ladner and Head of Consulting Solutions Austin Fitch, CFA®, review the third quarter of 2024 and provide a market outlook. Download

Chief Investment Officer Scott Ladner joined BNN Bloomberg for a wide-ranging conversation on the post-COVID economic landscape, the growing significance of AI, and the potential

What Happened Last Week Geopolitical Volatility: Oil soared over 9% as investors weighed Israeli retaliation against Iran’s energy infrastructure. U.S. Jobs: A blow-out jobs figure

It’s been 17 years since we’ve seen a weekly return this strong Long-suffering Chinese stocks broke out of their doldrums last week following the announcement

How do you harness the resilience of the U.S. consumer? With steady wage gains and relatively low debt levels, consumer spending remains a key factor

During a recent conversation with Schwab Network, Chief Investment Officer Scott Ladner highlighted three key sectors to watch in the months ahead: Technology (boosted by

With recent Chinese stimulus measures stirring excitement in the markets, it’s easy to get caught up in the buzz. However, as Scott Ladner, our Chief

Defensive stocks have come into focus as global tensions have risen in recent weeks – particularly in the Middle East. With elections around the corner

What Happened Last Week China: Property market support was announced over the weekend in major cities in addition to the raft of monetary and fiscal

Which sector has been leading the rally so far in 2024? One market sector has outperformed all others so far this year—and it’s probably not

What Happened Last Week Fed: Equities rallied as the Fed cut 50 bps to kick off its rate-cutting cycle, guiding for further rate decreases down

https://www.youtube.com/watch?v=-f7S0cz_D-4&t=95s We remain bullish on equities, anticipating that continued support from the Fed will drive markets higher as we close out the year. Head of

What Happened? The Federal Reserve (Fed) started their much-awaited easing cycle on Wednesday after holding their target rate in the 5.25-5.50% range since last July.

Are you ready? All eyes are on Jerome Powell on Wednesday as investors await the Federal Reserve Board’s near-certain decision to cut the federal funds

What happened last week Stocks Rebound: U.S. large caps posted their best week of the year, up about 4% and mostly reversing the worst week

Successful investing doesn’t have to be a thrill ride. Anyone who has driven California’s Pacific Coast Highway or North Carolina and Tennessee’s Tail of the

Election Season: A Time for Ballots, Not Drastic Portfolio Changes When major elections are near, investors may be concerned about how their portfolios will be

September holds its notorious history of challenging stocks. How could interest rate cuts affect the market’s response? Chief Investment Officer Scott Ladner joins BNN Bloomberg

Regardless of stabilized delinquency rates and healthy debt-to-income ratios, consumers do not believe this is a good economy. Chief Investment Officer Scott Ladner joins Fox

What happened last week Price Action: Poor September seasonality may be to blame for a more than 4% decline in U.S. large caps. AI Woes:

Join us at 4:00 PM ET on Tuesday, October 8, 2024, for Horizon’s Quarterly Webcast, hosted by Chief Investment Officer Scott Ladner and Head of

Here’s how stocks may perform for the rest of 2024 As the fall harvest season begins, it’s a time of reaping the rewards of hard

Despite Nvida’s recent slump, the market kept moving. Chief Investment Officer Scott Ladner joins Schwab Network to discuss a shift in focus to the broadening

What happened last week NVDA: Nvidia’s (NVDA) beat and raise was not enough to impress investors, resulting in a nearly double-digit sell-off. Strong Data: Second

Watch out above. Here comes revenue per employee. Chief Investment Officer Scott Ladner joins CNBC to discuss how the adoption of AI moves the market.

Fed Chair Powell tees up the long-awaited rate cut Fed Chair Powell said just about everything investors wanted to hear during his Jackson Hole, Wyoming

What happened last week Powell Pivot: Chair Powell validated the market’s view that a rate cut is coming in September. Markets Rally: Investors took comfort

Conventional economic thinking may not have a place in today’s market cycle. Head of Portfolio Management Zach Hill, CFA®, joins Schwab Network to discuss the

Best week of 2024 for the S&P 500 After a brief summer slump and a short-lived overreaction, stocks enjoyed their best week since November, up

What happened last week Market Recovery: S&P rallies to within 2% of its all-time high. Healthy Data: Strong retail sales, good guidance from Walmart, and

Homebuilders and housing stocks may be a smart first play for the anticipated September cut by the Fed. Chief Investment Officer Scott Ladner joins Schwab

U.S. company profits continue to impress. Earnings season is in the home stretch, with more than 90% of the companies in the S&P 500 index

What happened last week Price Action: U.S. and global stocks ended the week practically unchanged despite Monday’s historic volatility. Carry & Dispersion Trades: Unwinds in

Slower numbers do not necessarily mean weak numbers. Chief Investment Officer Scott Ladner joins BNN Bloomberg to discuss the recent U.S. jobs report and his

The markets have shown remarkable resilience, rebounding from last Monday’s sell-off. But is it time to feel confident? While the panic we witnessed last week

The S&P 500 fell 3% on Monday—its biggest one-day decline in nearly two years—amid growing fears that July’s slowdown in hiring could spark a recession.

Market volatility spikes—but how much should you worry about it? The first full week of August started with a bang: The S&P 500 dropped 3%

What happened last week Price action: Summer liquidity, poor economic data, a less dovish than desired Fed, and positioning all contributed to a broad-based decline

The recent market volatility should prompt investors to take a deep breath and evaluate their investment time horizon. Chief Investment Office Scott Ladner joined Yahoo

A growing number of stocks are having their moment in the sun Everybody loves a good comeback story: Seabiscuit. The Mighty Ducks. 493 stocks in

What happened last week Price Action: Small-caps continued to outperform year-to-date leaders, like the tech-heavy NASDAQ 100. U.S. Data: U.S. GDP came in stronger than

Don’t read too much into harbingers of stock market doom and gloom Sometimes, it pays—literally—to look beyond what’s “obvious” to everyone else. Case in point:

What happened last week Equity Market Reversion: Small-caps outperformed mega-cap technology by a little less than 6% as year-to-date laggards continued their string of outperformance.

Overview Overall, stocks delivered another quarter of strong gains during the three-month period ending June 28, 2024. For the quarter: The Nasdaq 100 returned 8.1%.