Now that the Federal Reserve Board has started raising rates, the upcoming first quarter earnings season could arguably be one of the most interesting and important in recent memory. And lest we forget, “recent memory” includes the pandemic years!

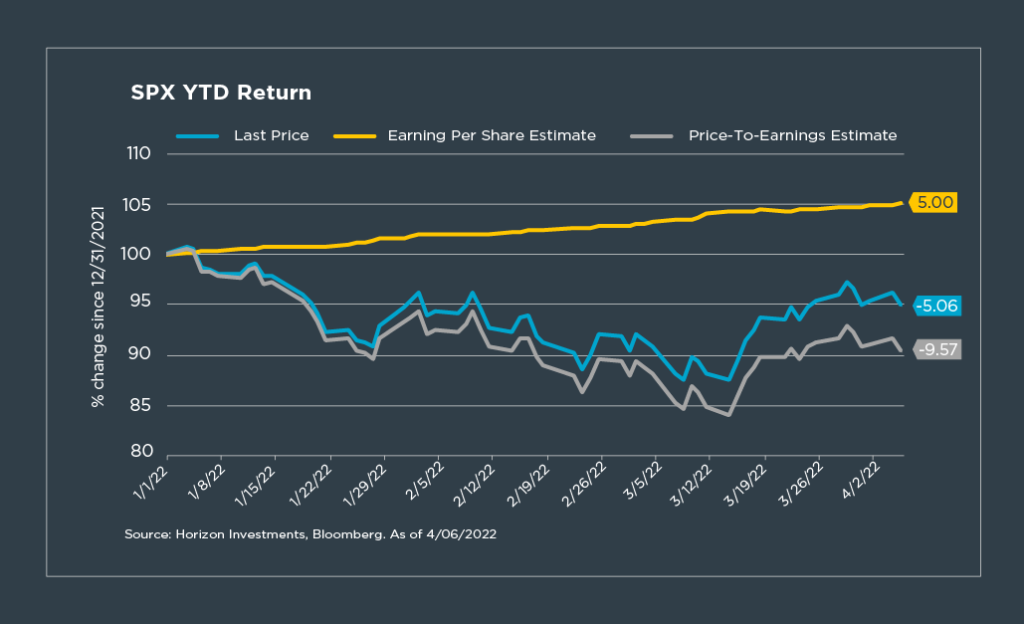

This is the first earnings season since 2018 in which the Federal Funds Rate is on the rise. Investors’ concerns about Fed policy, and navigating a higher interest rate environment, are evidenced by the S&P 500’s –5.06% year-to-date return.

But going forward, we expect to see a key shift as investors focus less on the Fed and more on company fundamentals as the primary driver of equity market performance.

A closer look at the S&P 500’s YTD performance—as seen in the chart below—reveals that price-to-earnings (P/E) valuation compression, or when price declines faster than earnings estimates, has accounted for a whopping 189% of the index’s decline so far this year. Notice, however, that the forward earnings estimate for companies in the index is up 5.0% so far this year.

In other words, it’s the “P”—not the “E”—that’s been the issue.

Which brings us to the upcoming earnings season. In the past, multiples typically have not expanded during periods when the Fed tightened. Therefore, as price volatility around Fed policy takes a breather, returns will become about fundamentals—the strength or weakness of corporate earnings.

The good news is that expectations remain solid. However, given the uncertain and fluid environment we find ourselves in today, investors will likely be paying particularly close attention to earnings revisions and earnings guidance from U.S. companies in the weeks ahead.

The upshot: What we hear from corporate America starting next week will likely tell us a lot about where stocks could go for the rest of 2022.

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC