Is the Fed’s battle to contain inflation finally done?

The market seems to think so. Recent comments from multiple Wall Street firms and economists suggest this week’s rate hike will be the last one we see this year. After this week’s quarter-point rate hike, Fed Chair Powell acknowledged that inflation has proven resilient, leaving a September rate hike on the table. Meanwhile, the yield on the 10-year Treasury has fallen from its recent high.

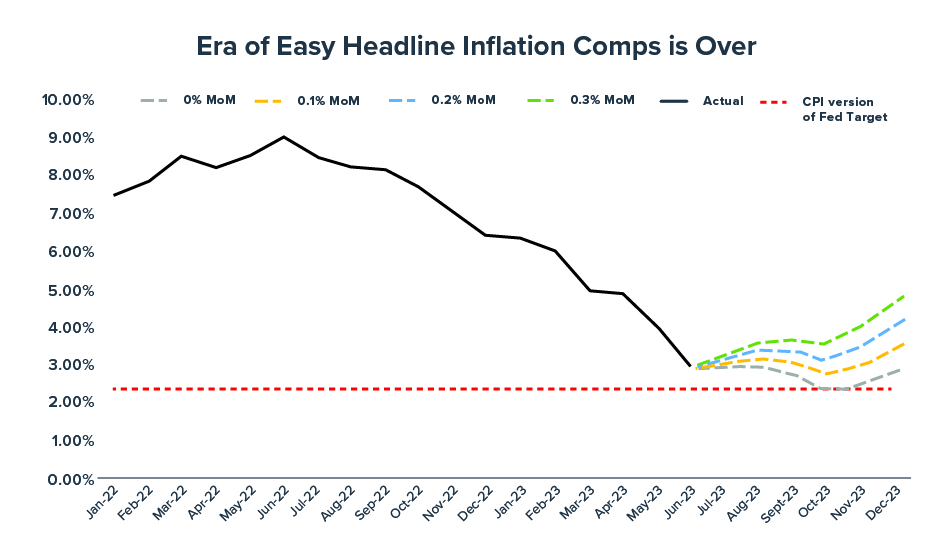

Our view: While inflation remains on a downward trend overall, the path lower could take longer than some think. In part because the trend of favorable comparisons to prices last year is set to reverse. That means the annual inflation rate comparisons for the second half of 2023, as compared to the second half of 2022, will be far less striking than what we saw earlier this year.

The result: Don’t be surprised to see an upswing in the headline inflation rate over the next few months.

Consider, for example, that month-over-month headline inflation has averaged 0.22% during the past three months. If that continues, the annual reported inflation rate will be back up to 4% in December—and close to 5% if the monthly inflation rate rises to 0.3% (see the chart).

Notice that even if prices are flat month-over-month, annual headline inflation will end the year higher than the Fed’s target.

All this makes the Fed’s job particularly tough from here on out—and will likely cause Chair Powell and company to be less convinced than the market that inflation will simply keep fading away. If so, interest rates may stay elevated for longer than investors expect—setting the stage for potential market volatility later this year.

In that environment, we believe it will be important for portfolios to have some protection measures in place—while, of course, maintaining the broad exposure to equities that (as the last nine months of returns have shown) is crucial to generating the returns investors need to reach their goals.

Disclosures

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC