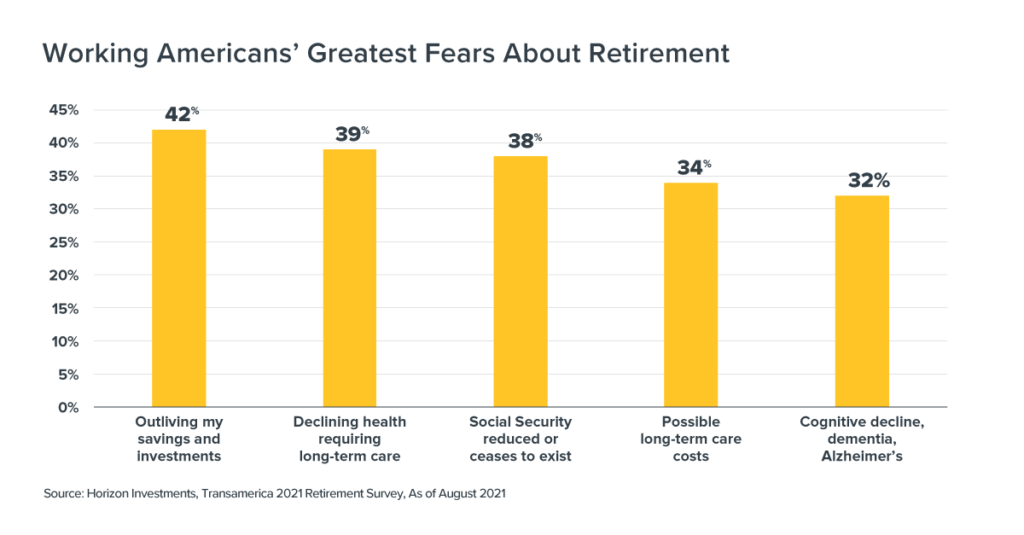

The biggest retirement fear in Transamerica’s 2021 Retirement Survey is “outliving my savings and investments.”

From the youngest to the oldest American workers – GenZ to Baby Boomers – their greatest fear about retirement is ‘’outliving my savings and investments.’’ That’s according to Transamerica’s 2021 Retirement Survey, where 42% of respondents picked that as their biggest worry, outweighing concerns about physical or mental decline.1 Those closest to retirement, who are likely confronting the full cost of a long stretch outside of work, showed more concern about depleting their nest egg than younger workers. Nearly half of the GenX (age 41-56) and Baby Boomers generations – 46% – cited it as their greatest fear.

Those closest to retirement, who are likely confronting the full cost of a long stretch outside of work, showed more concern about depleting their nest egg than younger workers. Nearly half of the GenX (age 41-56) and Baby Boomers generations – 46% – cited it as their greatest fear.

For younger workers, a lack of confidence in Social Security as a safety net helped fuel their fear of becoming destitute in retirement. 70% of GenZ and 77% of Millennials agreed that ‘’when I’m ready to retire, Social Security will not be there for me.’’

(related Big Numbers: Many GenXers Agree: It’ll Take a Miracle to Have a Secure Retirement, Americans Seek Advice Amid Social Security’s Financial Stress)

A lack of investment knowledge can also be part of what makes the future scary. 62% of those surveyed said they had little to no understanding of asset allocation principles as it relates to investing for retirement.

The fear of outliving your money is a concern that resonates with Horizon Investments, a goals-based investment manager that creates strategies that aim to meet the needs and address the risks people face in the accumulation, preservation, and distribution stages of an investment journey.

(Read Horizon’s Redefining Risk paper to understand our goals-based investing philosophy)

Horizon has long identified the primary risk for retirees as longevity, given the twin pressures of people living longer and healthier lives, and the puny yields currently found in fixed-income markets.

Regrettably, the traditional financial advice to add more exposure to bonds as someone gets older may no longer be sufficient if the aim is to produce a financially secure retirement.

(related Big Number: Are Glide Path Strategies Still a Good Option for Retirement?)

Horizon Investments believes inflation-adjusted, fixed-income returns will likely be meager in the years ahead. The starting level of yields on fixed-income have historically been a good predictor of future returns. After 40 years of falling yields, there is much less room for a continued decline. Simply put, today’s low yields are likely to limit the potential future returns of bonds. And even if the Federal Reserve decides to raise rates in 2022 or 2023, we believe those invested too heavily in fixed income could struggle to generate interest income if rates remain at historically low levels.

Related Big Number reports and research papers:

Horizon Investments’ Real Spend® retirement income strategy was designed to address the fear of running out of money. It combines a spending reserve, a growth-seeking portfolio, and our Risk Assist® algorithm.

Real Spend® is designed to carry a greater exposure to equities than what is typically found in traditional retirement strategies with the aim of replenishing or growing a client’s assets over time.

Real Spend’s® equity allocation decisions, coupled with tactical risk mitigation, are designed with the goal of limiting a retiree’s investing risk in meeting their short- and long-term financial needs.

See our Real Spend® strategy and download our distribution stage brochure for further details about how advisors can help their clients tackle common retirement income challenges.

1Transamerica Retirement Survey, https://transamericacenter.org/docs/default-source/retirement-survey-of-workers/tcrs2021_sr_four-generations-living-in-a-pandemic.pdf

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The Real Spend® retirement income strategy is NOT A GUARANTEE against market loss and there is no guarantee that the Real Spend® strategy chosen by an investor will lead to successful investment outcomes for part of, or for the entirety of an investor’s retirement. This strategy is not an insurance product with payments guaranteed. It is a strategy that invests in marketable securities, any of which will fluctuate in value. Before investing, consider the investment objectives, risks, charges, and expenses of the strategy. Keep in mind investing involves risk. The value of an investment will fluctuate over time and will gain or lose money.

RiskAssist® is NOT A GUARANTEE against loss or declines in the value of a portfolio; it is an investment strategy that supplements a more traditional strategy by periodically modifying exposure to fixed income securities based on Horizon’s view of market conditions. While Risk Assist was designed with the goal of limiting drawdown, Horizon is not able to predict all market conditions and ensure that Risk Assist will always limit drawdown as designed.

Accounts with Risk Assist® are not fully protected against all loss. Furthermore, when Risk Assist® is deployed (whether partially or entirely) to mitigate risk for an account, the account will not be fully invested in its original strategy, and accordingly during periods of strong market growth the account may underperform accounts that do not have the Risk Assist® feature. Clients may lose money.

Horizon Investments makes no predictions, representations, or warranties herein as to the future performance of any portfolio. Past performance is never a guarantee of future results. There may be economic times where all investments are unfavorable and depreciate in value.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC