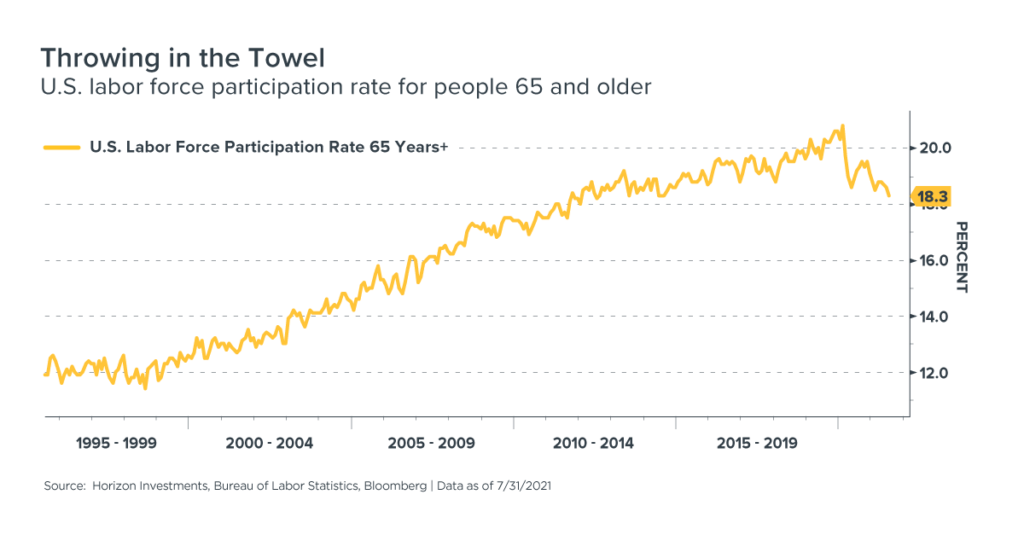

The long-term trend of more people working past the age of 65 may be over; that group’s labor participation rate sank to a seven-year low of 18.3% last month.

The Baby Boomer retirement wave, sparked by Covid, rolls on. Another 248,000 Americans over the age of 65 left the labor force last month, according to the July employment report released last Friday.1

Since the economy was shut down in March last year, 3.16 million people have given up on the idea of working past the typical retirement age, according to Bureau of Labor Statistics data. That cut the labor force participation rate for people aged 65 and over to a seven-year low of 18.3%, potentially ending a two-decade uptrend. The exodus of people aged 65 and over from the job market partially explains why companies are having trouble finding workers as the economy rebounds.

The exodus of people aged 65 and over from the job market partially explains why companies are having trouble finding workers as the economy rebounds.

Older workers may be convinced that a surge in the value of their retirement accounts gives them the financial firepower to exit the workforce. The average 401(k) account balance for those 65 and older leaped by 18% last year to $255,151, according to Vanguard’s long-running series titled “How America Saves.”2 Presumably, this year’s U.S. stock market rally to all-time highs is adding to that retirement savings.

However, many other Americans have too little saved for retirement. And their goal was to extend their working lives so they could delay taking Social Security benefits.

Remember that women have a 31% probability of living to age 95 if they’re in excellent health at age 65; the probability for men in excellent health is 21%, according to the Society of Actuaries.3

Retirees could also face the possibility of shortfall risk if their portfolio is too heavily allocated to traditional bonds during a time of historically low yields. A recent Big Number report said the inflation-adjusted, ten-year return on a portfolio of 30% stocks and 70% bonds could be zero over the next decade, based on the capital market return assumptions from 12 leading investment firms.

Horizon believes a potential solution for the longevity and shortfall risks retirees face is its Real Spend® strategy. It can offer retirees a comprehensive distribution plan designed to meet their goals of steady income, preserving savings and growing assets during what could be a three-decade retirement. And as we detailed in an April Big Number report, financial advisors can choose a higher Real Spend® distribution rate to serve as primary income for clients who are speeding up their retirement timeline, and later switch to a lower payout rate for supplemental income.

To download a copy of this commentary, click the button below.

Further reading:

Corporate America’s Profit Machine Is as Strong as Ever

Are Glide Path Strategies Still a Good Option for Retirement?

Americans Taking Early Retirement May Benefit From a Goals-Based Solution

Junk-Bond Yields Don’t Provide Much of a Cushion Against Inflation

Abnormally Low Interest Rates to Remain Even If Fed Hikes in 2023

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

1 Bureau of Labor Statistics, https://www.bls.gov/news.release/archives/empsit_07022021.htm

2 Vanguard, https://institutional.vanguard.com/content/dam/inst/vanguard-has/insights-pdfs/21_CIR_HAS21_HAS_FSreport.pdf

3 Society of Actuaries, 2020

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The Real Spend® retirement income strategy is NOT A GUARANTEE against market loss and there is no guarantee that the Real Spend® strategy chosen by an investor will be successful for the entirety of an investor’s retirement. Clients may lose money. Real Spend® is an asset allocation strategy that uses an investment model to (i) plan savings amounts and overall asset allocation during the distribution phase of retirement planning, (ii) compute target retirement wealth, assuming a retirement budget and a spending-investment strategy after retirement, (iii) compute the transition from the accumulation phase to the retirement phase, and (iv) generate the spending-investment strategy after retirement. Our retirement spending investment strategy uses an allocation model that replenishes cash needed for withdrawals. Before investing, consider the investment objectives, risks, charges, and expenses of the strategy. All investing involves risk. This strategy is not an insurance product with payments guaranteed. It is a strategy that invests in marketable securities, any of which may fluctuate in value. There is a possibility of outliving the assets if market performance is lower than forecasts used in planning, or if longevity is longer than anticipated.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC