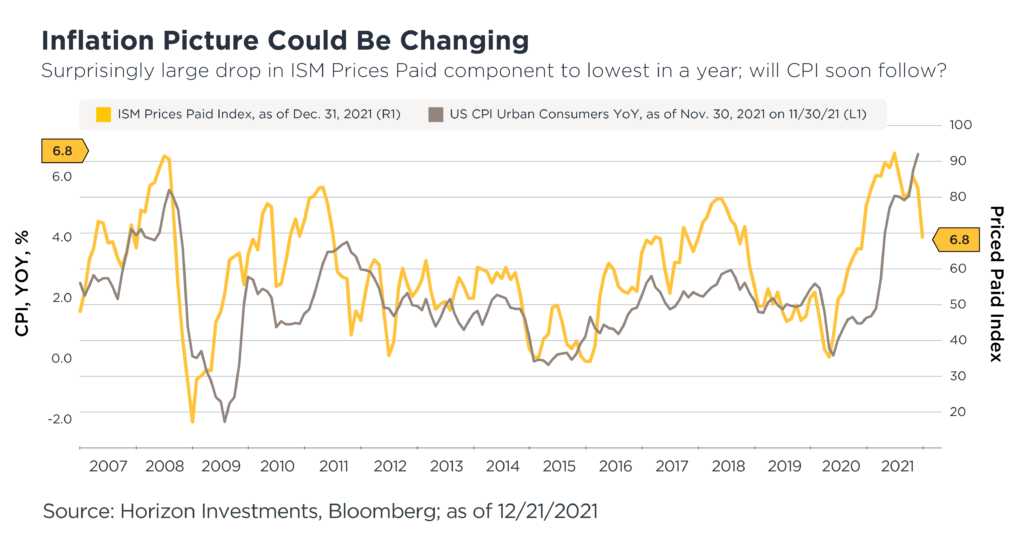

We are once again forced to ask: have we passed the peak of maximum inflation pain? The question is spurred by the surprisingly large drop in factory input prices paid by manufacturers, as measured by the Institute for Supply Management’s (ISM) Prices Paid Index.

We are once again forced to ask: have we passed the peak of maximum inflation pain? The question is spurred by the surprisingly large drop in factory input prices paid by manufacturers, as measured by the Institute for Supply Management’s (ISM) Prices Paid Index.

The index, which is generally seen as an inflation indicator, shed 14.2 points in December – its largest monthly drop in over 10 years, or since October 2011.1 The pullback to the 68.2 level in Tuesday’s report indicates supply chain shortages are easing, which should bring some balance back to the supply-demand equation, and in turn help ease price pressures. (Note: ISM is a diffusion index, meaning that readings above 50 indicate prices are rising; progressively higher numbers above 50 indicate more widespread price increases.)

Does the ISM data have any bearing on the Consumer Price Index (CPI), which recently hit a 30-year high? The two data series do not have a one-to-one relationship, but their broad contours are similar. The ISM Prices Paid Index has been falling for six months, suggesting that perhaps we may soon see an easing of CPI as well.

We need to be clear, prices are still rising in the ISM report driven by continued strong demand for factory-made goods. The upbeat news is that the price pressures are not as broad-based as they were last summer. The other caveat is that inflation at the factory level isn’t always passed on to consumers, so the current tumbling may not have a dramatic effect on your local store.

That said, the ISM report makes the inflation picture more interesting and messy than those blunt predictions that prices will run away to the upside. Many money managers, ourselves included, have been anticipating an easing in the rate of growth of inflation, however, that’s taken longer than we expected. The ISM is a sign that maybe our view will turn out to be correct, but we’re conscious of the danger that this could be another false sign of improvement, especially as omicron poses a threat to supply chains, transportation networks, and factories worldwide.

As for the Federal Reserve, we believe the ISM data is unlikely to change its march towards raising interest rates sometime this year. Higher inflation expectations are becoming ingrained among Americans, which risks sparking a vicious cycle where demands for higher wages feed into higher prices. And a rate increase may also be needed to cool consumer spending, which has been an important driver of inflation. (See recent Big Number reports: Many Americans Give Up on Inflation Remaining Tame, Inflation Sticker Shock Is Spreading, Booming U.S. Economy Snuffs Out Fed’s `Transitory’ View of Inflation)

For goals-based investors, we think the glimmer of improvement in inflation from the ISM data can serve as a reminder of a timeless investment adage: don’t overreact to short-term news when you’re investing for the long term. Emotion-based decision-making can do lasting damage to the probability of reaching your long-term financial goals. We think the better path is to adhere to your saving and investing plan while talking with your advisor about whether any changes are truly necessary in light of the news. In our view, staying the course can often be the hardest, but the best, thing to do.

Related Articles:

Read Our 2022 Outlook: The Next `Unprecedented’ Year

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

The Biggest Retirement Fear: Outliving My Money

Many GenXers Agree: It’ll Take a Miracle to Have a Secure Retirement

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index. The investments recommended by Horizon Investments are not guaranteed. There can be economic times where all investments are unfavorable and depreciate in value. Clients may lose money.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments, Risk Assist and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC