What tools can investors use to fight longevity risk in retirement?

Many retirees today probably remember the 1976 disco hit “Right Back Where We Started From.” Unfortunately, that same sentiment might accurately describe those retirees’ investment returns over the past two-plus years.

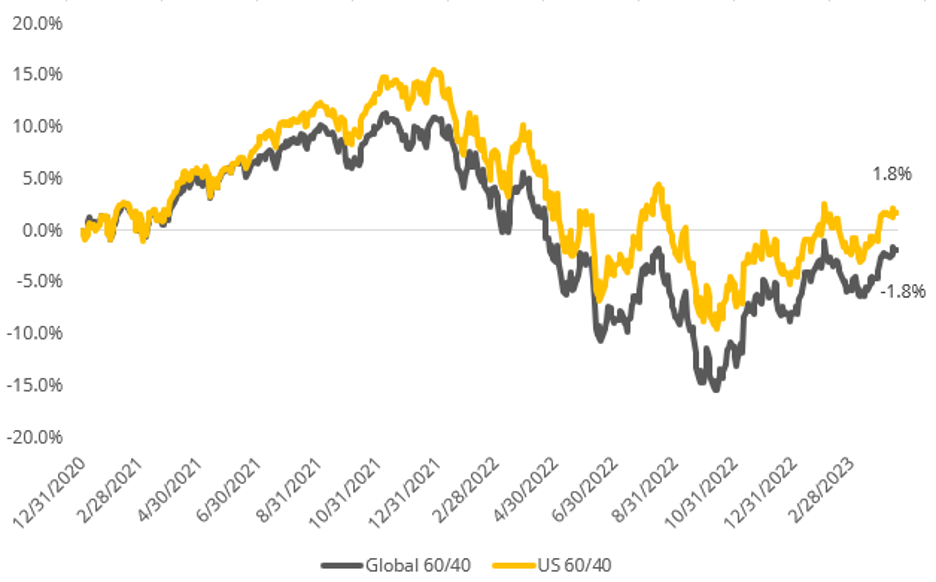

Case in point: Investors in either a globally diversified portfolio with a traditional mix of 60% stocks/40% fixed-income or a similarly allocated U.S.-only portfolio today likely find themselves back where they were at the end of 2020 (see the chart). Indeed, the return of those two portfolios averages out to 0% during that period.

Results like these could give retirees reason to consider having a reserve of liquid assets from which to take distributions and fund current expenses. Given the returns shown above, it’s likely that investors without such a reserve needed to sell some stocks or other assets during the past two years to meet their income needs—thereby realizing losses that would otherwise have been losses only “on paper.”

Being forced to sell assets in a down market boosts a significant risk that retirees face: longevity risk–or, more specifically, sequence of return risk. Locking in losses can make it more likely that a retirement portfolio won’t generate the growth needed to ensure retirees can maintain their standard of living over what could be a very long retirement.

In our view, effectively fighting this risk requires portfolios that are designed to match a spending reserve allocation of liquid assets with an investment growth portfolio structured to fund retirees’ income needs of the future.

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

Bloomberg US Equity Fixed Income 60:40 Index and the Bloomberg Global Equity Fixed Income 60:40 are designed to measure cross-asset market performance in the US and Globally. The indexed rebalances monthly to 60% equities and 40% fixed income. You cannot invest directly in an index.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC