Assessing risk

The financial industry is centered around statistical probabilities — we’re all familiar with the bell curve. In fact, evaluating the potential odds of investment outcomes is fundamental to good planning. And as human beings, we’re confronted almost daily with decisions that statistics could help us make. Statistics that could help us decide, “Is this a risk worth taking?”

Consider that the odds of dying from a lightning strike are 1 in 161,856 compared to about 1 in 3,748,067 for a shark attack. Given those odds, it’s rational for you to be more wary of taking a walk during a thunderstorm than going for a swim in the ocean — but you’re still likely to be cautious about diving into shark-infested waters. After all, your risk isn’t 0%. When it comes to investing, shouldn’t statistics similarly guide our decision-making?

What’s normal?

There’s been a lot of talk about investment models built for “normal” times. By definition, we encounter “normal” a lot in our lives — from the size of our shoes to the circumference of our waistlines, from the height of a countertop to the shape of an orange.

So what is normal, statistically speaking?

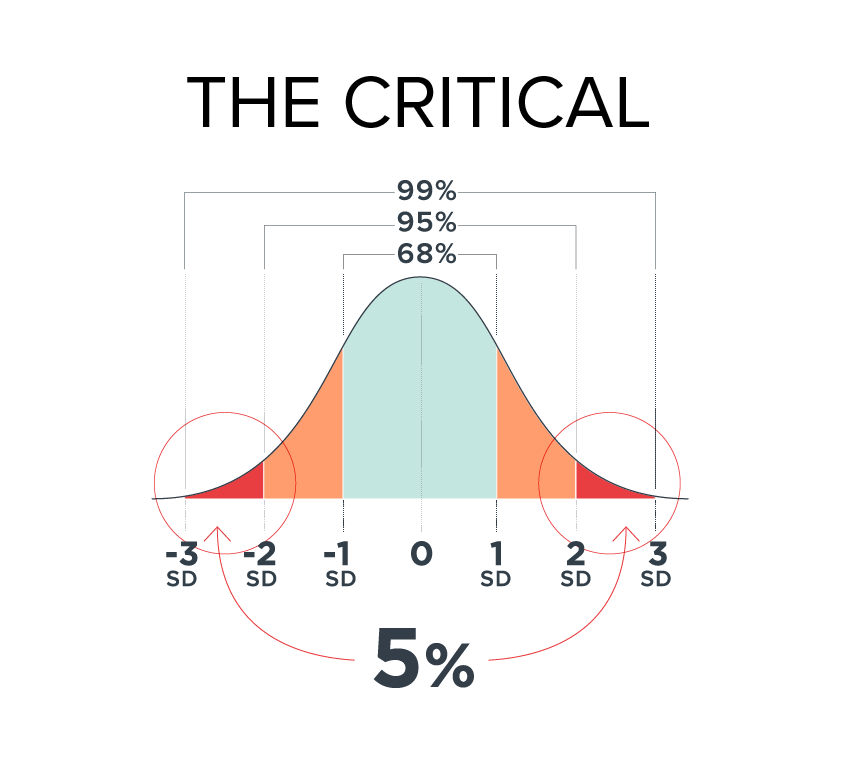

That bell-shaped curve you first learned about in high school is all about normal observations. About 68% of observations fall within the center of that curve, or within one standard deviation of the mean. Extending out to 2 standard deviations accounts for 95% of observations.

But what about that last 5%?

Outliers exist. The tail ends are what people might more casually refer to as “atypical” or even abnormal. But negative tail risk, while less likely to occur, is still part of the curve. Ask a statistician what the odds are of a market shutdown like that of 2001 or of the financial crisis of 2008 or our current pandemic-driven volatility — what do you think they’d say? Because, like shark attacks, these types of financial crises “normally” shouldn’t occur. But they did…and three times!

That means, a large number of investors and retirees have had to endure multiple statistically improbable catastrophic market events over the course of their investment journey. As Markowitz said, “The losing cards are in the deck.” But did anyone expect so many to be dealt at once? The odds of an investor in retirement enduring all three crises within a 20-year time horizon are remarkably small.

How well-prepared was the financial services industry for these events? Not very, because industry participants have tended to build products and investment processes for only 95% of markets. The problem with that is, as a financial advisor, you have to plan for 100% of the risks 100% of the time.

The Critical 5% planning problem

In order to act in the best interests of your clients, you should plan for the unlikely as much as the likely, or the abnormal as much as the normal. That’s why we find ourselves now in the middle of a 5% financial planning crisis. Because advisors planning for 100% of the risks, by and large, are only able to access investments and frameworks built for 95% of them.

But that critical 5% is where catastrophic market events happen. It’s where financial plans can get derailed, and customer decision-making can go awry. And it’s why advisors are increasingly adopting goals-based frameworks that seek to account for those risks. In fact, by 2030, McKinsey predicts 80% of financial advice will be given in a goals-based framework.

Until now, the financial industry has been built around normal risk scoring and risk tolerance questions. But as an advisor, you can only set clear expectations with clients, in the context of their personal goals, if you understand and can plan for all of the risk you’re recommending they take on.

That means if you’re only talking to your clients about conventional moderate or aggressive or growth portfolios, you have to be willing to acknowledge that those approaches are built for “normal” markets only. Otherwise, when the next improbable shark attack happens and your client panics, the bite it takes out of their portfolio might be too big to recover from.

1 Hafner, John. (2017, Jul 24). Shark week: You’re way more likely to die from these than a shark attack. www.USAToday.com.

2 McKinsey & Company. (2020, January). On the cusp of change: North American wealth management in 2030. www.mckinsey.com.

This information is for educational use only and should not be considered financial advice. Forward looking statements cannot be guaranteed. The opinions expressed are those of Horizon Investments and are subject to change without notice. All investing involves risk, and no investment is guaranteed. Clients may lose money.

© 2022 Horizon Investments, LLC is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Horizon’s investment advisory services can be found in its Form ADV Part 2, which is available upon request. HIM032022