Rallying American stocks outperform plunging Chinese equities by 32.4% so far this year.

There’s a record-breaking chasm opening up between American and Chinese stocks this year.

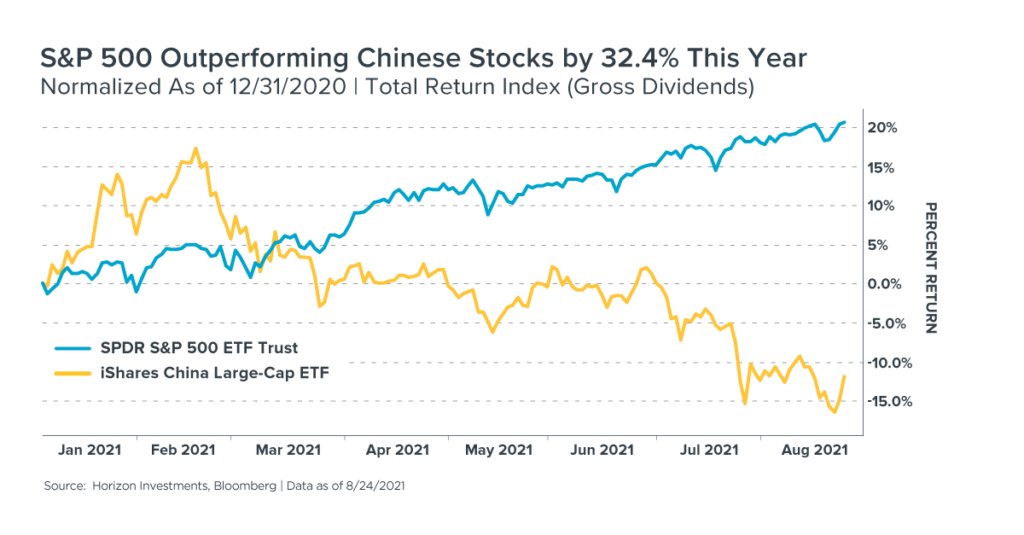

The SPDR S&P 500 ETF (SPY) is outperforming large-cap Chinese stocks by 32.4%, as of August 24. It is, by far, the largest year-to-date performance gap in favor of the U.S. since the inception of the iShares China Large-Cap ETF (FXI) 17 years ago, according to Bloomberg data.

China’s Communist Party has not been kind to stock market investors in 2021. Their broad crackdown on businesses, especially online companies, has sent the FXI down nearly 12%. There’s also worries about the country’s economic growth as supply lines remain in knots and the rise of the Delta Covid variant risks more handcuffs on economic activity.

American stocks, in contrast, have been in a slow, steady rally to record highs. SPY is up 20.6% this year. (Related Big Number: Does It Make Sense to Invest in Stocks When They’re at Record Highs?)  It’s a stunning reversal from the early months of 2021 when Chinese stocks were beating U.S. equities by about 10% as shares of growth companies surged. At the start of the year, Covid cases were soaring in the U.S., while China was reopening more of its economy as it seemed to be past the worst of the pandemic. Lately, however, China has returned to using “draconian” lockdowns, reports Bloomberg News1, as it tries to achieve Covid zero, meaning quickly squelching a flare-up in order to stamp out cases. And that has slowed the Chinese economy in July, at a time when other countries are taking a different approach and trying to balance the spread of Covid against the economic impact of lockdowns.

It’s a stunning reversal from the early months of 2021 when Chinese stocks were beating U.S. equities by about 10% as shares of growth companies surged. At the start of the year, Covid cases were soaring in the U.S., while China was reopening more of its economy as it seemed to be past the worst of the pandemic. Lately, however, China has returned to using “draconian” lockdowns, reports Bloomberg News1, as it tries to achieve Covid zero, meaning quickly squelching a flare-up in order to stamp out cases. And that has slowed the Chinese economy in July, at a time when other countries are taking a different approach and trying to balance the spread of Covid against the economic impact of lockdowns.

The investment community – blindsided by the Communist Party’s broad regulatory crackdown – is debating whether China is uninvestable. Meaning, does the government’s sweeping intervention into such a large part of the economy signal that investors should abandon their Chinese holdings? Presumably those who are doubting their exposure to China had likely bought it believing the narrative that the country’s size and growth would eventually propel it past the United States in terms of GDP.

Horizon Investments doesn’t have a firm conclusion about whether China is uninvestable, however the investment narrative around China doesn’t appear to be living up to the hype over the last decade.

While Chinese economic growth has beaten the U.S. for the past decade – China’s GDP grew nearly 142% from 2010 to 2020 in U.S. dollars vs 40% in the U.S., according to World Bank data2 – that has not translated into a windfall for investors. The ten-year, annualized total return for FXI is 2.02% versus 15.2% for SPY, as of July 31, 2021, according to Bloomberg data.

The disconnect is a cautionary tale for those who might be tempted to buy and hold an asset mainly because of the attractiveness of an investment narrative. (related Big Number: Does High-Flying Crypto Fit Into Goals-Based Investment Plans?)

Horizon Investments, as a goals-based investment manager (read our Redefining Risk paper to understand our goals-based philosophy), takes an active approach, utilizing a multi-disciplinary research process to screen the assets that make up its portfolios, especially its Accumulation strategies. Horizon’s tactical process seeks to capture equity investment opportunities with the aim of producing high, risk-adjusted returns.

As an example of Horizon’s flexible approach, the firm began this year with some of its Accumulation strategies having a meaningful exposure to emerging markets. However, as of our last strategy update on July 31, these same strategies had minimal exposure to emerging markets. (Related Big Number: the current strength of Corporate America’s profit machine)

Horizon consistently monitors markets and portfolios for new risks and attractive opportunities. At the moment, we do not believe emerging market equities, and China specifically, look favorable through our multi-disciplined investment process. Conditions can change on a dime, however; we are paying attention, so you don’t have to.

To download a copy of this commentary, click the button below.

Further reading:

Does It Make Sense to Invest in Stocks When They’re at Record Highs?

Corporate America’s Profit Machine Is as Strong as Ever

Over 65 Years Old and Working? That’s Not as Common Anymore

Are Glide Path Strategies Still a Good Option for Retirement?

Americans Taking Early Retirement May Benefit From a Goals-Based Solution

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

1 Bloomberg.com, “China Hits Zero Covid Cases With a Month of Draconian Curbs,” Aug. 22, 2021

2 World Bank data: https://data.worldbank.org

3 Society of Actuaries, 2020

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

It should not be assumed that any security transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance discussed herein. There is no assurance that any securities or sectors discussed herein will remain in an account’s portfolio at the time you receive this report or that those sold have not been repurchased. The securities or sectors discussed may represent only a small percentage of an account’s portfolio holdings.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC