In the consumer market, high-quality products are identified as reliable, longer lasting, and are generally viewed very positively. Names of iconic brands receive instant recognition, and consumers are typically willing to pay a premium for products deemed high-quality. The reputation these brands hold is typically earned from years of delivering a superior product and customer experience.

Investing can be similar. Companies that are considered to be high-quality investments typically have well respected brands and are selected based on realizing historically lower average risk, having strong balance sheets, and exhibited more sustainable growth.

In the past, high-quality companies were selected by investment managers through various means, including fundamental analysis and in-person interviews with management teams. With the rise of technology, quality portfolios can now be constructed using purely quantitative analysis. This is referred to as quantitative factor investing, and while it can be effective, it does ignore company specific non-tangibles that are often uncovered through interviewing management teams. However, with the proliferation of non-traditional data, investors now have quantitative ways to analyze and screen management teams, which can help make up for the missing “secret sauce” and provide an alternative to management interviews.

An investor can use quantitative data to select securities based on non-traditional measures. For example, an investor can consider the ethicality of a company through it’s Environmental, Social and Governance (ESG) scores. One aspect of ESG is governance, which includes ethical team management and using responsible supply chains, both of which could result in potentially lower risk of fines and lawsuits.

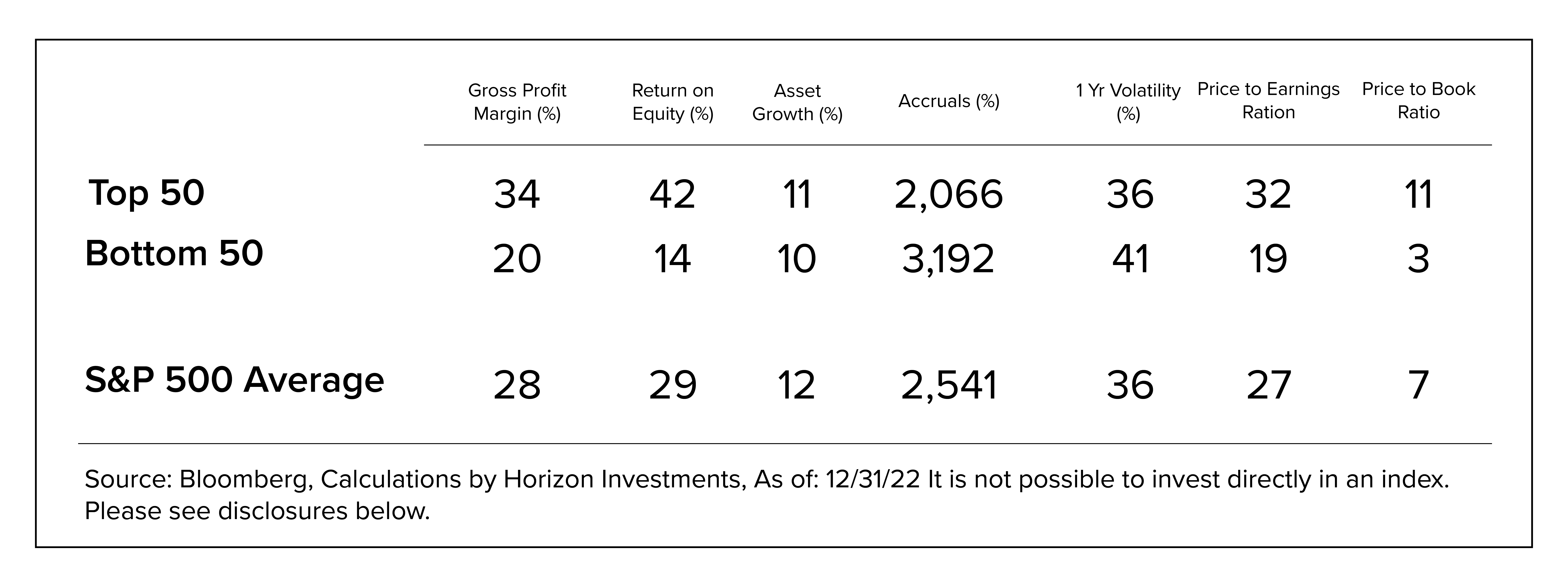

To further explore the impact ESG can have on an investment, we evaluated S&P 500 companies based on their ESG scoring, using the average scores of two of the largest ESG rating providers, Sustainalytics and MSCI, as a guide. Table 1 below examines the top and bottom 50 companies in the S&P 500 ranked by ESG aggregate non-traditional data scores*. As a whole, the top 50 companies based on the non-traditional data scores exhibit higher-quality characteristics, as they realize lower risk, have strong balance sheets, and exhibit more sustainable growth. These characteristics are relative to both the bottom 50 ranked companies as well as relative to the entire S&P 500. Relative to the bottom 50 ranked companies, the top 50 ranked companies had 70% higher margins, three times the return on equity, 10% higher asset growth, 35% lower accruals, and have recently realized 15% less volatility over the time period. Additionally, similar to high quality products, many investors are willing to pay more for these high-quality companies as measured by their above average price to earnings and price to book ratios.

Table 1: One year average measure for the top 50 and bottom 50 companies based on the non-traditional data score*

ESG can be a divisive topic. Let us be intellectually honest and put aside our preconceived ideas of ESG.

Environmental, Social and Governance can be about more than just the environment, and it doesn’t only include moral and political topics, which can be polarizing. ESG data can provide information about issues that contribute to the company’s success and non-traditional data points about a company and its management team. ESG data can go beyond the financial statement and provide a second layer of quantitative analysis similar to some of the data once collected from interviewing management teams, employees, and other stakeholders.

As shown above, ESG scores can be a helpful measurement of the quality of a company and can create a quantitative way to form an opinion on a management team and its non-financial attributes.

In summary, we believe ESG investing has viability to be used as an alternative data source to gain exposure to high quality companies.

* The aggregate non-traditional score is an average of the MSCI and Sustainalytics ESG ratings. The companies are sorted based on their average aggregate ESG score to find the top and bottom 50 ESG rated companies. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

Disclosure:

The S&P 500 Index is a stock market Index tracking the stock performance of the 500 largest companies listed on stock exchanges in the United States. You cannot invest directly in an Index. References to indices, or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change.

It is not possible to invest directly in an index. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

Past performance is not indicative of future results, and past market conditions are not indicative of future market conditions. This information is for educational use only and makes not prediction of future market results; nothing herein is guaranteed. More information about the data and calculations of the data mentioned herein is available from Horizon. All investing involves risk. Clients may lose money. There can be economic times when all investments are unfavorable and depreciate in value. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. The aggregate non-traditional score is an average of the MSCI and Sustainalytics ESG ratings. The companies are sorted based on their average aggregate ESG score to find the top and bottom 50 ESG rated companies. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

This information is not investment advice and does not take into consideration specific client objectives or restrictions. This should not be considered a recommendation to buy or sell any security. The investment strategy or strategies discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. ESG securities are not suitable for all investors and can carry additional risks.

Horizon Investments is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Horizon’s investment advisory services can be found in its Form ADV Part 2, which is available upon request. Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC.

© 2023 Horizon Investments, LLC.