Investors liked what they heard from the Fed this week.

The Federal Reserve Board raised the Federal Funds Rate by 50 basis points (0.50 percentage points) on Wednesday as it ramps up efforts to contain the highest inflation in 40 years.

The largest rate increase since 2000 was an expected–yet significant–shift in the Fed’s approach to fighting inflation, which to date has included one 25 basis point increase. Fed Chair Powell stated after the decision that the Fed is now “moving expeditiously to bring (inflation) back down.”

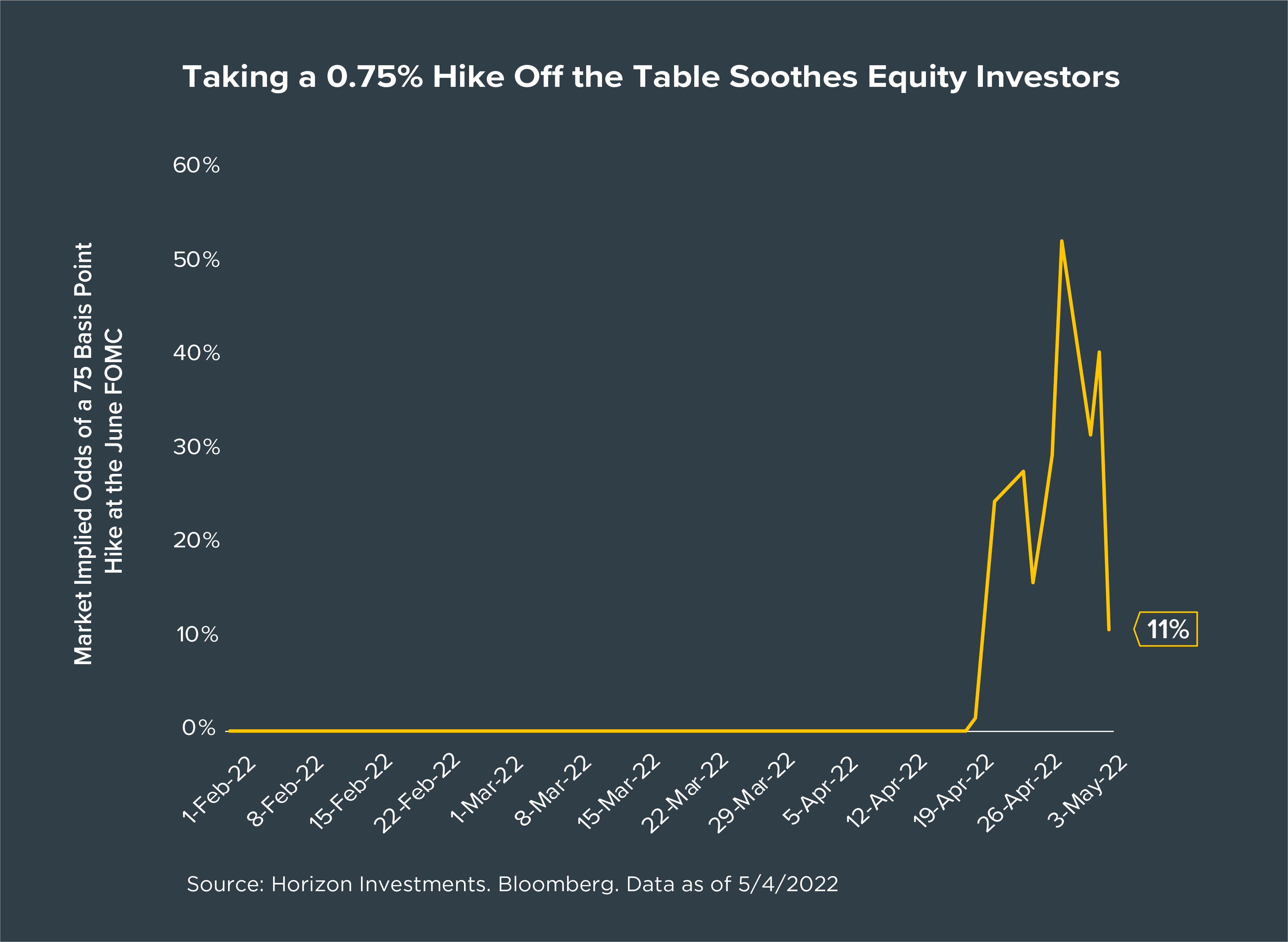

Mainly, investors cheered news of what the Fed isn’t about to do anytime soon. While Powell noted that the Fed may continue raising rates by 50 basis points at future meetings, he emphasized that a larger increase of 75 basis points is “not something the committee is actively considering.”

That pronouncement pushed the odds of a 75 basis point increase at the Fed’s next meeting in June down to just 11%, as seen in the chart above, from a high of more than 50% last month. Greater clarity about the likely direction of short-term rates sent the S&P 500 soaring, with the index closing up 3% on the day.

Any further market rallies may be short lived, however. It’s clear that the Fed wants to see financial conditions tighten going forward in order to crimp demand—but higher equity prices are incompatible with that goal. Unless supply chains improve significantly or workers flood back into the labor force—helping to alleviate supply-side inflation pressures—the Fed’s messaging may become more hawkish, causing equity market strength to fade.

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC