Active management aims to navigate trends as they emerge—and fade

We believe an active, dynamic approach to portfolio management can provide investors the potential to capitalize on emerging market opportunities and shift away from asset classes and sectors as their prospects for outperformance fade.

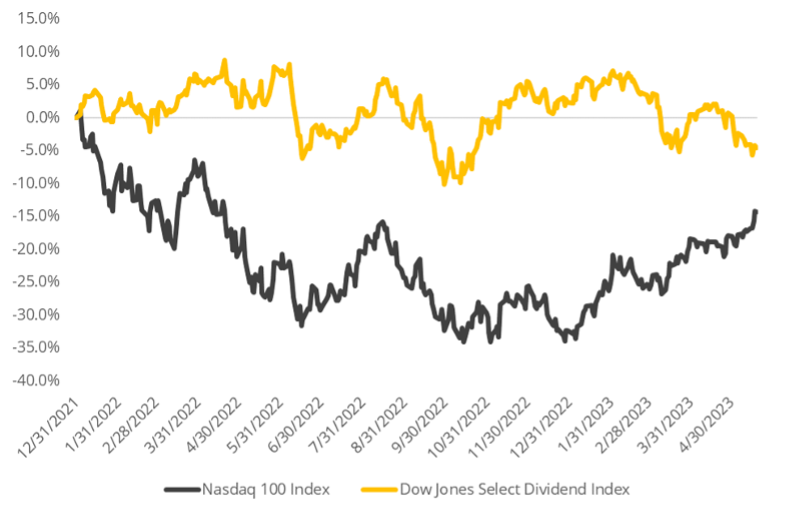

For example, consider the recent performance of two very different segments of the market: the tech-dominated Nasdaq 100 Index and the Dow Jones Select Dividend Index (which emphasizes utilities, health care, consumer goods, and financials).

- So far this year1, the Nasdaq 100 has soared 26.6%—while the Select Dividend index is down over 6%.

- But a slightly longer view reveals that, since the start of 20221, dividend stocks have outpaced the Nasdaq by 9.9 percent points, even in the wake of the Nasdaq’s recent surge.

A typical strategic allocation approach would likely passively participate, riding both the ups and downs of the market and potentially realizing higher volatility. In contrast, an active management methodology seeks to navigate multiple trends. For example, in markets like 2022, an active manager may have overweighted dividend-paying stocks and defensive sectors in a core allocation. In the market we are experiencing this year, a manager may elect to steadily increase allocations to growth-oriented market segments.

The Nasdaq 100 may have more room to run and could catch up to the Select Dividend Index. Eventually, however, the tech-heavy index might no longer lead the market higher; hitting new highs will likely require greater market participation. We are monitoring for catalysts likely to drive broader gains—such as healthy labor market trends, inflation continuing to fall back to a more normal range, a Fed policy pivot, and containment of further credit crunches from the regional bank problems earlier this year.

1 Through 05/19/23

Disclosure

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

The S&P 500 Index tracks the stock performance of 500 of the largest companies listed on stock exchanges in the United States. The Nasdaq-100 Index comprises 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. You cannot invest directly in an index.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC