The U.S dollar continues its steady march higher, up 14.7% during the past 12 months.

That sharp rise, coupled with the euro’s ongoing slide, created a scenario we haven’t seen since 2002: parity—a one-to-one exchange rate where €1 = $1. What’s more, that development comes on the heels of the dollar recently hitting a twenty-year high against the Japanese yen.

Many factors are driving these currency dynamics, of course—from the Russia-Ukraine war and concerns of a recession in Europe to various central banks tackling inflation at different speeds to strong demand for “safe haven” dollars in the wake of economic uncertainty.

This trend might be a welcome one if you’re looking for a cheap European vacation this summer. But as the second-quarter earnings season kicks into high gear, it’s causing headaches for U.S. companies that derive a big percentage of their revenues from foreign markets. When the dollar rises relative to other currencies, U.S. multinational companies’ earnings from overseas are worth less when they get converted from foreign currencies into dollars.

The result: Don’t be surprised to see lower profits and disappointed investors—particularly among sectors with the highest exposure to foreign currencies.

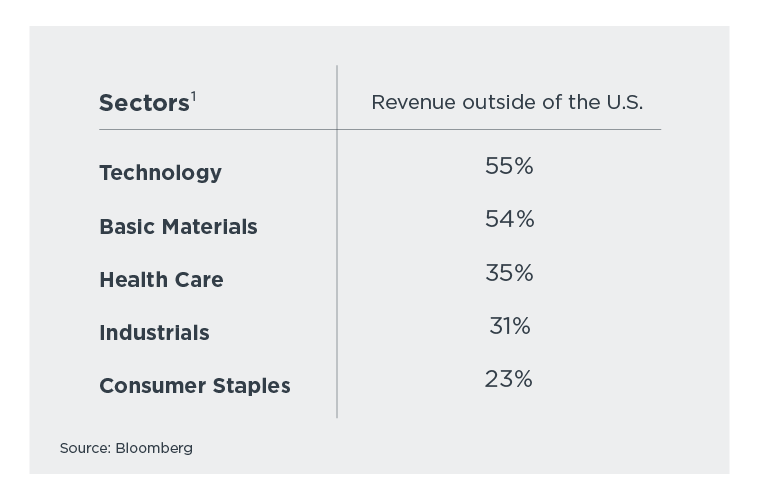

Those include:

At Horizon, we have taken steps to both pursue the potential opportunities of a rising dollar as well as mitigate the risk of that scenario–including overweighting domestic equities (as a strong dollar is currently acting as a drag on foreign investments) and underweighting emerging markets and the technology sector.

1 S&P GICS Level 1 Sectors, represented by S5INFT (IT); S5MATR (Materials); S5HLTH (HC); S5INDU (Industrials); S5CONS (Staples)

This commentary is written by Horizon Investments’ asset management team.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC