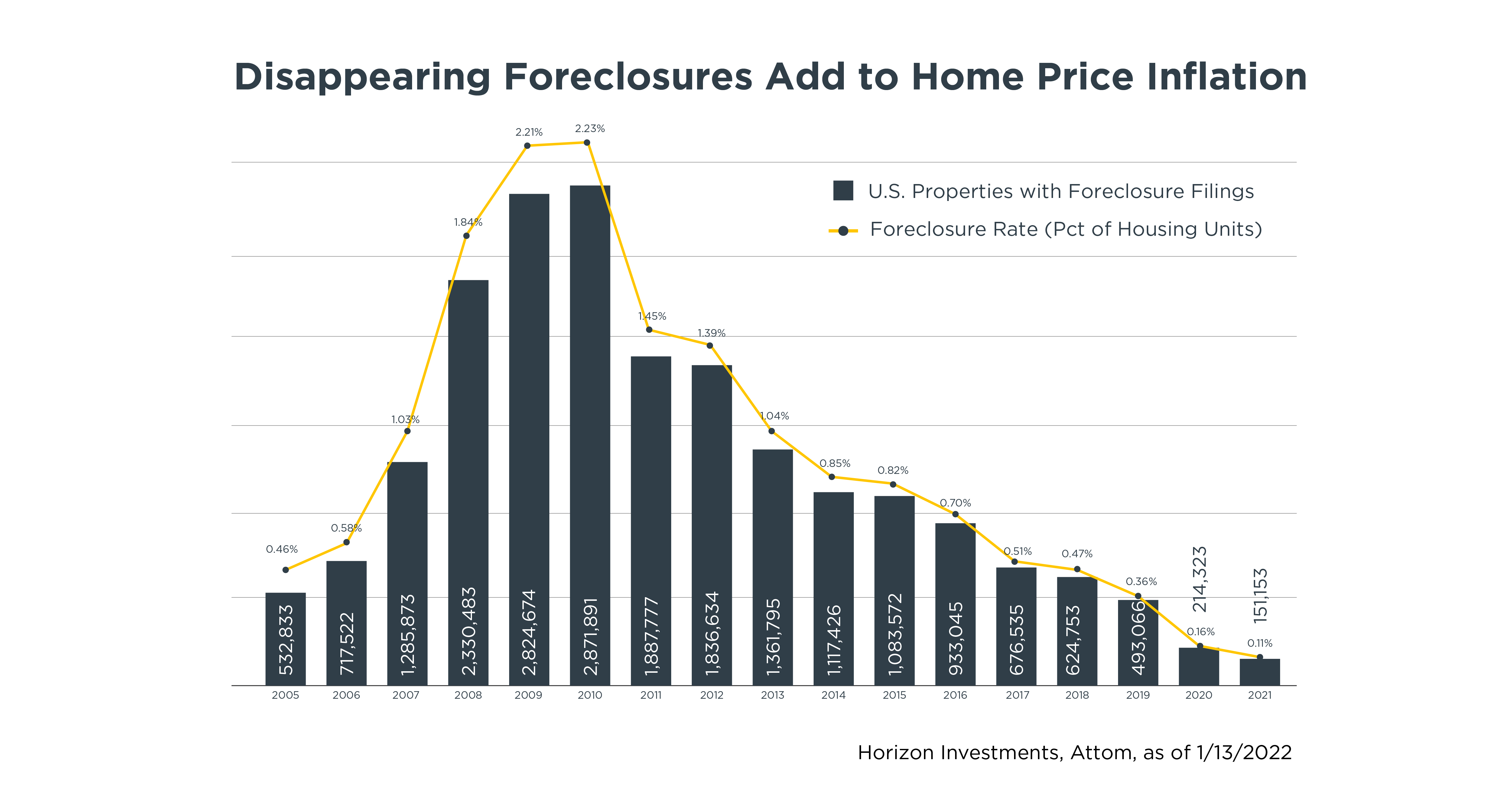

Supply is so tight in the housing market that buyers willing to bid on a foreclosed home are finding there’s not much out there.

Foreclosure filings nationwide affected just 0.11% or 151,153 homes last year, according to real estate data provider ATTOM.[1]That’s a record low in their data, and down 58% from 2019’s pre-pandemic pace.

The plunge in foreclosures was a surprise to Rick Sharga, executive VP at RealtyTrac, which is part of ATTOM. He was expecting a surge after the end of forbearance programs and pandemic stimulus checks. But a combination of flush savings accounts, rising homeowner equity, job gains and rising pay mean fewer people are falling behind.

The lack of repossessions is contributing to the record low in the number of existing homes for sale currently,[2] and adds to a whole host of reasons why home prices are marching higher.

Housing will probably become more expensive over the course of this year, despite the price jumps we’ve already seen. ATTOM says its analysis shows buying a home is currently more affordable than renting in the majority of U.S. counties. It certainly helps home shoppers that the average rate on a 30-year fixed rate mortgage remains below 4%.[3]

It’s a very strange situation. Usually there’s a glut of homes and soaring foreclosures after a recession, as we experienced with the Great Financial Crisis. The unusual circumstances are another example of what we’ve been harping on: today’s economic conditions aren’t like any prior recovery, making it difficult to forecast the future.

We bring up the strength of the housing market because if inflation statistics remain high this year, we will look to homes as a key driving force. Their rising prices, and the increases in apartment rents, are slowly being added to the Consumer Price Index (CPI), and so the bulk of 2021’s sticker shock should be felt this year. Housing is such a large component of CPI that it can more than offset improvement in other areas, such as furniture, cars, or energy. We go into more detail about that in our Q4 Focus article, Inflation: The Good, The Bad and The Ugly.

Goals-based investors who have set a home purchase as part of their financial objectives may want to review with their advisor if they are on track, considering many housing market experts, such as Zillow,[4] see prices continuing to rise for the foreseeable future.

[1] ATTOM, www.attomdata.com, ‘’U.S. Foreclosure Activity Drops To An All-Time Low in 2021,’’ Jan. 13, 2022

[2] National Association of Realtors, ‘’Annual Existing-Home Sales Hit Highest Mark Since 2006,’’ Jan. 20, 2022

[3] Freddie Mac weekly national survey, http://www.freddiemac.com/pmms/, as of Jan. 20, 2022

[4] Zillow.com, “Zillow’s Hot Housing Takes for 2022,’’ Dec. 8, 2021

Further reading:

You May Need a Bigger Down Payment for a New Home

Is Inflation Pressure Easing? Factory Input Costs Tumble Again

Read Our 2022 Outlook: The Next `Unprecedented’ Year

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

The Biggest Retirement Fear: Outliving My Money

Many GenXers Agree: It’ll Take a Miracle to Have a Secure Retirement

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments, Risk Assist and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC