Everybody can appreciate a smooth ride—and for investors, a journey without too many bumps along the way can potentially result in more wealth.

One reason: low-volatility stocks. These relatively steady shares—whose valuations are expected to fluctuate less than those of other equities—have generally helped investors avoid some of the market’s biggest woes over the past year.

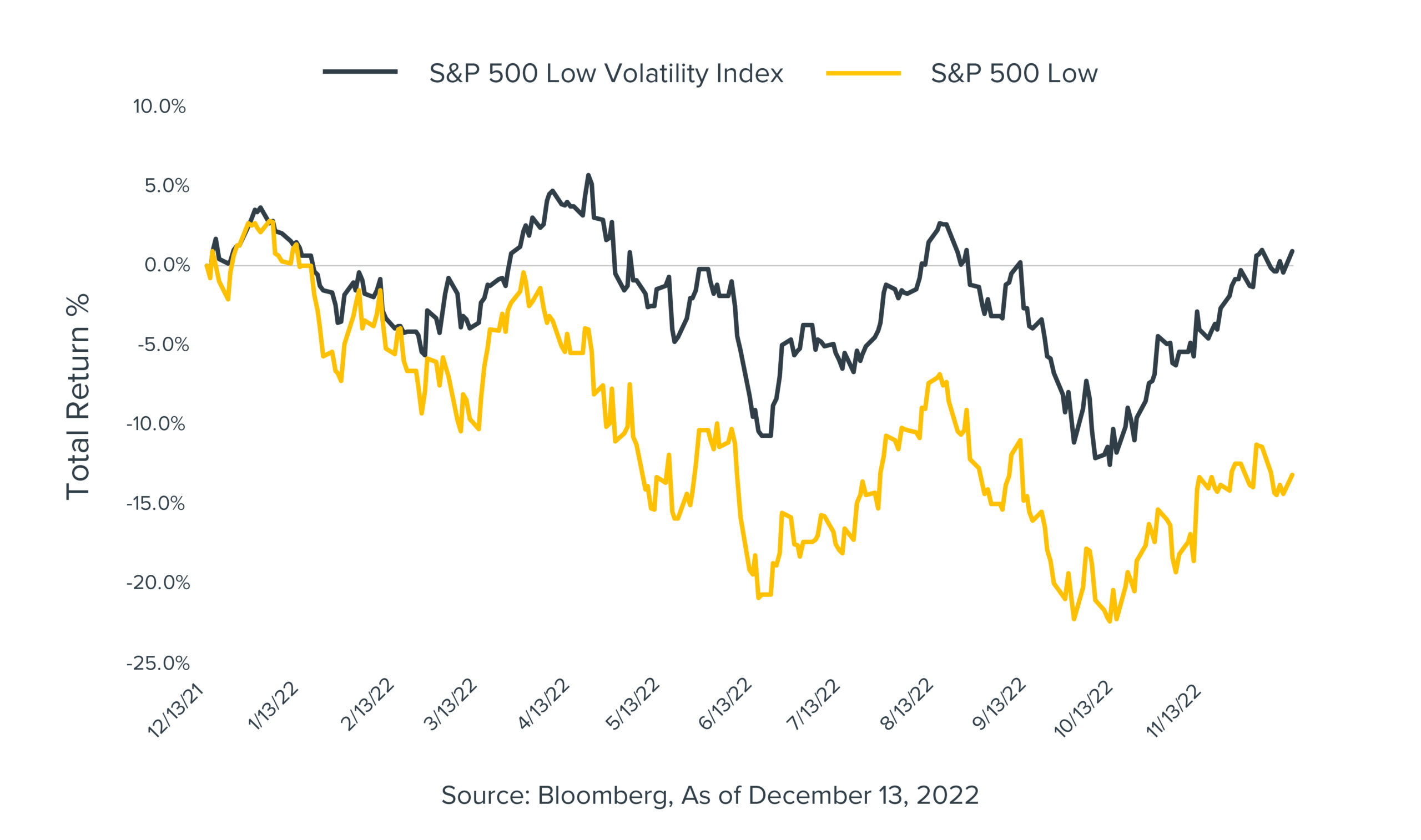

For example, while the S&P 500 has fallen 12.5% since this time last year, the S&P 500 Low Volatility index1 is up 0.9%—a difference of 13.4 percentage points. “Low-vol” stocks have been able to serve as ballast this year in portfolios with broad market exposure by mitigating some of the losses.

The case for low-volatility stocks goes beyond the past 12 months, however. History and academic studies have shown that portfolios of low-volatility stocks have actually produced higher risk-adjusted returns over time than portfolios of high-volatility stocks in most major markets studied.2

Why has the steady outpaced the frenetic? This anomaly could be the result of consistent market mispricing due to factors such as behavioral biases. For example, investors may pay more attention to highly volatile stocks because such shares are often hyped by the media—giving them a “lottery payoff” aura. As a result, less-risky stocks may be regularly undervalued (and therefore offer more return potential) compared to these riskier “hot” stocks.

At Horizon, we incorporate low-volatility equities in two main ways:

- For wealth accumulation-focused clients in the GAIN stage of investing, we may allocate tactically to low-volatility stocks in an effort to capture this particular investment factor and take a more targeted approach that seeks to go deeper than the typical growth-versus-value style investing.

- For wealth protection-focused clients in the PROTECT stage and SPEND stage, we view low volatility stocks as a larger strategic approach that can help clients maintain appropriate equity allocations with lower risk exposure as they look to safeguard their wealth and minimize drawdowns.

For additional information on low-volatility stocks, we think the article, “Is Low Volatility Anomaly Universal?” by Fei Mei Chan and Craig J. Lazzara, CFA® with Dow Jones Global is helpful.

1 The index consists of the 100 S&P 500 stocks with the lowest trailing 12-month volatility and is rebalanced quarterly.

2 Andrea Frazzini, Lasse H. Pederson, “Betting Against Beta.” AQR.com, AQR, January 2014.

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

References to indices or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. Low-volatility investing is not a guarantee against loss or declines in the value of a portfolio. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC