Sharply higher oil prices have the potential to re-ignite inflation.

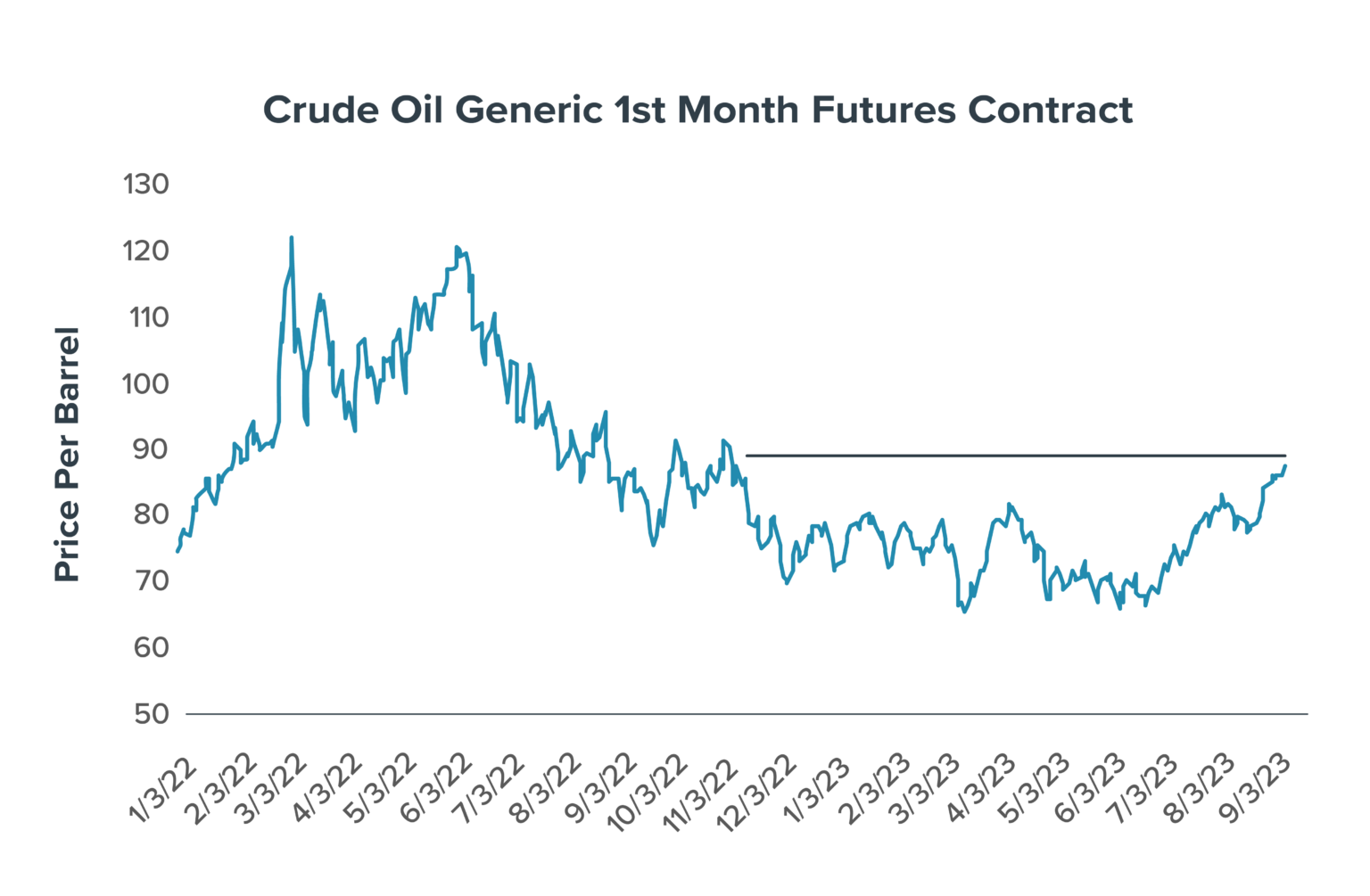

Last week saw oil prices hitting their highest point in 10 months following news that Russia and Saudi Arabia will extend their oil production cuts through December. This week, Brent crude hit $90 per barrel for the first time since last November (see the chart), while U.S. oil prices have jumped approximately 10% over the last two weeks.

Since then, gas prices—already on the rise for much of the year—have surged in many areas of the country. In the Midwest, for example, pump prices are expected to spike by 50 cents or more per gallon. Nationwide, gas prices now stand at $3.82 per gallon—up more than 18% since the start of 2023.1

From an investment perspective, rising oil prices constitute a double-edged sword:

- On the one hand, our portfolios’ overweight position in the energy sector has been favorable in the recent environment.

- That said, investors are increasingly worried that rising oil prices (if sustained) could rekindle widespread inflation—and force the Fed to keep interest rates high or even raise them again.

The latest inflation report (CPI), released this week, showed that U.S. consumer prices jumped 0.6% in August—the most significant increase in 14 months—mainly due to higher oil prices. Overall, energy contributed 0.4% to August’s price increase.

There’s also the potential impact of high gas prices on overall consumer demand. Research2 shows consumer sentiment becomes more pessimistic with rising gas prices—and as consumers become less certain about their financial prospects, they tend to rein in their spending. Given consumers’ crucial role in keeping the current economy strong, we’ll be watching this factor closely in the coming months.

Disclosures

1https://www.eia.gov/petroleum/gasdiesel/

2Binder, Carola and Makridis, Christos, Stuck in the Seventies: Gas Prices and Consumer Sentiment (May 20, 2019).

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any

investments. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index. Indices are unmanaged and do not have fees or expense charges, which would lower returns. The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns.

All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied,

or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Other disclosure information is available at hinubrand.wpengine.com. Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC