Horizon Continues to Build Its Lineup of Exchange Traded Funds with the Launch of Two New Active Fixed Income ETFs

Core Bond ETF (BNDY) and Flexible Income ETF (FLXN) expand the firm’s goals-based lineup, offering

How we help advisors guide clients through their life journeys

Intuitive technology that supports advisors

Horizon’s innovative investment framework

Outsourced CIO (OCIO) consulting solutions

Customizable actively managed single-stock portfolio

Intuitive, user-friendly planning software

Goals-based investing with Horizon Funds

Our latest thoughts, in and on the media

Our regular look at the market’s most revealing number

Our in-depth thinking on goals-based investing

What we do—and why we do it

What we do—and why we do it

Our culture and open positions

Topics

Our media mentions and appearances.

Core Bond ETF (BNDY) and Flexible Income ETF (FLXN) expand the firm’s goals-based lineup, offering

Read More

Launches represent start of next wave of ETF introductions following firm’s introduction of Horizon-branded ETFs

Read More Askar – stock.adobe.com

Read More Renan – stock.adobe.com

Listen Here

Read More

See why we’re committed to Fueling Advisor Growth. As advisors navigate unprecedented changes, Horizon provides

Read More

Read More

Watch Now

Watch Now

Watch Now

Watch Now

Read More

Read More

Watch Now

Read More

Watch Now

Watch Now

Read More

Watch Now

Read More

Read More

Watch Now

Read More

Watch Now

Watch Now

Listen Now

Watch Now

Watch Now

Watch Now

Watch Now

Watch Now

Listen Now

Watch Now

Watch Now

Watch Now

Watch Now

Watch Now Mike Dickson sees early-year volatility as ‘normal’, with positive signs from CPI, retail

Watch Now

Watch Video As stocks dip and Treasury yields climb, CIO Scott Ladner remains cautiously optimistic.

Watch Video Despite no significant changes in the economy, a shift in perspective has created

Watch Now

Watch Now

Watch Now During a recent interview with BNN Bloomberg, Zach Hill highlighted key themes for

Watch Now

Watch Now Broadcom hits a record high after proving nay-sayers wrong. How will the custom

Watch Now

Watch Now

Watch Now

Watch Now

The latest homebuilder data could provide some promising signals for the housing market. Chief Investment

Chief Investment Officer Scott Ladner dove into the key forces shaping today’s markets during a

Listen Now

While inflation remains sticky in areas like services and housing, Mike sees an opportunity to

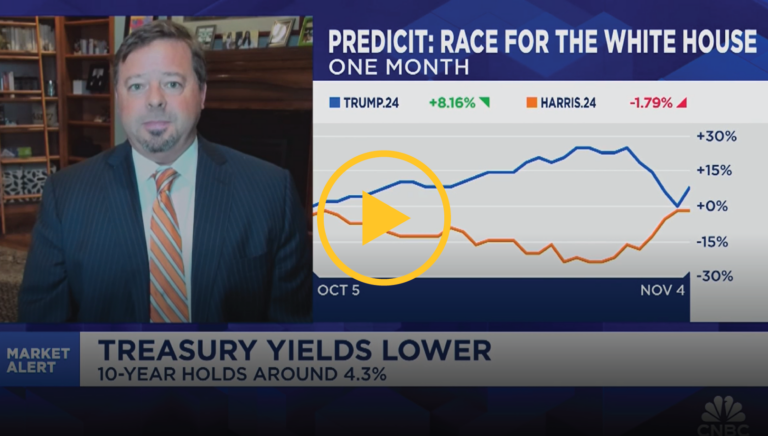

Recent election results bring a 2016 vibe back to the market, with U.S. stocks currently

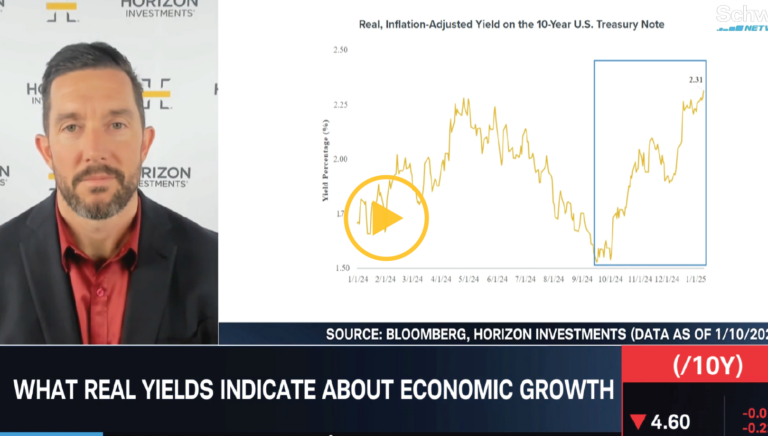

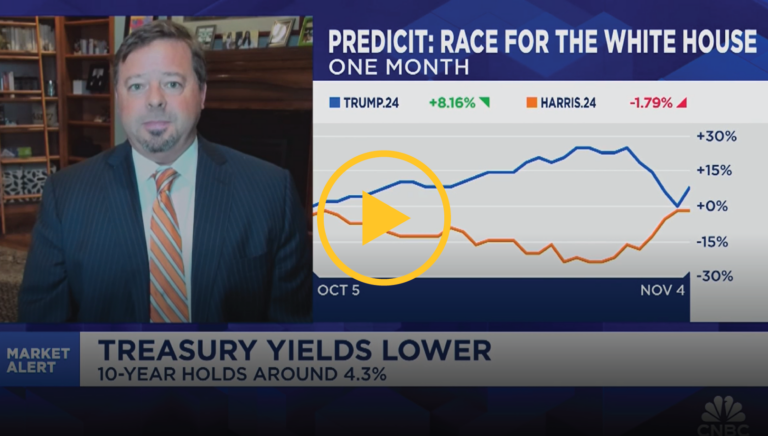

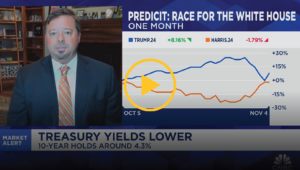

Inflation concerns, rather than growth expectations, could be behind the rise in 10-year yields, especially

“We’re gaining on it.” The mega-cap growth to small-cap stock transition that is. A solid

Chief Investment Scott Ladner joined BNN Bloomberg to discuss potential impacts of the U.S. election

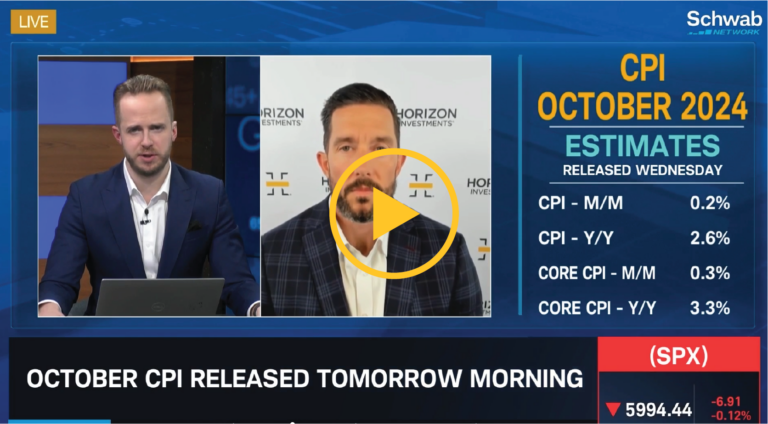

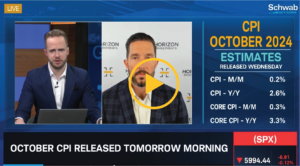

Head of Research and Quantitative Strategies Mike Dickson joined Schwab Network to highlight the U.S.’s

We think a “barbell approach” combining both sectors and ETFs may be beneficial to balance

“We’re looking under the hood of the micro,” says Horizon Investments’ Zach Hill. He looks

Chief Investment Officer Scott Ladner joined BNN Bloomberg for a wide-ranging conversation on the post-COVID

How do you harness the resilience of the U.S. consumer? With steady wage gains and

During a recent conversation with Schwab Network, Chief Investment Officer Scott Ladner highlighted three key

With recent Chinese stimulus measures stirring excitement in the markets, it’s easy to get caught

Defensive stocks have come into focus as global tensions have risen in recent weeks –

https://www.youtube.com/watch?v=-f7S0cz_D-4&t=95s We remain bullish on equities, anticipating that continued support from the Fed will drive

Election Season: A Time for Ballots, Not Drastic Portfolio Changes When major elections are near,

September holds its notorious history of challenging stocks. How could interest rate cuts affect the

Regardless of stabilized delinquency rates and healthy debt-to-income ratios, consumers do not believe this is

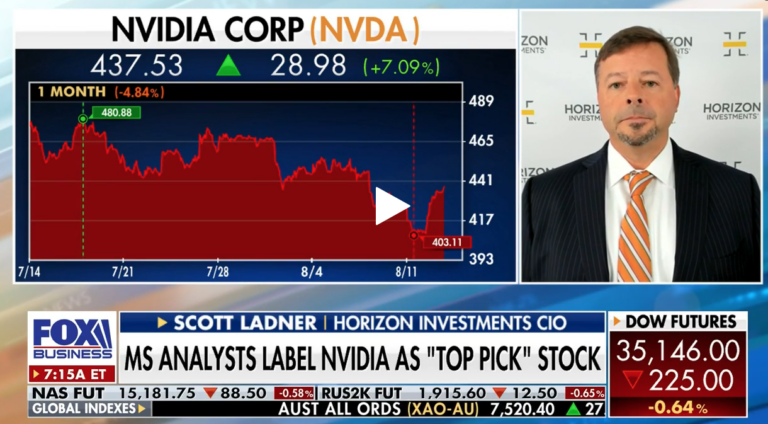

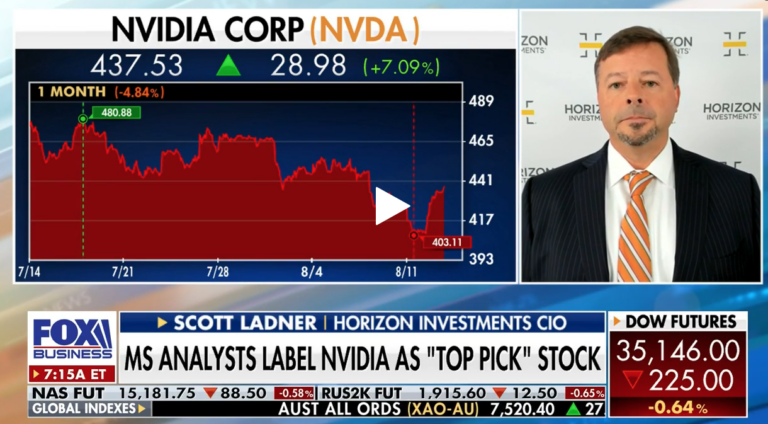

Despite Nvida’s recent slump, the market kept moving. Chief Investment Officer Scott Ladner joins Schwab

Watch out above. Here comes revenue per employee. Chief Investment Officer Scott Ladner joins CNBC

Conventional economic thinking may not have a place in today’s market cycle. Head of Portfolio

Homebuilders and housing stocks may be a smart first play for the anticipated September cut

Slower numbers do not necessarily mean weak numbers. Chief Investment Officer Scott Ladner joins BNN

The markets have shown remarkable resilience, rebounding from last Monday’s sell-off. But is it time

The recent market volatility should prompt investors to take a deep breath and evaluate their

Will we see broader market growth beyond the tech giants? Head of Portfolio Management Zach

Will the next round of AI earnings be impressive – or lackluster? Chief Investment Officer

Head of Portfolio Management Zach Hill, CFA®, joins BNN Bloomberg to share our thoughts on

Would a September rate cut be a political move? Chief Investment Officer Scott Ladner joined

Are we in for a slow summer with the Fed? Head of Portfolio Management Zach

With GDP and inflation slowing, keep in mind our strong starting place. Chief Investment Officer

Where do you go from yesterday’s Fed-induced sell-off? CIO Scott Ladner joins CNBC Worldwide Exchange

Utilities are the top performing sector this quarter. Is this the next AI play? Chief

Finding a balance between growth potential and low-risk investments can be essential for long-term retirement

https://www.youtube.com/watch?v=K_2CoH-Ju1o&t=8234s%20 Chief Investment Officer Scott Ladner joins Bloomberg to discuss large vs small business confidence.

Is the Fed out of play as a market catalyst at this point? Chief Investment

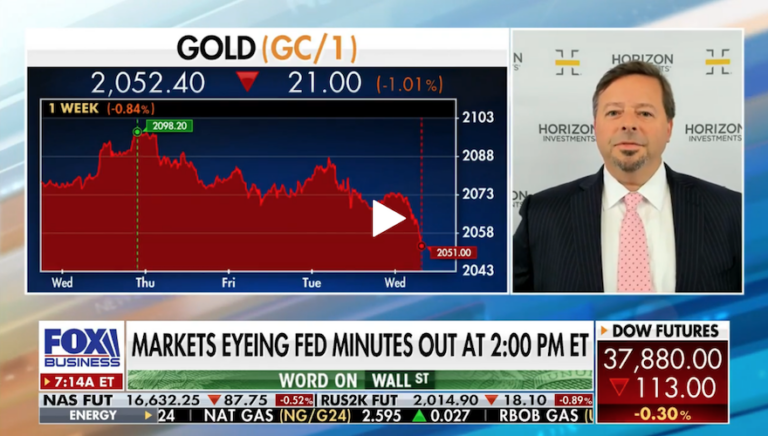

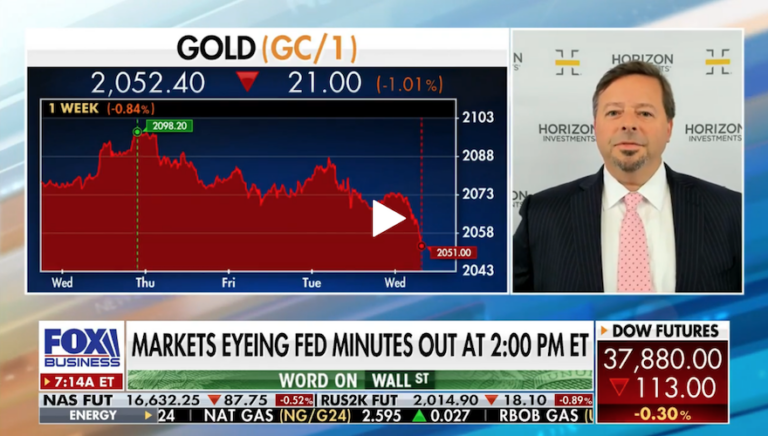

Chief Investment Officer Scott Ladner joins Mornings With Maria on Fox Business to analyze this

Chief Investment Officer Scott Ladner breaks down the chips and the materials and energy sectors

Head of Research & Quantitative Strategies Mike Dickson, Ph.D, joins BNN Bloomberg to discuss pivoting

Accelerating inflation and long-term growth have tilted the balance in favor of the hawks. Head

Head of Research & Product Development Mike Dickson, Ph.D., joins Schwab Network to discuss his

The market has done well in the face of repricing to half of their initial

We expect market broadening within the S&P rather than small or mid-caps. Chief Investment Officer

Earnings momentum, disinflation, and a global easing cycle… is the US an attractive place to

Chief Investment Officer Scott Ladner joins Gregg Greenberg with InvestmentNews to share how Horizon’s goals-based

Until bazooka-style fiscal government spending is announced, we don’t see China as an attractive investment.

A broader tech. trade could be the largest driver in 2024 as the market moves

China would need massive fiscal spending to get out of its balance sheet recession

We appear to be in a war-recovery-like period, going through an abrupt normalization process, which

While some headlines focus on credit card debt alone, Head of Research & Product Development

“This Covid cycle that we’ve just been through was not a traditional business cycle. It

Chief Investment Officer Scott Ladner discusses his outlook for markets and investment strategy. Watch Video

Chief Investment Officer Scott Ladner joins CNBC to discuss the divergence in stock performance between

Chief Investment Officer Scott Ladner joins Fox Business ‘The Claman Countdown’ to provide investing advice.

Scott Ladner joins BNN Bloomberg to discuss the U.S. markets, and Powell’s recent comments on

MASTERCLASS: Portfolio Construction The portfolio construction process can be broken down into a series of

Bond market must get ‘under control’ before stocks rise again. Chief Investment Officer Scott Ladner

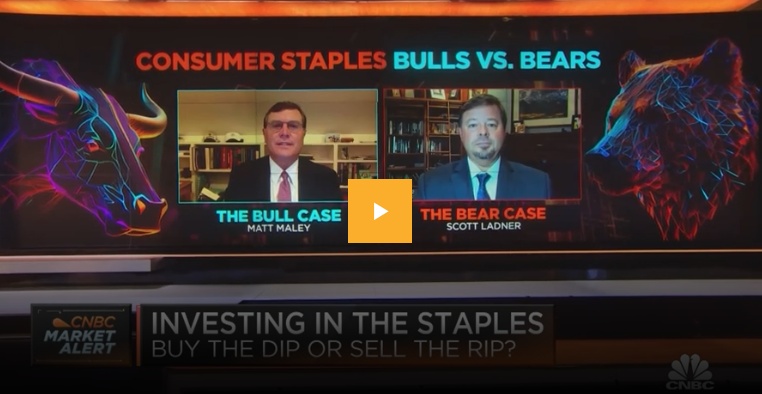

Look Outside of the Stocks that Gained from the Inflation Trade The staples companies were

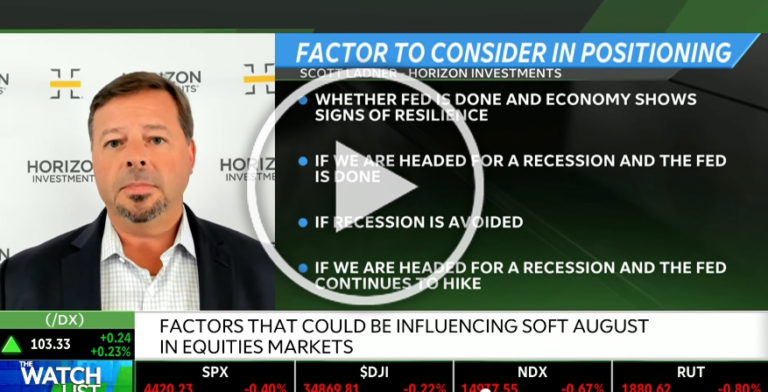

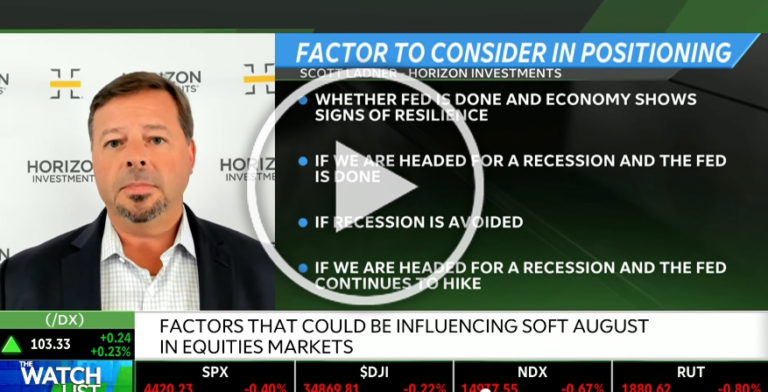

CIO Scott Ladner joined Schwab Network to discuss recent employment and inflation data, factors behind

Chief Investment Officer Scott Ladner joined Fox News to provide critical tips to investors on ‘Mornings

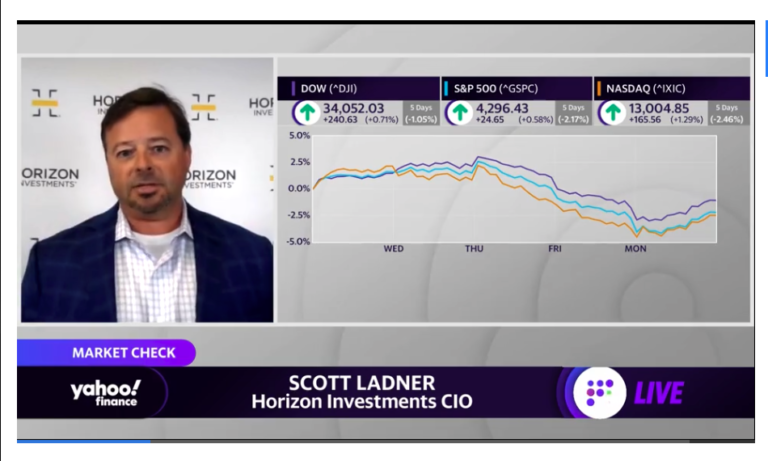

CIO Scott Ladner joined Yahoo! Finance to discuss portfolio positioning and how to prepare for

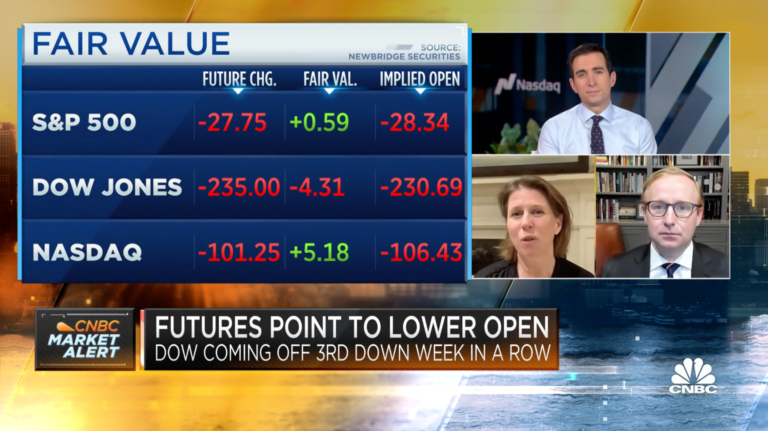

Chief Investment Officer Scott Ladner joined CNBC to discuss what’s ahead for the busiest week

Horizon Investments chief investment officer Scott Ladner analyzes the market as it enters the second

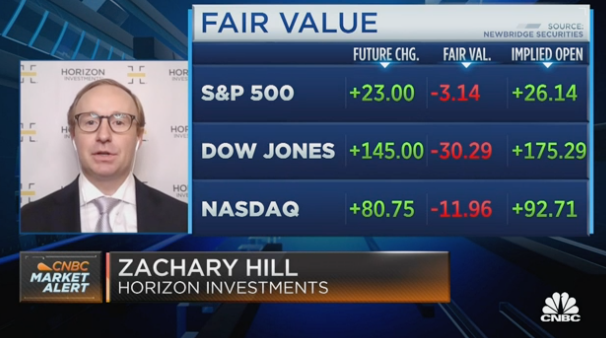

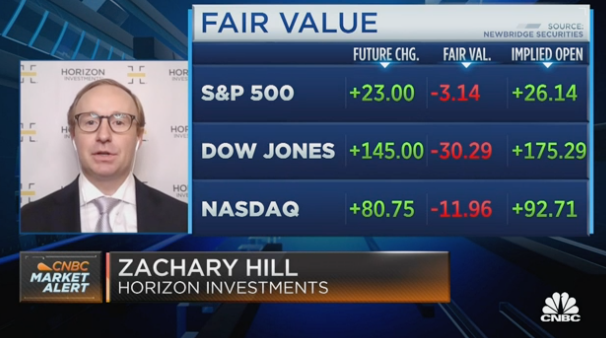

Zachary Hill, CFA, joins ‘Squawk Box’ to discuss the latest market trends, whether stocks are

A.I. could be the most important productivity-enhancing development for the global economy since the uptake

“The U.S. economy looks pretty strong, and we think that will feed into corporate profits.”

WATCH VIDEO

Hear Scott talk about areas of the market to watch in 2023, and his expectations

Scott provides insight on the state of the market.

WATCH VIDEO

“For tech and communication services, there was this belief that those revenue streams were impervious

Ladner: We think there will be a lot of tailwinds for the markets in the

Zach Hill, CFA® discusses concerns around markets and the economy in 2023 on Mornings with

Scott Ladner recently appeared on ‘Mornings with Maria’ with Fox Business to review inflation, the

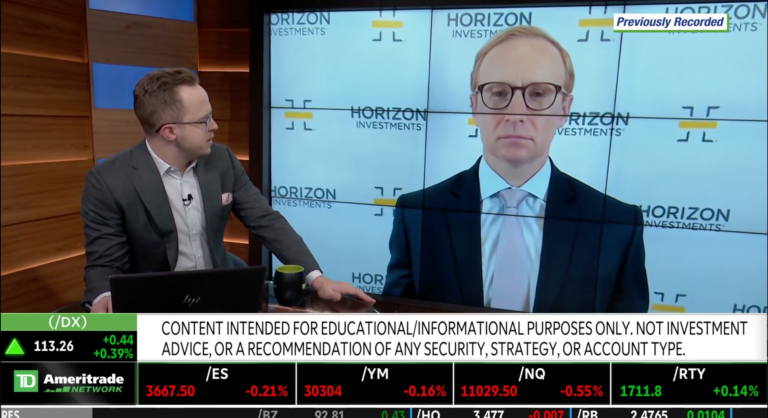

Zach Hill, CFA® joined Nicole Petallides on TD Ameritrade Network to discuss the takeaways from

Horizon’s Head of Portfolio Management, Zach Hill, CFA®, joined Squawk Box Friday to discuss the

“The market is – as it has been a few times this year – very

CIO Scott Ladner joined Yahoo Finance Live to discuss Fed policy and inflation, economic data,

Scott Ladner joined Nicole Petallides on TD Ameritrade’s ‘The Watch List’ to discuss the market,

Ron Saba weighs in on shifting focus from tech stocks to so-called value stocks in

Horizon’s Head of Portfolio Management, Zach Hill, CFA®, discussed his expectations for earnings estimates, the

CIO Scott Ladner joined Maria Bartiromo on Fox Business to discuss the impact of inflation

Zach Hill, CFA® shares his expectations around negative demand, the next Fed meeting, and his

Horizon Investments CIO Scott Ladner explains the lull in chip demand and why now is

“It’s interest rates that are driving equity volatility, that is the way we have been

Head of Portfolio Management Zach Hill, CFA® joins Yahoo! Finance to weigh in on recent

CIO Scott Ladner joins BNN Bloomberg to discuss the BOE announcement, global growth, and sectors.

CIO Scott Ladner joins CNBC to discuss Treasuries, the Fed’s next moves, and the impact

CIO Scott Ladner argues housing leads the economy and will cause a market ‘softening’ as

“The recent CPI report threw cold water on hopes that the Fed could ease up

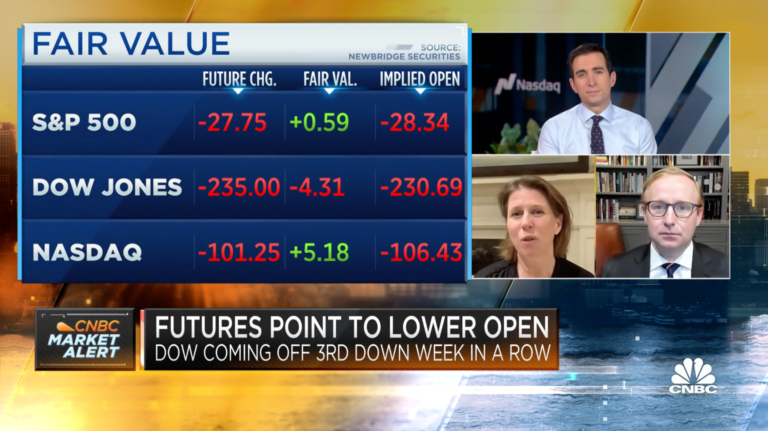

Head of Portfolio Management Zachary Hill, joined CNBC Worldwide Exchange to discuss the markets ahead

Chief Investment Officer Scott Ladner, joined Cheddar News’ Closing Bell to discuss U.S. stocks after

Chief Investment Officer Scott Ladner joined ‘Morning with Maria’ to weigh in on the August

“Nominal GDP slowdown has been baked in the cake. The stock market today has started

Scott Ladner, CIO of Horizon Investments, joins Worldwide Exchange to discuss his views on inflation

Zach Hill, CFA and ERShares COO Eva Ados joined Yahoo Finance Live after the closing

Zach Hill, CFA®, head of portfolio management at Horizon Investments, says this bear market is

CIO Scott Ladner joined Brigg MacAdam LTD founding partner Greg Swenson and Rosecliff Capital CEO

CIO Scott Ladner joined Bloomberg to share his expectations for the market and why boring

Last week ended with the S&P dipping briefly into bear market territory before closing higher

CIO Scott Ladner joined Liz Claman to discuss this week’s market sell-off and share his

“…unless supply chains heal rapidly or workers flood back into the labor force, any equity

Stocks fell hard Thursday, May 5, 2022 following the FOMC meeting announcement in which the

Scott Ladner on air for Mornings with Maria Bartiromo. Scott sheds light on the micro

Scott Ladner joins Kristina Hooper after the closing bell yesterday on Yahoo Finance to discuss

There’s something strange happening with energy ETFs. Zachary Hill, CFA comments on the sector’s flagships

The broader tech sell-off comes after the Federal Reserve announced plans to hike interest rates

U.S. companies start to report the effect of decades-high inflation on their profit margins.

“Volatility in the bond market is simply too high right now…” Zachary Hill, CFA is

Zachary Hill, CFA‘s insights on the economic health from a consumer and corporate perspective.

Stocks fluctuate to end whirlwind week. But have we hit the bottom?

Fed Finally Moves Against Inflation With Rate Hike.

Wall Street adds to gains following surge in Chinese markets

Watch this short video as Scott Ladner discusses the current market environment, the Fed, interest

Horizon Investments CIO, Scott Ladner was on Mornings with Maria Bartiromo on Fox Business Network

Horizon Investments CIO, Scott Ladner joins Yahoo Finance Live to discuss the outlook for the

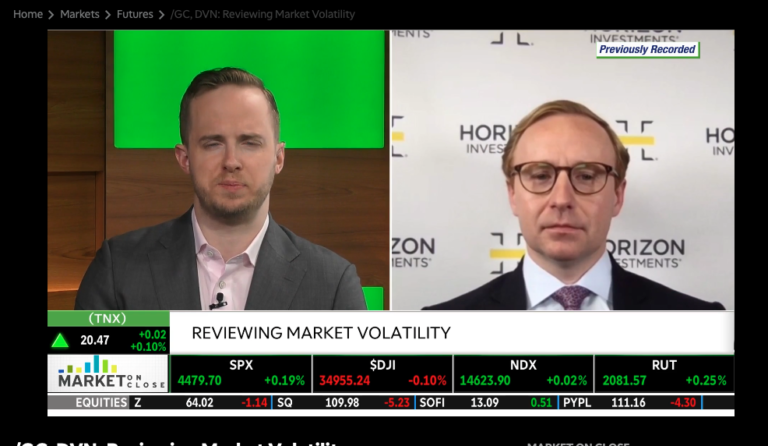

Zachary Hill, CFA, Head of Portfolio Management at Horizon Investments, reviews market volatility with TD

With such a choppy week so far in the markets, we pose the question, ‘Will

In case you missed it, check out Horizon Investments’ CIO Scott Ladner discussing his market

Tracking alternative investments to Treasurys Kevin O’Leary of O’Shares and Scott Ladner of Horizon Investments

One sector’s secret weapon against rising inflation, according to ETF manager Alexi Panagiotakopoulos of Fundamental

Stocks closed the first trading week of 2022 in the red as investors digested a

Kevin O’Leary of O’Shares joins Scott Ladner of Horizon Investments to discuss how to invest

Flush with new cash, Horizon Investments is even better positioned to provide first-rate advice to

Check out what Zachary Hill, CFA, Horizon Investments’ Head of Portfolio Management, had to say

Tech stocks spur Wall Street slide as investors continue to monitor inflation impact

The waiting game is almost over. Zachary Hill, CFA weighs in onthe Fed’s decision coming

A common investor assumption is that bonds tend to go up in value when the

On Wednesday, March 10, 2021, Scott Ladner, Horizon’s Chief Investment Officer, spoke with CNBC Pro’s

A common investor assumption is that bonds tend to go up in value when the

A common investor assumption is that bonds tend to go up in value when the

A common investor assumption is that bonds tend to go up in value when the

Categories

Topics

Core Bond ETF (BNDY) and Flexible Income ETF (FLXN) expand the firm’s goals-based lineup, offering new tools for advisors to meet client objectives CHARLOTTE, NC

Read More

Launches represent start of next wave of ETF introductions following firm’s introduction of Horizon-branded ETFs in Q1 2025 CHARLOTTE, NC (June 26, 2025) – Horizon,

Read More Askar – stock.adobe.com

Read More Renan – stock.adobe.com

Listen Here

Read More

See why we’re committed to Fueling Advisor Growth. As advisors navigate unprecedented changes, Horizon provides the solutions and support to help transform their practices and

Watch Now

Read More

Watch Now

Read More

Read More

Read More

Watch Now

Watch Now

Watch Now

Watch Now

Listen Now

Watch Now

Watch Now

Watch Now

Watch Now

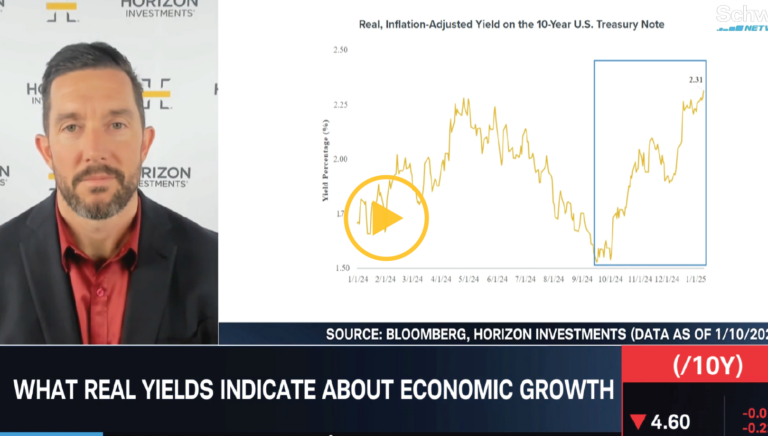

Watch Now Mike Dickson sees early-year volatility as ‘normal’, with positive signs from CPI, retail sales, and broadening sector strength beyond tech. Head of Research

Watch Video As stocks dip and Treasury yields climb, CIO Scott Ladner remains cautiously optimistic. Unlike 2022, when inflation and interest rate hikes were the

Watch Video Despite no significant changes in the economy, a shift in perspective has created market volatility and raised questions about the Fed’s outlook. Chief

Watch Now

Watch Now During a recent interview with BNN Bloomberg, Zach Hill highlighted key themes for 2025, including corporate resilience, deregulation, and earnings growth. However, recent

Watch Now

Watch Now Broadcom hits a record high after proving nay-sayers wrong. How will the custom chip creator finish out the year? Head of Research Mike

Watch Now

The latest homebuilder data could provide some promising signals for the housing market. Chief Investment Officer Scott Ladner visited BNN Bloomberg to discuss how potential

Chief Investment Officer Scott Ladner dove into the key forces shaping today’s markets during a recent appearance on Schwab network. From the ongoing bond volatility

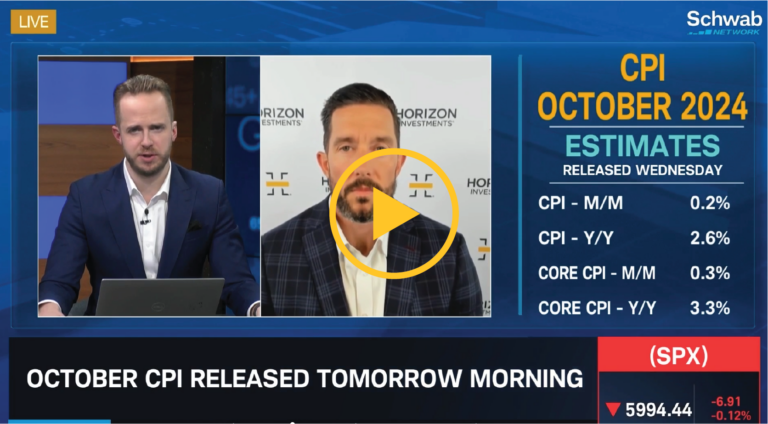

While inflation remains sticky in areas like services and housing, Mike sees an opportunity to navigate this complexity. He spotlighted healthcare as a potential hidden

Recent election results bring a 2016 vibe back to the market, with U.S. stocks currently leading over internationals, but inflation concerns are real. Head of

Inflation concerns, rather than growth expectations, could be behind the rise in 10-year yields, especially as prediction markets fluctuate with the election. Chief Investment Officer

“We’re gaining on it.” The mega-cap growth to small-cap stock transition that is. A solid earnings outlook could solve recent small-caps underperformance relative to large-caps.

Chief Investment Scott Ladner joined BNN Bloomberg to discuss potential impacts of the U.S. election on markets.

Head of Research and Quantitative Strategies Mike Dickson joined Schwab Network to highlight the U.S.’s strong economic growth, with the Atlanta Fed’s GDP forecast at

We think a “barbell approach” combining both sectors and ETFs may be beneficial to balance risk and capture opportunities as AI advances drug development and

“We’re looking under the hood of the micro,” says Horizon Investments’ Zach Hill. He looks at how earnings season is proving to show continued resilience

Chief Investment Officer Scott Ladner joined BNN Bloomberg for a wide-ranging conversation on the post-COVID economic landscape, the growing significance of AI, and the potential

How do you harness the resilience of the U.S. consumer? With steady wage gains and relatively low debt levels, consumer spending remains a key factor

During a recent conversation with Schwab Network, Chief Investment Officer Scott Ladner highlighted three key sectors to watch in the months ahead: Technology (boosted by

With recent Chinese stimulus measures stirring excitement in the markets, it’s easy to get caught up in the buzz. However, as Scott Ladner, our Chief

Defensive stocks have come into focus as global tensions have risen in recent weeks – particularly in the Middle East. With elections around the corner

https://www.youtube.com/watch?v=-f7S0cz_D-4&t=95s We remain bullish on equities, anticipating that continued support from the Fed will drive markets higher as we close out the year. Head of

Election Season: A Time for Ballots, Not Drastic Portfolio Changes When major elections are near, investors may be concerned about how their portfolios will be

September holds its notorious history of challenging stocks. How could interest rate cuts affect the market’s response? Chief Investment Officer Scott Ladner joins BNN Bloomberg

Regardless of stabilized delinquency rates and healthy debt-to-income ratios, consumers do not believe this is a good economy. Chief Investment Officer Scott Ladner joins Fox

Despite Nvida’s recent slump, the market kept moving. Chief Investment Officer Scott Ladner joins Schwab Network to discuss a shift in focus to the broadening

Watch out above. Here comes revenue per employee. Chief Investment Officer Scott Ladner joins CNBC to discuss how the adoption of AI moves the market.

Conventional economic thinking may not have a place in today’s market cycle. Head of Portfolio Management Zach Hill, CFA®, joins Schwab Network to discuss the

Homebuilders and housing stocks may be a smart first play for the anticipated September cut by the Fed. Chief Investment Officer Scott Ladner joins Schwab

Slower numbers do not necessarily mean weak numbers. Chief Investment Officer Scott Ladner joins BNN Bloomberg to discuss the recent U.S. jobs report and his

The markets have shown remarkable resilience, rebounding from last Monday’s sell-off. But is it time to feel confident? While the panic we witnessed last week

The recent market volatility should prompt investors to take a deep breath and evaluate their investment time horizon. Chief Investment Office Scott Ladner joined Yahoo

Will we see broader market growth beyond the tech giants? Head of Portfolio Management Zach Hill, CFA®, provided insights on the S&P 500’s performance and the

Will the next round of AI earnings be impressive – or lackluster? Chief Investment Officer Scott Ladner joined CNBC to forecast his expectations on where

Head of Portfolio Management Zach Hill, CFA®, joins BNN Bloomberg to share our thoughts on the AI trade trajectory and why investors are underweight financials.

Would a September rate cut be a political move? Chief Investment Officer Scott Ladner joined Schwab Network to discuss potential motivators for the timing of

Are we in for a slow summer with the Fed? Head of Portfolio Management Zach Hill, CFA®, joins Schwab Network to discuss what fewer Fed

With GDP and inflation slowing, keep in mind our strong starting place. Chief Investment Officer Scott Ladner joins Fox Business Mornings With Maria to discuss

Where do you go from yesterday’s Fed-induced sell-off? CIO Scott Ladner joins CNBC Worldwide Exchange to discuss how he would play the markets. Watch Video

Utilities are the top performing sector this quarter. Is this the next AI play? Chief Investment Officer Scott Ladner joins Fox Business The Claman countdown

Finding a balance between growth potential and low-risk investments can be essential for long-term retirement income. Head of Research & Quantitative Strategies Mike Dickson, Ph.D.,

https://www.youtube.com/watch?v=K_2CoH-Ju1o&t=8234s%20 Chief Investment Officer Scott Ladner joins Bloomberg to discuss large vs small business confidence. Watch Video

Is the Fed out of play as a market catalyst at this point? Chief Investment Officer Scott Ladner joins Yahoo! Finance on Market Domination to

Chief Investment Officer Scott Ladner joins Mornings With Maria on Fox Business to analyze this week’s earnings, recession probability, and Fed decision impacts on inflation.

Chief Investment Officer Scott Ladner breaks down the chips and the materials and energy sectors on Fox Business Network ‘The Claman Countdown.’ Watch Video

Head of Research & Quantitative Strategies Mike Dickson, Ph.D, joins BNN Bloomberg to discuss pivoting from planning for nearly seven rate cuts to less than

Accelerating inflation and long-term growth have tilted the balance in favor of the hawks. Head of Portfolio Management Zach Hill, CFA®, Joins Schwab Network to

Head of Research & Product Development Mike Dickson, Ph.D., joins Schwab Network to discuss his expectations of Fed rate cuts, investing in a high rate,

The market has done well in the face of repricing to half of their initial projected Fed cuts this year. CIO Scott Ladner joins Fox

We expect market broadening within the S&P rather than small or mid-caps. Chief Investment Officer Scott Ladner joins CNBC to discuss what’s ahead for the

Earnings momentum, disinflation, and a global easing cycle… is the US an attractive place to invest? Chief Investment Officer

Chief Investment Officer Scott Ladner joins Gregg Greenberg with InvestmentNews to share how Horizon’s goals-based investment management differs from traditional investing. Watch Video

Until bazooka-style fiscal government spending is announced, we don’t see China as an attractive investment. Chief Investment Officer Scott Ladner joins Bloomberg Radio to discuss

A broader tech. trade could be the largest driver in 2024 as the market moves from hardware technology to the services part of the AI

China would need massive fiscal spending to get out of its balance sheet recession and become a wise investment. Chief Investment Officer Scott Ladner

We appear to be in a war-recovery-like period, going through an abrupt normalization process, which we think should lead central banks, especially the Fed, to

While some headlines focus on credit card debt alone, Head of Research & Product Development Mike Dickson, Ph.D., provides a different perspective on how the

“This Covid cycle that we’ve just been through was not a traditional business cycle. It never has been.” CIO Scott Ladner joins Fox Business to

Chief Investment Officer Scott Ladner discusses his outlook for markets and investment strategy. Watch Video

Chief Investment Officer Scott Ladner joins CNBC to discuss the divergence in stock performance between small-cap and large-cap companies. Watch Video

Chief Investment Officer Scott Ladner joins Fox Business ‘The Claman Countdown’ to provide investing advice. Watch Video This is not investment advice or a recommendation

Scott Ladner joins BNN Bloomberg to discuss the U.S. markets, and Powell’s recent comments on raising rates. Watch Video

MASTERCLASS: Portfolio Construction The portfolio construction process can be broken down into a series of important decisions, including asset allocation, manager due diligence, and more.

Bond market must get ‘under control’ before stocks rise again. Chief Investment Officer Scott Ladner predicts ‘problems’ with small and mid-capital businesses amid high Fed

Look Outside of the Stocks that Gained from the Inflation Trade The staples companies were not hurt on the input side of the inflation equation,

CIO Scott Ladner joined Schwab Network to discuss recent employment and inflation data, factors behind soft August, and artificial intelligence.

Chief Investment Officer Scott Ladner joined Fox News to provide critical tips to investors on ‘Mornings with Maria.’

CIO Scott Ladner joined Yahoo! Finance to discuss portfolio positioning and how to prepare for the Fed.

Chief Investment Officer Scott Ladner joined CNBC to discuss what’s ahead for the busiest week of the summer on Wall Street.

Horizon Investments chief investment officer Scott Ladner analyzes the market as it enters the second half of 2023. Read Article

Zachary Hill, CFA, joins ‘Squawk Box’ to discuss the latest market trends, whether stocks are due for a correction, and more. Watch Now

A.I. could be the most important productivity-enhancing development for the global economy since the uptake of the internet, notes Chief Investment Officer Scott Ladner. Watch

“The U.S. economy looks pretty strong, and we think that will feed into corporate profits.” – Zach Hill, Head of Portfolio Management

WATCH VIDEO

Hear Scott talk about areas of the market to watch in 2023, and his expectations for after inflation has cooled. WATCH VIDEO

Scott provides insight on the state of the market.

WATCH VIDEO

“For tech and communication services, there was this belief that those revenue streams were impervious to the ups and downs of the economy” READ FULL

Ladner: We think there will be a lot of tailwinds for the markets in the back half of next year. WATCH NOW

Zach Hill, CFA® discusses concerns around markets and the economy in 2023 on Mornings with Maria. WATCH NOW

Scott Ladner recently appeared on ‘Mornings with Maria’ with Fox Business to review inflation, the job market, interest rates, and more. WATCH NOW

Zach Hill, CFA® joined Nicole Petallides on TD Ameritrade Network to discuss the takeaways from the jobs report that came out on December 2nd. WATCH

Horizon’s Head of Portfolio Management, Zach Hill, CFA®, joined Squawk Box Friday to discuss the inflation trade, expectations for this week’s Fed meeting, and his

“The market is – as it has been a few times this year – very eager to trade a ‘Fed pivot’ … but we think

CIO Scott Ladner joined Yahoo Finance Live to discuss Fed policy and inflation, economic data, and overall volatility. Watch the Video

Scott Ladner joined Nicole Petallides on TD Ameritrade’s ‘The Watch List’ to discuss the market, what investors have learned from earnings season thus far and

Ron Saba weighs in on shifting focus from tech stocks to so-called value stocks in the Wall Street Journal. Read Article

Horizon’s Head of Portfolio Management, Zach Hill, CFA®, discussed his expectations for earnings estimates, the impacts of inflation, and his thoughts on specific sectors. Watch

CIO Scott Ladner joined Maria Bartiromo on Fox Business to discuss the impact of inflation on earnings and his thoughts on the economy and a

Zach Hill, CFA® shares his expectations around negative demand, the next Fed meeting, and his thoughts on particular sectors. Watch the Video

Horizon Investments CIO Scott Ladner explains the lull in chip demand and why now is the time to invest in tech stocks on ‘The Claman

“It’s interest rates that are driving equity volatility, that is the way we have been looking at things all year, that is kind of the

Head of Portfolio Management Zach Hill, CFA® joins Yahoo! Finance to weigh in on recent market volatility, bond yields, and why investing in equities may

CIO Scott Ladner joins BNN Bloomberg to discuss the BOE announcement, global growth, and sectors.

CIO Scott Ladner joins CNBC to discuss Treasuries, the Fed’s next moves, and the impact of inflation on the markets.

CIO Scott Ladner argues housing leads the economy and will cause a market ‘softening’ as he joins Maria Bartiromo on Fox News Media

“The recent CPI report threw cold water on hopes that the Fed could ease up on policy tightening aimed at cooling inflation.” Zachary Hill, CFA.

Head of Portfolio Management Zachary Hill, joined CNBC Worldwide Exchange to discuss the markets ahead of the August CPI print.

Chief Investment Officer Scott Ladner, joined Cheddar News’ Closing Bell to discuss U.S. stocks after investors returned to trading action following Labor Day weekend.

Chief Investment Officer Scott Ladner joined ‘Morning with Maria’ to weigh in on the August jobs reports and unemployment rate.

“Nominal GDP slowdown has been baked in the cake. The stock market today has started to move on from inflation to recession fears. Don’t fight

Scott Ladner, CIO of Horizon Investments, joins Worldwide Exchange to discuss his views on inflation and the Fed’s big decision this week.

Zach Hill, CFA and ERShares COO Eva Ados joined Yahoo Finance Live after the closing bell to examine the possibilities of a recession amid market

Zach Hill, CFA®, head of portfolio management at Horizon Investments, says this bear market is likely to stick around a while. Photo Source: Traders work

CIO Scott Ladner joined Brigg MacAdam LTD founding partner Greg Swenson and Rosecliff Capital CEO Mike Murphy on ‘Word on Wall Street’ to unpack markets

CIO Scott Ladner joined Bloomberg to share his expectations for the market and why boring investments may be prudent.

Last week ended with the S&P dipping briefly into bear market territory before closing higher on Friday. Inflationary pressures fueled by supply chain kinks and

CIO Scott Ladner joined Liz Claman to discuss this week’s market sell-off and share his thoughts on sectors, geopolitical risk, and the Fed.

“…unless supply chains heal rapidly or workers flood back into the labor force, any equity rallies are likely on borrowed time as Fed messaging becomes

Stocks fell hard Thursday, May 5, 2022 following the FOMC meeting announcement in which the Federal Reserve raised rates by 50 basis points as the

Scott Ladner on air for Mornings with Maria Bartiromo. Scott sheds light on the micro vs macro market drivers. Tune in around the 2:20 marker.

Scott Ladner joins Kristina Hooper after the closing bell yesterday on Yahoo Finance to discuss economic uncertainties behind China’s supply chain and COVID lockdowns, outlook

There’s something strange happening with energy ETFs. Zachary Hill, CFA comments on the sector’s flagships ETFs

The broader tech sell-off comes after the Federal Reserve announced plans to hike interest rates in an attempt to cool inflation. Scott Ladner, CIO, Horizon

U.S. companies start to report the effect of decades-high inflation on their profit margins.

“Volatility in the bond market is simply too high right now…” Zachary Hill, CFA is quoted on CNBC earlier today. As investors are keeping their

Zachary Hill, CFA‘s insights on the economic health from a consumer and corporate perspective.

Stocks fluctuate to end whirlwind week. But have we hit the bottom?

Fed Finally Moves Against Inflation With Rate Hike.

Wall Street adds to gains following surge in Chinese markets

Watch this short video as Scott Ladner discusses the current market environment, the Fed, interest rates and more on TD Ameritrade Network.

Horizon Investments CIO, Scott Ladner was on Mornings with Maria Bartiromo on Fox Business Network to discusses the impact the Russian invasion of Ukraine has

Horizon Investments CIO, Scott Ladner joins Yahoo Finance Live to discuss the outlook for the stock market ahead of President Biden addressing geopolitical tensions between

Zachary Hill, CFA, Head of Portfolio Management at Horizon Investments, reviews market volatility with TD Ameritrade. Tune in to find out more.

With such a choppy week so far in the markets, we pose the question, ‘Will the Federal Reserve run to the rescue?’. Listen to Scott

In case you missed it, check out Horizon Investments’ CIO Scott Ladner discussing his market sector picks on ‘Mornings with Maria’ on Fox Business Channel.

Tracking alternative investments to Treasurys Kevin O’Leary of O’Shares and Scott Ladner of Horizon Investments discuss their favorite alternatives to bonds in the hunt for

One sector’s secret weapon against rising inflation, according to ETF manager Alexi Panagiotakopoulos of Fundamental Income joins Kevin O’Leary of O’Shares and Scott Ladner of

Stocks closed the first trading week of 2022 in the red as investors digested a key report on the U.S. labor market recovery at the

Kevin O’Leary of O’Shares joins Scott Ladner of Horizon Investments to discuss how to invest in an inflationary environment.

Flush with new cash, Horizon Investments is even better positioned to provide first-rate advice to investors on the best ETFs and funds in the market.

Check out what Zachary Hill, CFA, Horizon Investments’ Head of Portfolio Management, had to say about defensive stocks and what we could see in this

Tech stocks spur Wall Street slide as investors continue to monitor inflation impact

The waiting game is almost over. Zachary Hill, CFA weighs in onthe Fed’s decision coming tomorrow.

A common investor assumption is that bonds tend to go up in value when the stock market is sliding. That’s been true during the bond

On Wednesday, March 10, 2021, Scott Ladner, Horizon’s Chief Investment Officer, spoke with CNBC Pro’s Yun Li around the S&P 500’s record close as Biden

A common investor assumption is that bonds tend to go up in value when the stock market is sliding. That’s been true during the bond

A common investor assumption is that bonds tend to go up in value when the stock market is sliding. That’s been true during the bond

A common investor assumption is that bonds tend to go up in value when the stock market is sliding. That’s been true during the bond

See Horizon Investments’ Customer Relationship Summary and

View Form ADV for additional information