Is More Volatility Coming Down the Pike?

Investors looking for greater clarity about the road ahead for equities—and a break from market volatility—probably shouldn’t hold their breath.

One big reason is that stock valuations are based largely on the value of so-called “risk-free” assets, such as short-term Treasury securities.

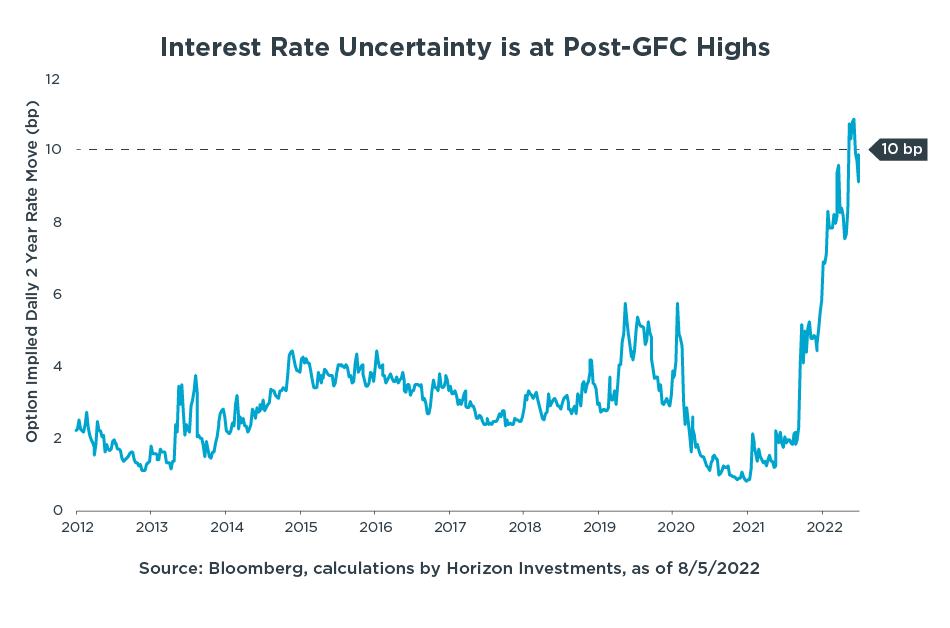

The issue? It is hard to know what “risk-free” rates should be right now. Options on short-term interest rates are currently implying that the yield of the 2-year U.S. Treasury note is expected to fluctuate by 10 basis points per day over the next three months, by far its highest level since the Great Financial Crisis.

For the 2-year U.S. Treasury, daily swings of 10 basis points each day would be far and away the most significant level of expected fluctuation seen at any time over the past decade—it’s averaged just 1.9 basis points per day over that time. This extreme expectation is evidence of investors’ continued uncertainty about the Federal Reserve’s next interest rate moves in the coming months.

The upshot: Given the projected volatility of one of the critical components behind equity valuations, it’s hard to see how stocks will have a smooth path to run on any time soon.

Ultimately, the “dovish pivot” that some think the Fed will implement is, in our view, massively premature and built on an understanding of how the Fed operates that is just not relevant when inflation is as high as it is today. Therefore, despite the recent rally, volatility may be with us for a while. We are maintaining defensive positioning across equities and fixed income as a result.

This commentary is written by Horizon Investments’ asset management team.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC