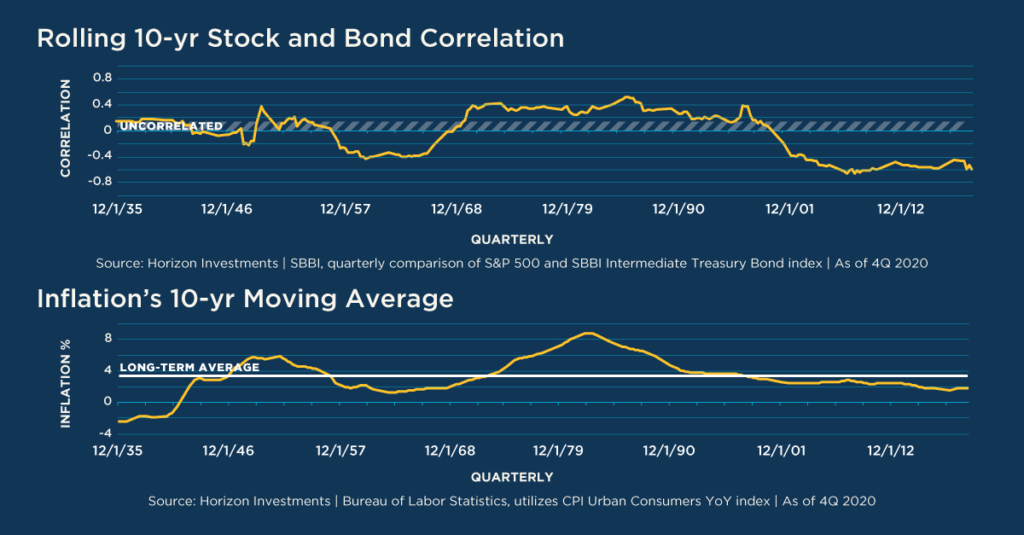

When stocks fall, bonds rally. That’s standard market action today. And it makes bonds look like a reliable way to counteract the stock market’s inevitable weakness. But that’s not always true.

From the 1970s to the 1990s, bonds often provided less diversification benefit as their price mostly moved in the same direction as stocks. That’s plain to see in the correlation of stocks and bonds, with a positive number meaning the two assets are moving in the same direction.

The difference between then and now?

- The Federal Reserve is comfortable now with low interest rates to boost economic growth; and they’re unafraid to cut rates to essentially zero in an emergency, which can drive a rally in bonds.

- Inflation is barely growing, rising at a tepid 1.75% rate at the end of last year on a 10-year moving average basis versus the 7.9% pace in the fourth quarter of 1980.

Inflation is the key. Horizon Investments’ research shows that when inflation is high or rising, stocks and bonds are positively correlated. So long as inflation is tame, the Fed can keep monetary policy easy, which helps bonds diversify a portfolio.

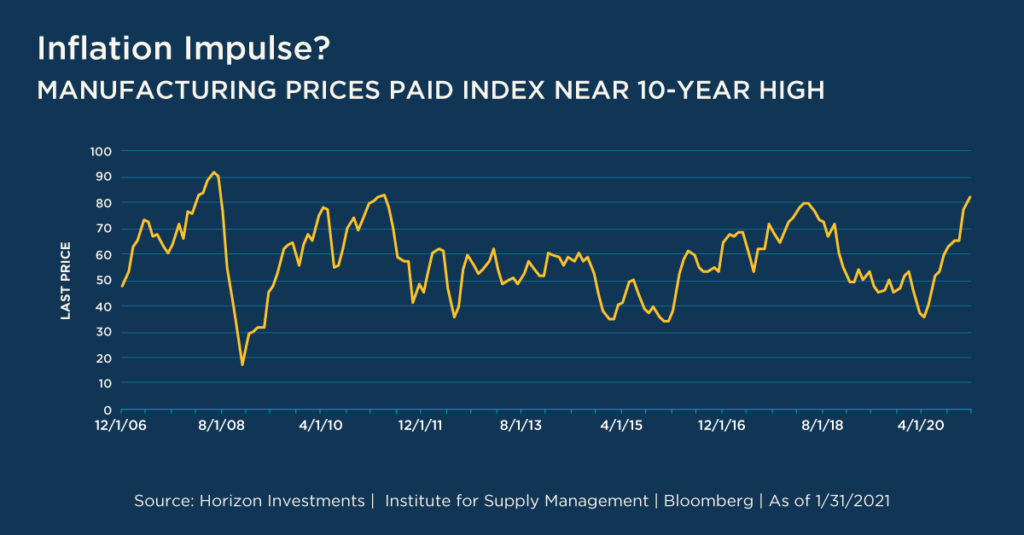

The important question is: will inflation make a big comeback anytime soon?

Horizon Investments is keeping close tabs on important market signals, including the prices American manufacturers are paying for their supplies. This is spiking to a nearly 10-year high in January. Recall that in September 2011, the Consumer Price Index of inflation was nearly 4%.

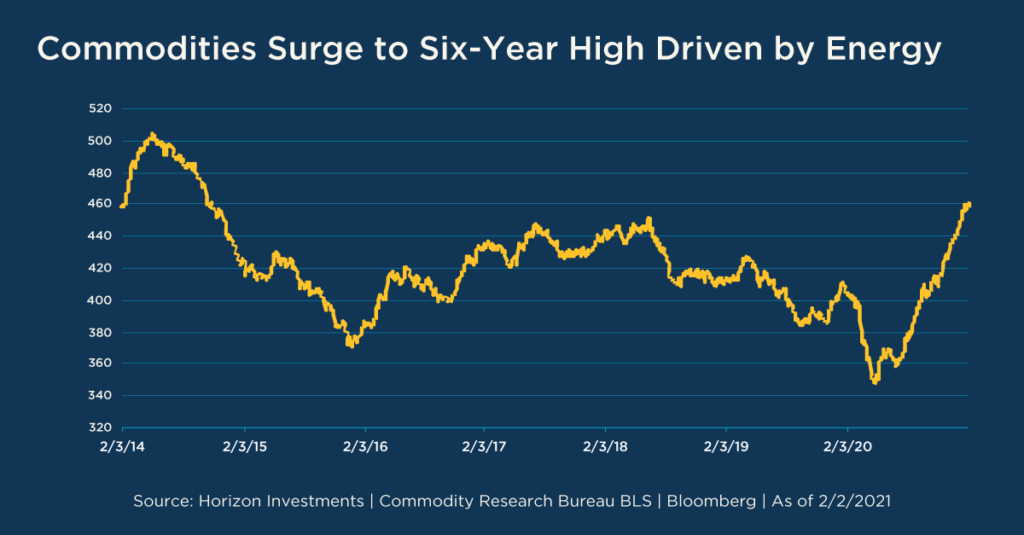

Meanwhile, the Commodities Research Bureau’s index continues its straight up rally. It’s at a six-year high, driven by gains in natural gas, gasoline and diesel.

On the other hand, inflation in the services sector (the biggest part of the Consumer Price Index) continues to tumble. Though that may change if consumers go on a spending spree when the economy fully reopens.

For investors in the Protect and Spend stages of their goals-based investment journey, the direction inflation takes could have a significant effect on their portfolios if they’re relying mainly on bonds (see the Big Number report on potentially no returns for bonds over the next five years). Horizon Investments’ approach is to emphasize active fixed-income management and the use of bond-like alternatives to help reduce the risk of portfolio erosion that could come from holding Treasuries and other bonds if inflation sharply increases.

Further reading:

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Bond Market Bears Growling as 10-Yr Yield Tops 1%

It’s Getting Harder to Fund Retirement Using Bonds

7.9 Trillion Reasons Not to Fight the Fed, ECB, BOJ or BOE

The Stock Market Is Strange, But Not Broken by GameStop

In Current Markets, Only Two Words Matter: Stimulus Spending

Top 2021 Themes: Horizon Investments’ New Year Special Report

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, please reach out to Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To download a copy of this commentary, click the button below.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.