We’re more than halfway through the third-quarter earnings season, and thus far, the S&P 500 overall is reporting its worst year-over-year earnings growth since the third quarter of 2020.1 The percentage of companies in the index posting positive earnings surprises is slightly below its long-term average, while companies’ earnings overall are just 2.2% above estimates—worse than the 10-year average of 6.5%.2

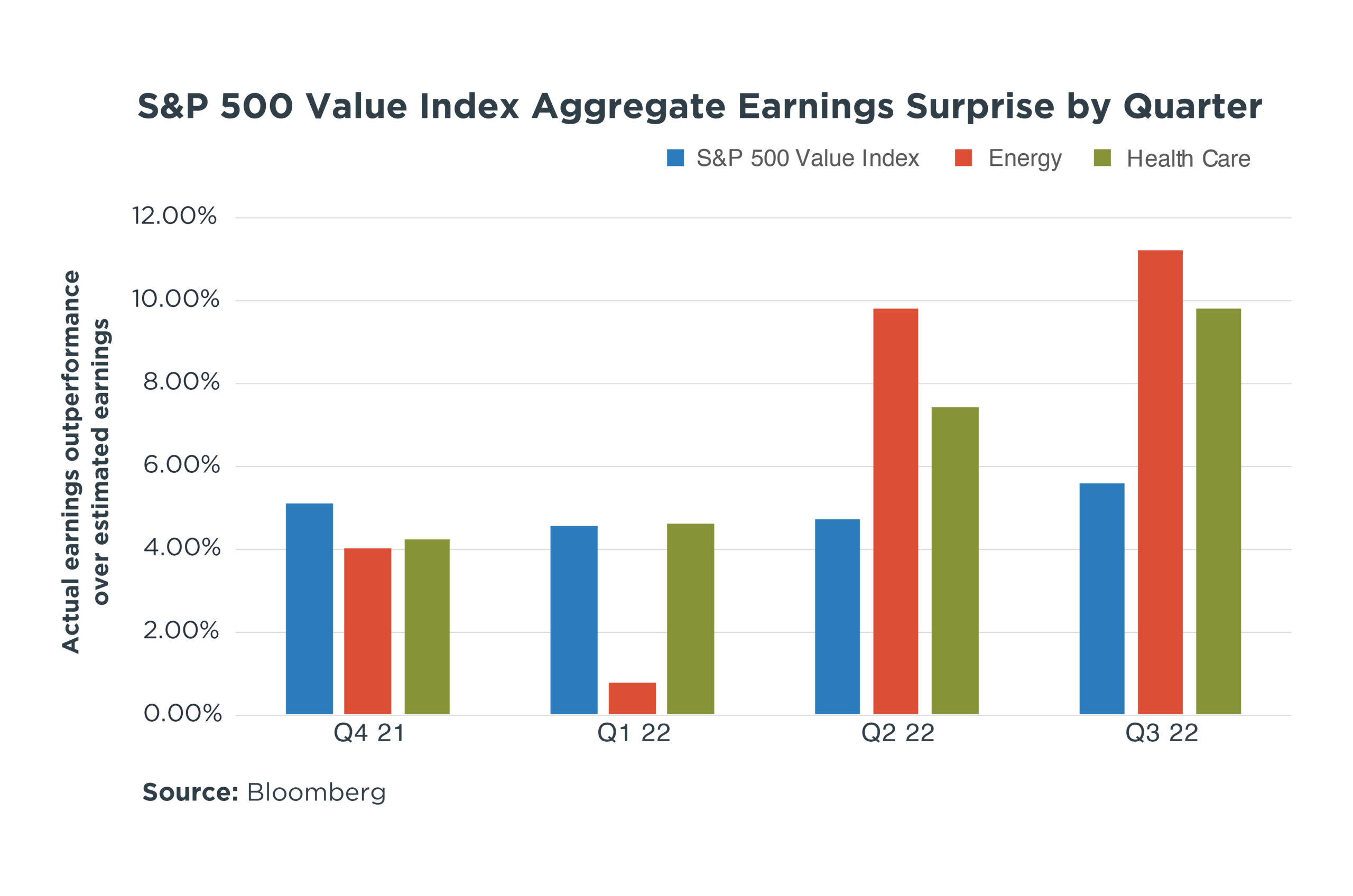

However, a look “under the hood” reveals select areas of real strength and potential opportunity. The chart shows that earnings among value stocks as a group, represented by the S&P 500 Value Index—along with the energy and health care sectors of the index—are giving investors reasons to cheer. For example:

● Value stocks’ 3Q earnings are nearly 6% above estimates.

● Earnings for energy stocks are around 11% higher than expected.

● Health care company stocks’ earnings are close to 10% above estimates.

Other pluses: The magnitude of these positive surprises for all three components of the market has (so far this quarter) exceed what we’ve seen in each of the previous three quarters, and earnings surprises in these sectors are trending up while the market is trending down.

Stock prices are based on expectations, so better-than-anticipated earnings naturally will be rewarded—and indeed, shares of many companies within upward-trending sectors have rallied after their earnings announcements. In stark contrast, third-quarter earnings disappointments from the likes of mega-cap tech companies sent many investors in those stocks running for the exits.

Ultimately, sectors such as energy and health care (which provide the essentials of modern life) exemplify areas of the market that typically benefit from pricing power in inflationary times. Value stocks may enjoy a similar tailwind due to a lower duration of cash flows and generally higher dividends. Conversely, higher interest rates are compressing tech stocks’ multiples while the companies’ earnings are proving to be more cyclical and sensitive to the underlying economic environment than previously thought—prompting some investors to reconsider the sector’s prospects.

The upshot: In this complex environment where market winners and losers can diverge in extreme ways, the case can be made for the benefit of active asset allocation strategies with the flexibility to pursue emerging opportunities.

1 FactSet S&P 500 earnings season update: October 28, 2022

2 FactSet S&P 500 earnings season update: October 28, 2022

Disclosure:

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

The S&P 500 Value Index represents the value companies of the S&P 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. References to indices or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC