An index for new heights

An index for new heights

Using techniques derived from academic and institutional experience, Horizon Investments' Ascend 5%™ Index aims to deliver smooth returns under a variety of market conditions.

An index for new heights

Using techniques derived from academic and institutional experience, Horizon Investments' Ascend 5%™ Index aims to deliver smooth returns under a variety of market conditions.

BUILT FOR THE JOURNEY

Horizon Ascend 5%™ Index

Using techniques derived from academic and institutional experience, Horizon Investments' Ascend 5%™ Index aims to deliver smooth returns under a variety of market conditions.

Our trend-following process with a risk management component seeks exposure to those assets that are trending higher while minimizing exposure to assets in downtrends.

BUILT FOR THE JOURNEY

Horizon Ascend 5%™ Index

Our trend-following process with a risk management component seeks exposure to those assets that are trending higher while minimizing exposure to assets in downtrends.

BUILT FOR THE JOURNEY

Horizon Ascend

5%™ Index

Our trend following process with a risk management component seeks exposure to those assets that are trending higher while minimizing exposure to assets in downtrends.

Here's what's inside Ascend 5%™

It begins with determining the market state and whether to invest in risky assets. The process then determines the weighting of the assets that make up the index. Lastly, a daily volatility assessment is calculated with the aim of managing investment risk.

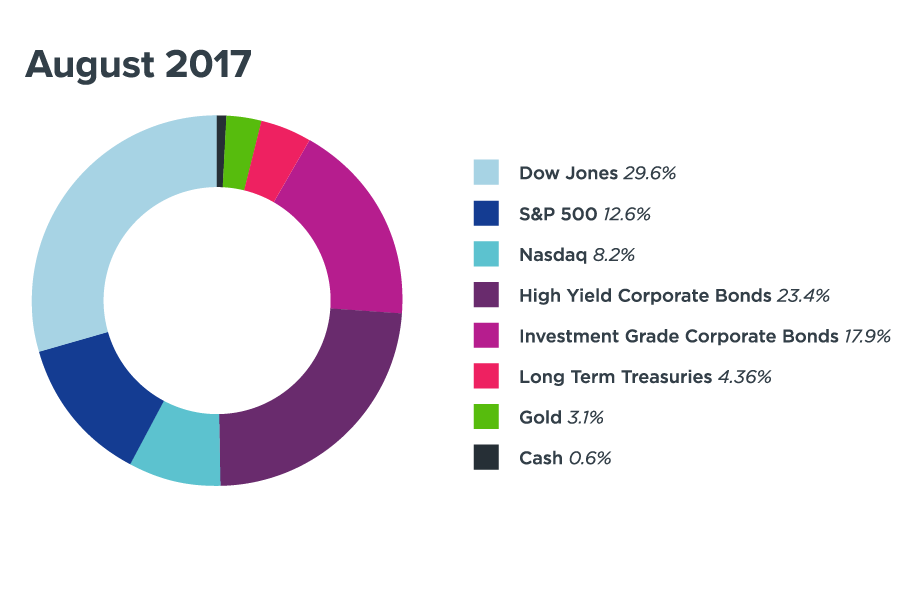

BROAD DIVERSIFICATION

Markets change, so choosing among a broad array of assets aims to make returns more stable and with the goal of making positive returns more likely.

TREND

FOLLOWING

Increase and/or maintain exposure to ETFs with positive trends, while reducing exposure to ETFs in a downtrend to minimize losses.

RISK

MANAGEMENT

A dynamic cash allocation is used to reduce risk when the index is above a 5% volatility target.

Here's what's inside Ascend 5%

It begins with determining the market state and whether to invest in risky assets. The process then determines the weighting of the assets that make up the index. Lastly, a daily volatility assessment is calculated with the aim of managing investment risk.

BROAD

DIVERSIFICATION

Markets change, so choosing among a broad array of assets aims to make returns more stable and with the goal of making positive returns more likely.

TREND

FOLLOWING

Increase and/or maintain exposure to ETFs with positive trends, while reducing exposure to ETFs in a downtrend to minimize losses.

RISK

MANAGEMENT

A dynamic cash allocation is used to reduce risk when the index is above a 5% volatility target.

Ascend in Different Market States

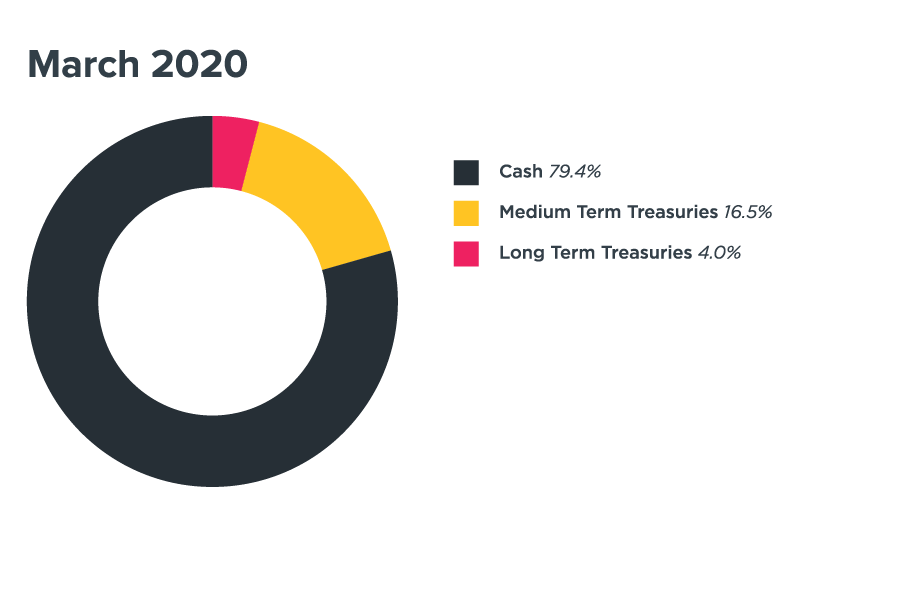

When the market state signal shows low risk, then exposure to equities and high-yield bonds may be the preferred allocation. In high risk environments, cash may become the largest weighting.

During a low risk environment:

During a high risk environment:

For illustrative purposes only.

Ascend in Different Market States

When the market state signal shows low risk, then exposure to equities and high-yield bonds may be the preferred allocation. In high risk environments, cash may become the largest weighting.

For illustrative purposes only. You cannot invest in an index directly.

Possible use cases

Diversify against rising rates

Use Ascend 5% to replace bonds in a portfolio as yields are near all-time lows.

Diversity from core passive stocks + bonds

Use to complement a portfolio already including passive core stock and bond investments.

A complement to an all-stock index

Ascend 5%™ can buffer losses, depending on market conditions.

Possible use cases

Diversify against

rising rates

Use Ascend 5% to replace bonds in a portfolio as yields are near all-time lows.

Diversity from core passive stocks + bonds

Use to complement a portfolio already including passive core stock and bond investments.

A complement to an all-stock index

Ascend 5%™ can buffer losses, depending on market conditions.

Have more questions?

Retirement planning?

DASHBOARD CAN HELP!

Connect product to planning with our visually-stunning, intuitive and powerful goals-based advisor planning platform.

Retirement

planning?

Let Horizon's Dashboard help.

FOR ILLUSTRATIVE PURPOSE ONLY.

Connect product to planning with our visually-stunning, intuitive and powerful goals-based advisor planning platform.

You cannot invest directly in an index. The Horizon Ascend 5%™ Index is not an investment advisory service. Please contact us for more information. Horizon Investments and the stylized H are each registered trademarks of Horizon Investments, LLC.

SUBSCRIBE TO OUR NEWSLETTER

[gravityform id="2" title="false" description="false" ajax="true" tabindex="50" ]