There’s a new leader in town

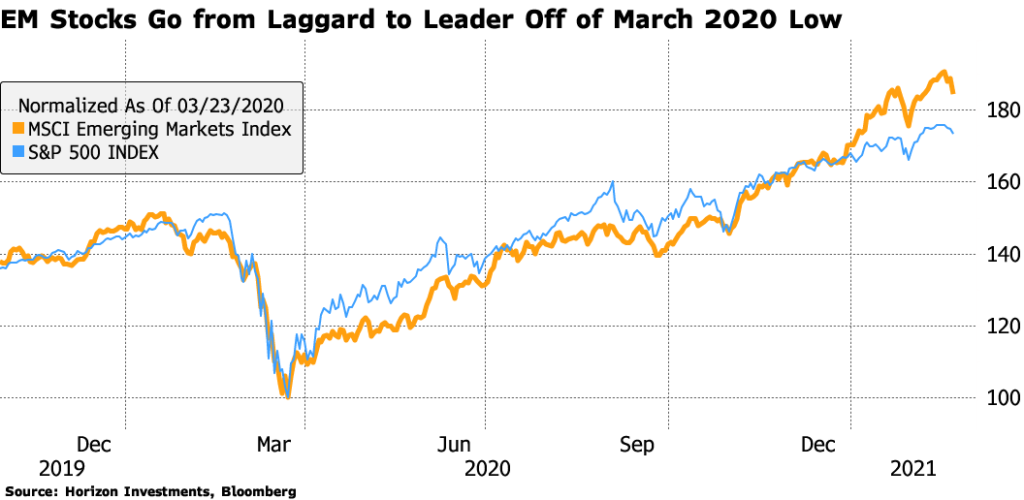

Investors who are globally diversified may be seeing that pay off at the start of 2021. Emerging market (EM) stocks are ripping, up 8.2% year to date for the MSCI Emerging Markets index versus 3.2% for the S&P 500, as of February 22. More than that, EM’s surge means it’s the current performance leader off the stock market lows of last year.

Post-pandemic economic reopening is a big EM driver, but not all reopening themes are winners. Value stocks, for example, are badly trailing.

Horizon Investments believes there are fundamental reasons that will drive emerging market outperformance for the foreseeable future. Here’s why we remain overweight EM in the global equity portion of our strategies.

All roads lead to China

Our EM analysis has to begin with China, which has grown to about 30% of the MSCI Emerging Markets index. China was the first country to suffer due to the pandemic, and now it’s recovering earlier than the rest of the world. There is a V-shaped recovery in much of the country’s economic data, indicating it – and therefore the wider Asian region – are far ahead of the West with respect to reopening. As a result, China’s GDP growth this year will return to beating the United States by a wide margin, according to economist forecasts compiled by Bloomberg.

2021 GDP growth forecasts:

Government stimulus globally, alongside a virus in retreat, suggests to us that growth is going to be strong in the second half of this year.

Year-to-date is nice, but long-term EM is …

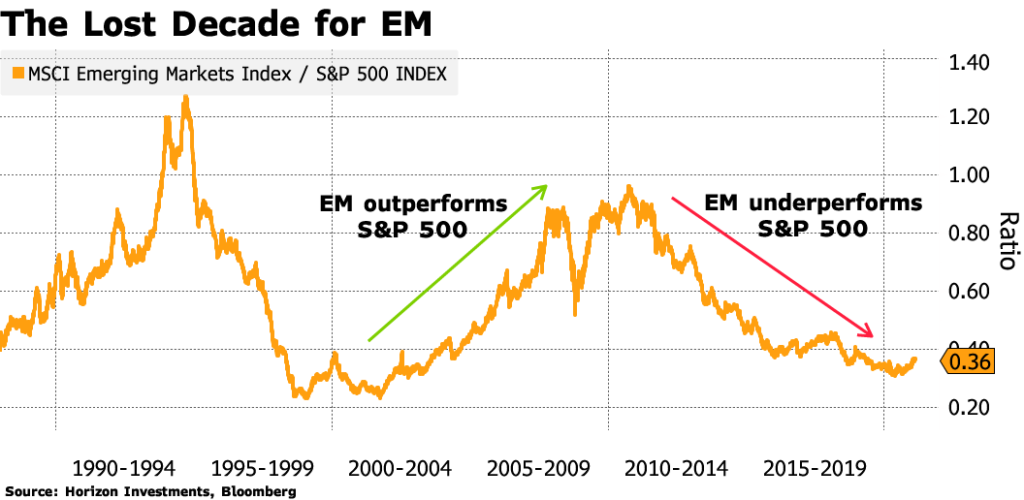

While EM is off to a fast start to the year, skeptics won’t be impressed. That’s because the last decade has been a boon for investors who bought and held the S&P 500 rather than the world’s developing economies – which is clear in terms of relative performance.

While this year hasn’t changed the long-term picture, EM’s past difficulties don’t take account of the evolution that’s occurring.

This is a new kind of EM

Twenty years ago, emerging market stocks were led by economically-dependent cyclical sectors. Today, it’s the growth-oriented industries of technology, consumer discretionary, telecommunications services and healthcare that dominate, accounting for nearly 60% of the MSCI EM index’s market capitalization as the energy, materials and utility sectors fade.

And if U.S. stock indexes are any indication, once sectors such as tech and e-commerce rise in market cap, their dominance tends to have staying power over cyclicals through deep recessions and fast recoveries.

Services rising, factories fading

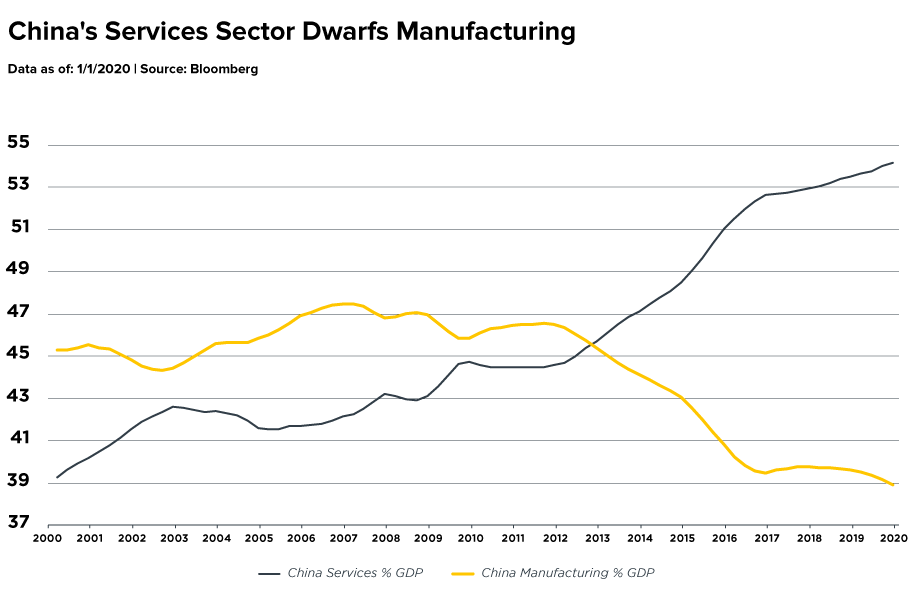

The increasing index weighting towards growth sectors is a reflection of two large Chinese companies: e-commerce leader Alibaba and social media firm Tencent. At the moment, they’re among the biggest weights in the MSCI EM index. Their ascension reflects a fundamental change in China. The country’s economy is now dominated by services, not manufacturing, as we showed in our Q4 Focus report.

Services industries don’t have inventory cycles, unlike factories which do. And that could smooth out the economic ups and downs for EM countries and the equity markets tied to them. Services businesses generally also carry higher profit margins than cyclicals, something that could buoy EM equity price-to-earnings ratios.

What could derail the emerging markets’ rally? The dollar is one risk. Its recent weakness has helped emerging market assets rise in value. But the dollar could turnaround if U.S. GDP growth is surprisingly strong and interest rates rise, driving up investor demand for the greenback. Another important factor determining the attractiveness of EM would be any resurgence of lockdowns to combat the pandemic.

With faster post-pandemic economic growth this year, a larger services sector, a tilt towards tech industries and rising wealth in China, Horizon Investments believes the ingredients are there to support EM outperformance over the S&P 500 for the foreseeable future, which would benefit those investors who have a portion of their portfolio allocated to global stocks.

Related stories:

Inflation Could Be Coming, Are You Ready?

Disappearing Junk Bond Yields

Do Bonds Really Offset Stock Market Declines?

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Only Two Words Matter to Markets: Stimulus Spending

PIIGS Fly and Other Stories of Investors Reaching for Risky Bets

Momentum’s No Longer the Stock Market King, Vaccine Will Raise New Leadership

It’s Getting Harder to Fund Retirement Using Bonds

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To download a copy of this commentary and the chart of the week, click the button below.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC

Insights

Emerging Markets Are Surging – And Evolving

Share:

There’s a new leader in town

Investors who are globally diversified may be seeing that pay off at the start of 2021. Emerging market (EM) stocks are ripping, up 8.2% year to date for the MSCI Emerging Markets index versus 3.2% for the S&P 500, as of February 22. More than that, EM’s surge means it’s the current performance leader off the stock market lows of last year.

Post-pandemic economic reopening is a big EM driver, but not all reopening themes are winners. Value stocks, for example, are badly trailing.

Horizon Investments believes there are fundamental reasons that will drive emerging market outperformance for the foreseeable future. Here’s why we remain overweight EM in the global equity portion of our strategies.

All roads lead to China

Our EM analysis has to begin with China, which has grown to about 30% of the MSCI Emerging Markets index. China was the first country to suffer due to the pandemic, and now it’s recovering earlier than the rest of the world. There is a V-shaped recovery in much of the country’s economic data, indicating it – and therefore the wider Asian region – are far ahead of the West with respect to reopening. As a result, China’s GDP growth this year will return to beating the United States by a wide margin, according to economist forecasts compiled by Bloomberg.

2021 GDP growth forecasts:

Government stimulus globally, alongside a virus in retreat, suggests to us that growth is going to be strong in the second half of this year.

Year-to-date is nice, but long-term EM is …

While EM is off to a fast start to the year, skeptics won’t be impressed. That’s because the last decade has been a boon for investors who bought and held the S&P 500 rather than the world’s developing economies – which is clear in terms of relative performance.

While this year hasn’t changed the long-term picture, EM’s past difficulties don’t take account of the evolution that’s occurring.

This is a new kind of EM

Twenty years ago, emerging market stocks were led by economically-dependent cyclical sectors. Today, it’s the growth-oriented industries of technology, consumer discretionary, telecommunications services and healthcare that dominate, accounting for nearly 60% of the MSCI EM index’s market capitalization as the energy, materials and utility sectors fade.

And if U.S. stock indexes are any indication, once sectors such as tech and e-commerce rise in market cap, their dominance tends to have staying power over cyclicals through deep recessions and fast recoveries.

Services rising, factories fading

The increasing index weighting towards growth sectors is a reflection of two large Chinese companies: e-commerce leader Alibaba and social media firm Tencent. At the moment, they’re among the biggest weights in the MSCI EM index. Their ascension reflects a fundamental change in China. The country’s economy is now dominated by services, not manufacturing, as we showed in our Q4 Focus report.

Services industries don’t have inventory cycles, unlike factories which do. And that could smooth out the economic ups and downs for EM countries and the equity markets tied to them. Services businesses generally also carry higher profit margins than cyclicals, something that could buoy EM equity price-to-earnings ratios.

What could derail the emerging markets’ rally? The dollar is one risk. Its recent weakness has helped emerging market assets rise in value. But the dollar could turnaround if U.S. GDP growth is surprisingly strong and interest rates rise, driving up investor demand for the greenback. Another important factor determining the attractiveness of EM would be any resurgence of lockdowns to combat the pandemic.

With faster post-pandemic economic growth this year, a larger services sector, a tilt towards tech industries and rising wealth in China, Horizon Investments believes the ingredients are there to support EM outperformance over the S&P 500 for the foreseeable future, which would benefit those investors who have a portion of their portfolio allocated to global stocks.

Related stories:

Inflation Could Be Coming, Are You Ready?

Disappearing Junk Bond Yields

Do Bonds Really Offset Stock Market Declines?

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Only Two Words Matter to Markets: Stimulus Spending

PIIGS Fly and Other Stories of Investors Reaching for Risky Bets

Momentum’s No Longer the Stock Market King, Vaccine Will Raise New Leadership

It’s Getting Harder to Fund Retirement Using Bonds

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To download a copy of this commentary and the chart of the week, click the button below.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC

Follow us on: